-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to revision over time.

Steering Equity Portfolios Through Stormy Style Seas

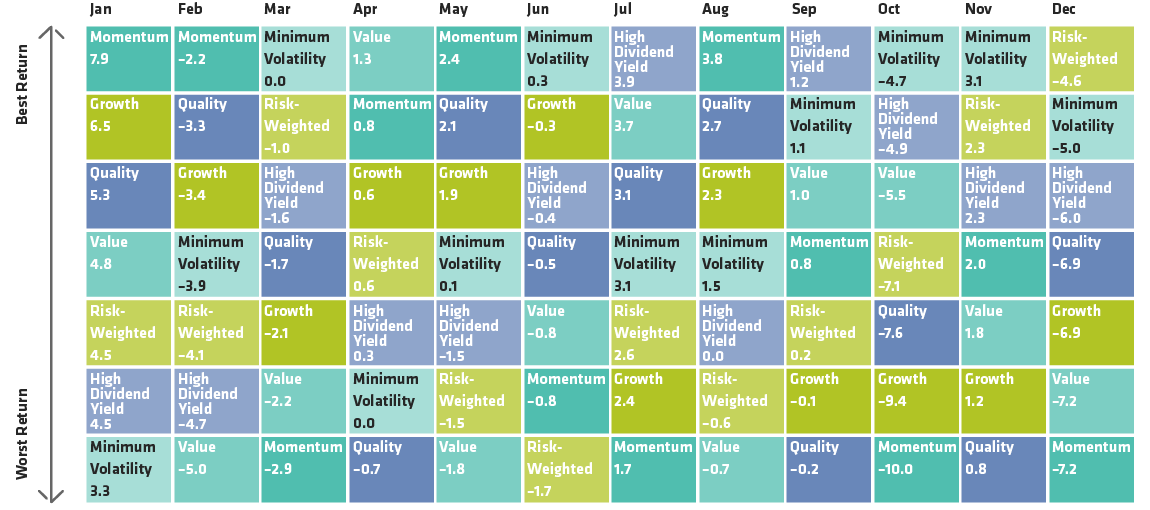

Global Equities: MSCI ACWI Month Factor Index Returns (USD, Percent)

As of December 31, 2018

Historical and current analysis do not guarantee future results.

Returns based on MSCI ACWI indices for each factor shown.

Source: MSCI and AllianceBernstein (AB)

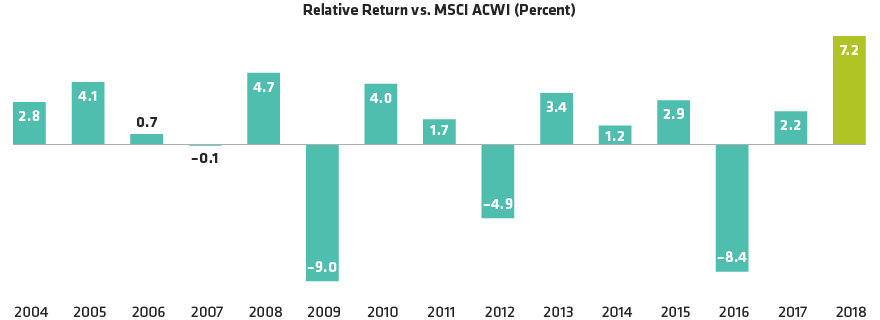

Model Portfolio Investing in Worst-Performing Factor Every Month

As of December 31, 2018

Historical and current analysis do not guarantee future results.

The Panic Portfolio is created by rebalancing every month. Each month, it buys 100% of the style benchmark that has posted the worst returns during the previous month, and sells the position held. Benchmarks included in the model portfolio are the MSCI style indices: MSCI ACWI Quality, MSCI ACWI Growth, MSCI ACWI Value, MSCI ACWI High Dividend Yield, MSCI ACWI Minimum Vol, MSCI ASWI Risk Weighted and MSCI ASWI Momentum, all in US-dollar terms. Trading costs are not taken into account in this analysis.

Source: MSCI and AllianceBernstein (AB)

-

AllianceBernstein Limited is authorised and regulated by the Financial Conduct Authority in the United Kingdom.