Q3 2023

Capital Markets Outlook

Highlights

- Macro

- Rates

- Credit

- EMD

- Equity

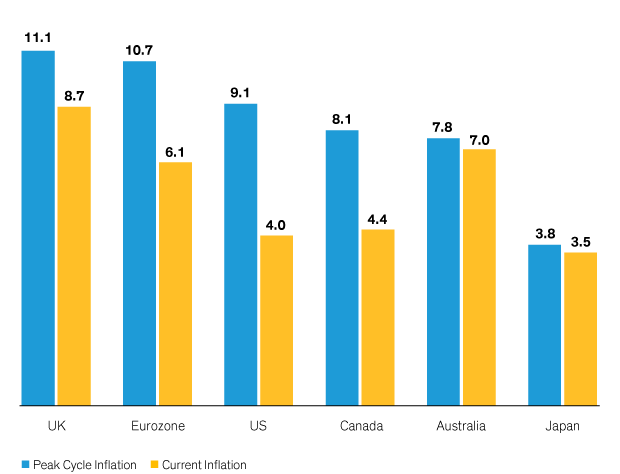

Headline Inflation Has Declined from Recent Peaks

CPI year over year (percent)

As of June 30, 2023

Source: Bloomberg, Office for National Statistics and AB

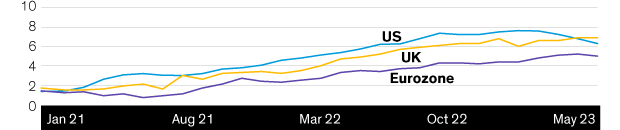

While Elevated, Services Inflation Peaked in the US; EU Should Be Monitored (Percent)

Through June 30, 2023

Source: Bloomberg, Office for National Statistics and AB

Food Inflation Has Started to Fall (Percent)

Through June 30, 2023

Source: Bloomberg, Office for National Statistics and AB

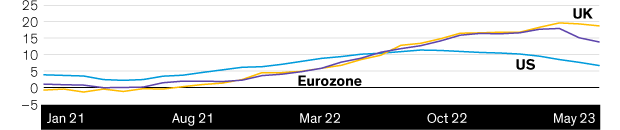

Despite Some Earlier Pauses, Central Banks Are Continuing to Hike Rates, Although at a Slower Pace

Cumulative rate hikes by country (trough to peak) (basis points)

As of June 20, 2023

Source: Bloomberg and AB

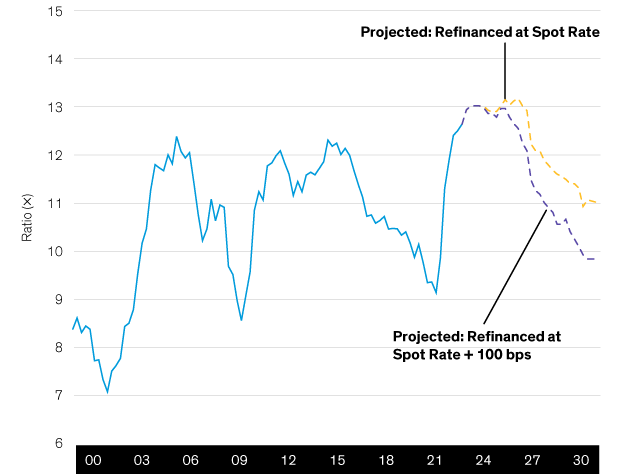

Even with Refinancing at Higher Rates, US IG Interest Coverage Can Remain Well Above GFC Levels

EBITDA/interest expense

As of June 30, 2023

Source: Bloomberg, Morgan Stanley and AB

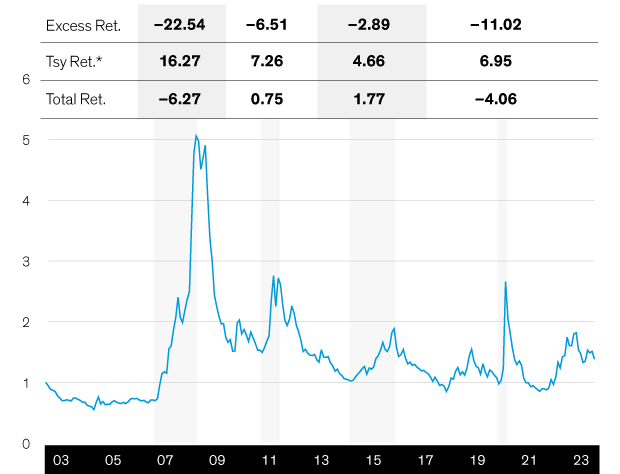

Duration Component of IG Returns Can Help Mitigate Negative Impacts of Spread Widening

Global corporates OAS (percent)

Through June 30, 2023

Source: Bloomberg, Morgan Stanley and AB

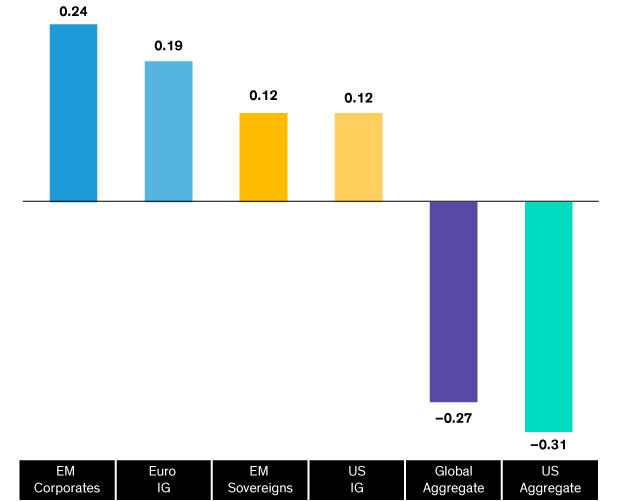

EM Corporate Sharpe Ratios Remain Attractive (2013–2023)

As of June 30, 2023

Source: Bloomberg, Haver Analytics and AB

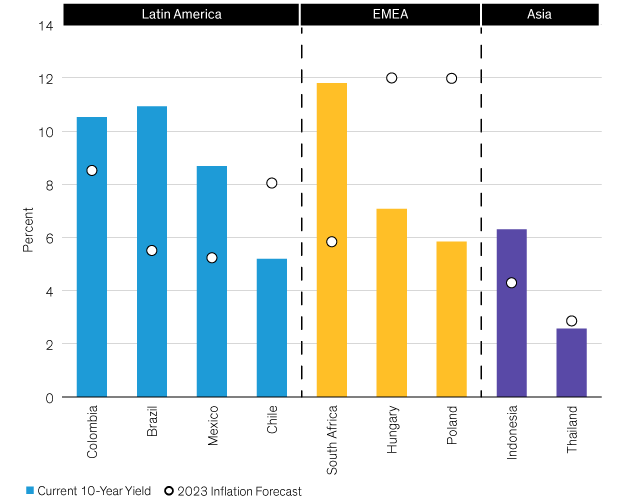

Opportunities Are Emerging in Select Local Markets

As of June 30, 2023

Source: Bloomberg, Haver Analytics and AB

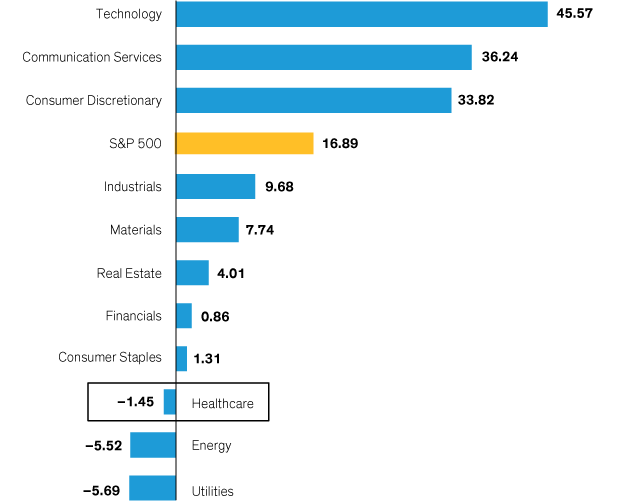

Outperformers: Driven in Part by the Prospects of Easing Inflation; Healthcare Should Also Benefit

As of June 30, 2023

Source: Bloomberg and AB

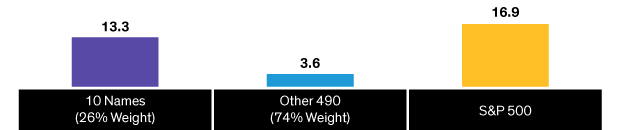

Year to Date, Approximately 80% of the S&P 500’s Return Was Generated by Just 10 Names (Percent)

As of June 30, 2023

Source: Bloomberg and AB

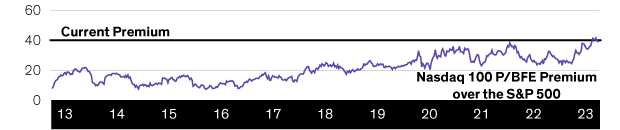

What and How Much You Own Among the Mega-Caps Matters

Many still trade at a high premium (percent)

As of June 30, 2023

Source: Bloomberg and AB