Each SMARTPath Retirement Fund has a date in its name. We call this the "target date," the approximate year when you expect to retire and begin withdrawing from your account.

Choose the date you expect to retire.

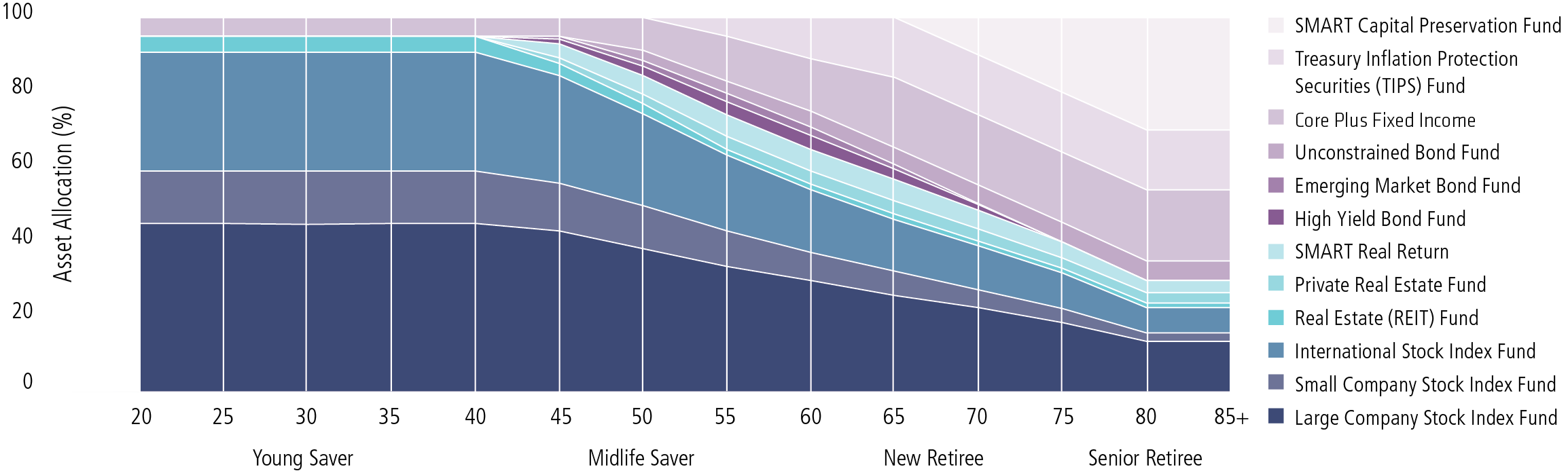

The funds will invest in a mix of investments, including bonds (fixed income), stocks (equities) and diversifiers, and automatically adjust them over time.

You have reached retirement. You may now start to withdraw cash to live on while your remaining savings continue to be invested throughout your retirement.

|

Asset Allocations |

Young Saver | Midlife Saver | New Retiree | Senior Retiree | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 20 | 25 | 30 | 35 | 40 | 45 | 50 | 55 | 60 | 65 | 70 | 75 | 80 | 85+ | |

| Large Company Stock Index Fund | 45.00% | 45.00% | 45.00% | 45.00% | 45.00% | 43.00% | 38.25% | 33.50% | 29.75% | 25.75% | 22.50% | 18.50% | 13.50% | 13.50% |

| Small Company Stock Index Fund | 14.00 | 14.00 | 14.00 | 14.00 | 14.00 | 12.75 | 11.50 | 9.50 | 7.50 | 6.50 | 4.75 | 3.75 | 2.25 | 2.25 |

| International Stock Index Fund | 31.75 | 31.75 | 31.75 | 31.75 | 31.75 | 28.75 | 24.50 | 20.25 | 16.75 | 13.75 | 11.75 | 9.50 | 6.75 | 6.75 |

| Real Estate (REIT) Fund | 4.25 | 4.25 | 4.25 | 4.25 | 4.25 | 3.25 | 2.75 | 1.50 | 1.50 | 1.50 | 1.25 | 1.25 | 1.25 | 1.25 |

| Private Real Estate Fund | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.50 | 2.50 | 3.50 | 3.50 | 3.50 | 3.25 | 2.75 | 2.75 | 2.75 |

| SMART Real Return | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.75 | 5.00 | 5.75 | 5.75 | 5.75 | 5.00 | 4.25 | 3.25 | 3.25 |

| High Yield Bond Fund | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.25 | 2.50 | 3.50 | 3.75 | 2.75 | 1.50 | 0.00 | 0.00 | 0.00 |

| Emerging Market Bond Fund | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.75 | 1.50 | 2.25 | 2.25 | 1.25 | 0.25 | 0.00 | 0.00 | 0.00 |

| Unconstrained Bond Fund | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.75 | 3.25 | 4.25 | 4.50 | 5.00 | 5.25 | 5.25 | 5.25 |

| Core Plus Fixed Income | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 | 8.75 | 12.00 | 14.00 | 18.75 | 18.75 | 18.75 | 19.00 | 19.00 |

| Treasury Inflation Protection Securities (TIPS) Fund | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 5.00 | 11.00 | 16.00 | 16.00 | 16.00 | 16.00 | 16.00 |

| SMART Capital Preservation Fund | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 10.00 | 20.00 | 30.00 | 30.00 |

| UNDERLYING INVESTMENT COMPONENT | Investment Manager | Management Style |

|---|---|---|

| Large Company Stock Index Fund | State Street Investment Management | Passive |

| Small Company Stock Index Fund | State Street Investment Management | Passive |

| International Stock Index Fund | State Street Investment Management | Passive |

| Real Estate (REIT) Fund |

J.P. Morgan Asset Management State Street Investment Management |

Active Passive |

| Private Real Estate Fund | J.P. Morgan Asset Management | Active |

| SMART Real Return Fund | GMO | Active |

| High Yield Bond Fund |

Eaton Vance Nomura Asset Management |

Active |

| Emerging Market Bond Fund | Prudential Trust Company | Active |

| Unconstrained Bond Fund | Reams Asset Management | Active |

| Core Plus Fixed Income | Loomis Sayles | Active |

| Treasury Inflation Protection (TIPS) Index Fund | State Street Investment Management | Passive |

| SMART Capital Preservation Fund |

Goldman Sachs Asset Management Wellington Management IR+M Loomis Sayles |

Active |

If you think a SMARTPath Retirement

Fund

is right for you, simply:

To take advantage of the SMARTPath

Retirement Fund,

simply: