Equity investors are facing significant challenges this year, from valuations to volatility to political risk and ESG issues. We asked four AB equity portfolio managers and product specialists to respond to five big questions about current market conditions and to explain how their respective portfolio strategies are addressing the issues.

Q1: After strong market returns last year, what’s your view on equity market valuations? Second, how are global interest rates impacting your views on valuations?

Chris Marx, Senior Investment Strategist—AB Strategic Core Equities: It’s true that many investors are concerned about valuations, but I’m a bit more optimistic because I think that outside the US, valuations are more normal. Our Global Strategic Core portfolios have been underweight the US, much to our detriment in recent years, but we are always focused on the price variable, and we see better value outside the US. As a defensive portfolio, we pay a lot of attention to interest rates. We are conscious that we have negative interest rate sensitivity—falling rates are good, rising rates are bad for us. As rates have come down sharply, that’s been a tailwind for us, and we must be conscious that we don’t have too much interest-rate risk.

Mark Phelps, CIO—AB Concentrated Global Equities: In a world of low economic activity, growth is hard to come by. But if you can find it, it’s very valuable. However, when buying stocks with solid growth potential, it’s important to be very focused on price levels. For example, we don’t hold Amazon because its relatively expensive. That’s a risk I can live with. But there are other ways to capture similar growth opportunities at more attractive valuations. I have a combination strategy of Microsoft and Alibaba that’s provides similar exposure to Amazon in retail and cloud computing. By holding Microsoft, we get access to the growth potential of its Azure cloud computing platform, while Alibaba Cloud gives us exposure to the rapidly developing China cloud business. And Alibaba is twice the size of Amazon in online retail. So if I place both of those stocks together, I get a similar growth rate at approximately half the valuation. That’s what we’re trying to do with the portfolio—find ways to get better growth and better positioning at a more reasonable price. You can do that in a concentrated portfolio.

Q2: Volatility has increased over the last year. How do you think about volatility and what is your approach to risk management?

Mark: Volatility is here to stay. So clients should no longer expect double digit returns and low volatility. It’s more realistic to expect mid-to-high upper single digit returns, with much higher volatility. But volatility itself is not a bad thing for active managers. In a concentrated portfolio, the essence of risk management is knowing the earnings in my companies really well. If I get the earnings right consistently, it will drive my return. This also means constructing forecasts that are suitable for current market conditions.

For example, you can buy a 10-year Swiss bond with a negative 0.7% yield or you can buy Nestle stock, with a 2% dividend yield. What does Nestle do? It has water, it has infant nutrition, it has coffee—which is addictive—and it has chocolate, which is also addictive. That means they have a pretty stable earnings profile.

My discount rate for Nestle is 8%—that’s the lowest discount rate in any one of our models, anywhere. What does that tell you? The discount rate is composed of an earnings risk premium (ERP), a risk-free rate and a stock-specific risk. With interest rates at historic lows, the risk-free rate is -0.7%. So, my 8% discount rate for Nestle is actually all ERP—that’s about twice the historic level. That is phenomenally high compared to what it should be historically.

Based on these numbers, that stock looks very expensive at 24 times earnings. But if the discount rate is 6%—and that’s still high historically—then the same stock should be trading at a p/e of 30x. And that’s the challenge you have with investors today. In a world with low growth and perpetually low interest rates, current valuations might overstate how expensive a stock really is. If the market begins to adjust discount rates accordingly, I can make a case for the market moving up and not down, and that’s how it gets there.

Klaus Ingemann, CIO—AB Global Core Equity: First, I don’t think we’ve seen anything yet in terms of volatility. It’s very natural that you have a volatile market as you come to the end of a very long cycle. From our perspective, what matters is that our performance doesn’t blow up because we get a decision wrong. That’s what we promised our investors. We go to great lengths to ensure that. The value added for our clients is consistent alpha, and that has nothing to do with volatility, except for the opportunity that it gives us.

So, we actually very deliberately try and remove ourselves from spending too much time on this. If you come to our offices in Copenhagen, you will be surprised to discover that there are no TV screens, no Jim Cramer screaming at us from the corner. We share one Bloomberg terminal. And it’s a very deliberate decision to remove ourselves from this noise. We don’t debate what Trump tweeted last night because it doesn’t really matter that much. What matters is where the long-term interest rate goes, because there is a duration play—also in equities—and that’s important. It’s important to balance your portfolio between long-duration and short-duration stocks. If you get that wrong, you can have your returns blown up by interest-rate movements. But outside of that, this doesn’t matter too much.

Chris: Our portfolio is built for volatility. That’s the whole reason we built this, to try and tame that and reduce the risk drag that comes with volatility. It’s not like we’re rooting for the end of the world. Risk can sound like a dirty word but it’s not. You want to take risk where you have insight and avoid risk where you don’t. When it comes to China trade, Brexit, US elections, and risks like that, we really don’t know what the long-term implications will be. We can argue over beer and talk about what’s going to happen, but we really don’t know. We try to neutralize the portfolio as best as we can to these events, so that no matter whether the outcome is favorable or negative, our portfolio will sail it down the middle either way. It’s a more humble approach to risk that says, “Let’s avoid the risks that we have no insight on and put the risk behind the ideas from analysts or factors that we’re OK taking on.” This approach lets us do well in down markets.

Eric Sprow, Managing Director—Equities: Volatility was extremely low in 2017, but that wasn’t normal. What we’ve seen recently is more normal. As far as drawing parallels to history, I think today’s market environment shares more similarities with the late 1990s than with 2007. Our view is that even in a contractionary environment, there are a lot of opportunities based on what is discounted in many more cyclically oriented stocks today. And on the flip side, there are a lot of stocks that may not have the cash flow to support their elevated valuations. Despite the volatility and mild recession that followed the tech bubble, our value services performed really well from 2000 to 2006.

Q3: How should equity investors think about China, given the political risk related to the trade war and the inclusion of more Chinese stocks in the global index?

Klaus: Obviously, China has a huge impact on the global economy. And it will have a larger impact on the index going forward, for mechanical reasons. So, we have included China as a natural piece of our investment universe. We do screens, and we do track China. We include China from our traditional way of looking at companies—which is from a sector-oriented point of view.

For example, in the technology sector, most companies have either a distribution relationship or a production relationship with Chinese companies. We regard them as any other company. There can be corporate governance issues that you need to be aware of in China, but you find corporate governance issues in the US, Germany and Denmark as well. That’s not really particular to China. We have embraced China for years as a traditional extension of our investment universe. We have two Chinese companies in the portfolio right now, and over the last year we have held both midcap companies and A-share-listed companies. We don’t regard investing in Chinese stocks as something that requires a special skillset.

On the other hand, regarding trade wars, it’s hugely important. We have many companies in the portfolio or as investment candidates whose entire supply chain is reliant on China. And as the trade war escalated during 2018 and 2019, we felt the pain on some of our companies. Now we’ve seen some relief in the latest Phase I deal, but risks remain, and they have a direct impact on the idiosyncratic stock-picking process that we go through with our companies. So, we are really trying to figure out, where do we have risk of investing in companies that have this very specific business model impact from trade friction? And we are willing to have some of that risk in the portfolio. If we have it through companies that are managing it well, maybe trying to get around that risk, perhaps by moving some of their supply chain. We are careful not to have too much of that risk, but we don’t want to eliminate it completely because if the situation improves, some Chinese companies could be expected to outperform over time.

Early in 2020, the coronavirus outbreak has obviously added another major risk to Chinese stocks. The market has been reacting quickly to the crisis, and we normally expect an overreaction from such events. But we appreciate that the situation can escalate quickly.

Travel-oriented and luxury stocks have been hit hard. We have two portfolio holdings in these areas that are exposed and will struggle to meet earnings expectations in the first half. But the portfolio’s exposure to travel and luxury is rather market neutral. Given the situation, we’re less inclined to add to positions, but we will be opportunistic if great entry-points present themselves amid the crisis.

More broadly, our response has been to keep our holdings in securities with exposure to the issue. We are aware of the sense of urgency but believe our long-term approach to stock picking is best served by maintaining that focus and by spending less time and energy on trying to outsmart the market on these occasions.

Mark: Given current data about the fatality rate from the coronavirus, I think it is right to be reasonably sanguine about the market response. However, the key will be the overall infection rate and that is still unknown.

The robust action around the world—in particular travel limitations—is appropriate but will probably result in a greater economic impact in the short term than SARS. However, we see no reason to change our long-term forecasts at present. We are therefore more likely to be buyers on weakness.

When it comes to tariffs, we just don’t know what the long-term outcome will be. While we have a Phase I deal on the books now, the reality is that these issues that China and the US face are complex and don’t always work out as you think. From our perspective, we take a step back and ask: what is my earnings risk in the portfolio if it doesn’t go according to plan? If I strip out as much of that as I can, then I feel much more comfortable. So we’ve reduced our exposure to companies that are at risk from the unresolved long-term trade issues.

Q4: Everybody in the industry is talking about environmental, social and governance (ESG) issues. How do you integrate ESG in your portfolios, and, do you see this trend continuing or is this a fad?

Mark: We always ask the question—do we want to be in this business with these people? And the “in this business” is the E and the S while the “with these people” is the “G”. We’ve now formalized that process using MSCI’s ESG ratings, as well as other independent vendors such as Sustainalytics. But third-party rating providers aren’t enough. We also must build our own database, and AB is doing this really well by using eSight to share data. Our investing teams don’t all have to do the same thing with it, but we should all contribute to it because that data helps us generate valuable insights that are well sourced and very timely. MSCI and Sustainalytics tend to review on a monthly, quarterly or even an annual basis. So as we improve our real-time ESG integration in our research processes, we’re building something that is unique.

Demand for responsible investing portfolios and practices is changing the playing field, certainly in Europe. The amount of money going toward ESG investing is now so big, that I think we’re at a tipping point in which it actually positively impacts performance. And of course, once that happens, then it becomes self-fulfilling.

Klaus: I completely agree with Mark that this is a one-way street. We have included ESG in our portfolios for about 15 years, starting with exclusions. Back then, this way of thinking didn’t resonate with some clients, particularly in the US. But we’ve seen now that basically every market has moved a lot in wanting to have some degree of ESG integration with their managers. The issue is global now and that’s great to see.

Our peers are moving really fast. We want to be at the forefront of this trend. Our quantitative analysts have done a tremendous amount of work to make sure that we can access databases and convert it into something that we can use in our investment processes. The holy grail for us is engagement. I don’t think exclusions helps bring about a better world. It might bring slightly higher cost of capital for some firms. But that’s not really the point of integrating ESG. What we really want to do is single out companies that have material exposure to ESG issues and engage with them, interact with them, try to push them in the right direction because that’s where the money is flowing so you can get better returns for your business, and help create a better world. We’re not interested in having a utility company sell their coal-fired plant to some investor who has no oversight on environmental standards. We actually want them to keep that coal-fired plant and improve the emissions from that plant. That takes engagement. It takes time—it’s super time consuming and it takes a lot of resources. But our firm is on the right track.

Chris: We look at this largely from a risk perspective, and where an ESG issue can cause a risk for a company. Social changes will make these factors more important. And we also need to cast our net a little more widely from some of the more obvious ones like tobacco or oil to things like data privacy and security, which are increasingly becoming different types of ESG risks. As investors, we need to be forward looking in thinking about the next issue that will catch people’s attention.

Engagement is another area where we think our large scale is an advantage, and we can do things that smaller firms can’t do.

Q5: Each of your portfolios has different goals and deploys different investing strategies. How should clients expect you to perform in various market environments?

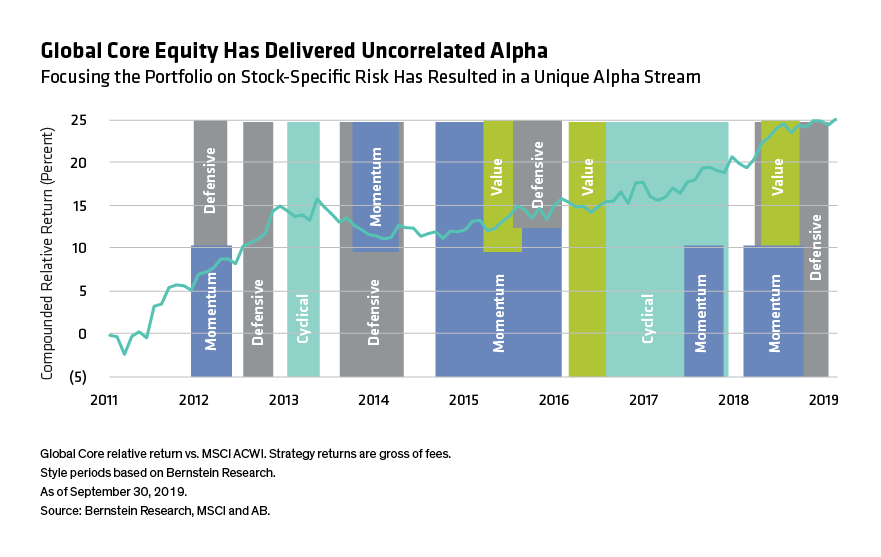

Klaus: First and foremost, you should think of us as a stock-picking team, dedicated to generating alpha in a risk-neutral portfolio. We call it an “all-weather portfolio.” We have a certain way of constructing our portfolio that makes it very unbiased toward either styles or factors. This has allowed us through almost 20 years now to go through different kinds of environments and events, such as US elections or Brexit or style rotations, without having a big impact on our alpha (Display).

To be sure, we have a certain bias that leads a little bit toward quality stocks; our portfolio companies tend to have higher returns on invested capital and stronger balance sheets. As a result, we would generally expect to underperform in a value market. We don’t have a lot of data recently on value markets, so we have to go back a long way to see persistent, drawn-out value markets. But there have been a few periods over the past 10 years in which value stocks have done well. And during those periods, we’ve actually outperformed the market—despite having a little bit of quality bias in our stocks.

So, if you ask us where do we underperform? The most unfavorable market for us is what we would refer to as a “garbage market.” It’s a market where the most indebted companies with the lowest margins at the brink of bankruptcy outperform. For example, from March 2009 to March 2010, these types of companies performed really well. In these types of markets, we would see some headwinds. But outside of that, I think we have portfolios that can do quite well in most market conditions.

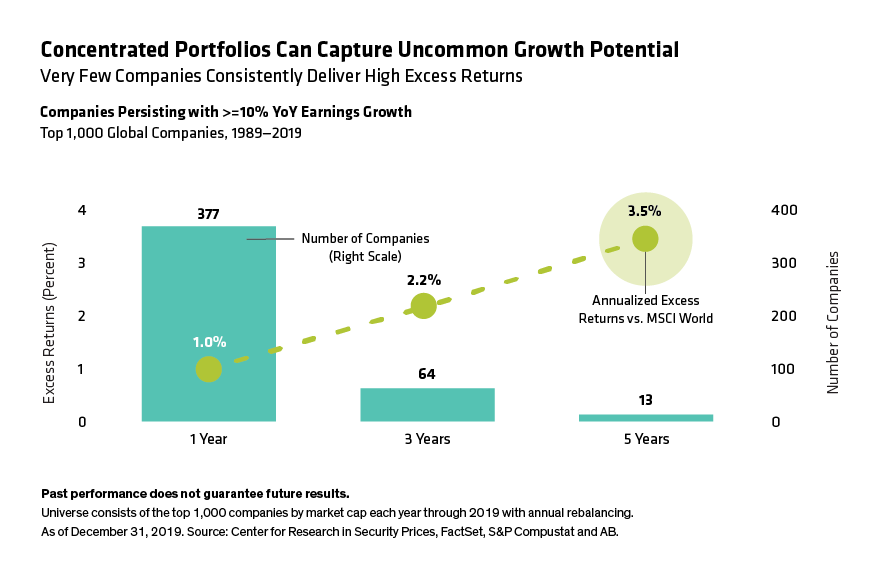

Mark: I think we can deliver similar results to our annualized performance since April 2005 of about 9% or 10%. I think that’s a perfectly reasonable number. The portfolio’s outperformance target is about 2.8% annualized. We think that’s what we should aspire to—around 2.5%-3% above the benchmark. To get there, we target companies that are capable of delivering earnings growth of at least 10% a year. They’re not easy to find but companies that can deliver this kind of persistent earnings growth have tended to generate strong outperformance over time (Display).

We also have good upside/downside capture, which sometimes surprises people. Because many people think that a concentrated growth investor may get us better returns, but with more volatility. In fact, over time, we actually have less volatility. And we’ve done particularly well in down markets.

That’s because quality stocks hold up in challenging times. When markets go down, it’s usually for three reasons—a financial crisis, a growth scare or a P/E contraction. Since I don’t own banks, we’re well positioned for a financial crisis. Our companies also tend to have secular drivers of growth, so if the market growth slows, those drivers keep going. Mathematically, our portfolio would probably underperform slightly in a p/e contraction because I pay a premium for better quality and better growth.

One thing that’s very important is that we have very high active share. Many of our clients have passive investments as well. We believe that a combination of concentrated equities and passive equities works well together. We’re kind of frenemies. The characteristics of our portfolio are very different than passive portfolios—which is good. The most important thing is to understand how these combinations can be best constructed to fit individual client needs.

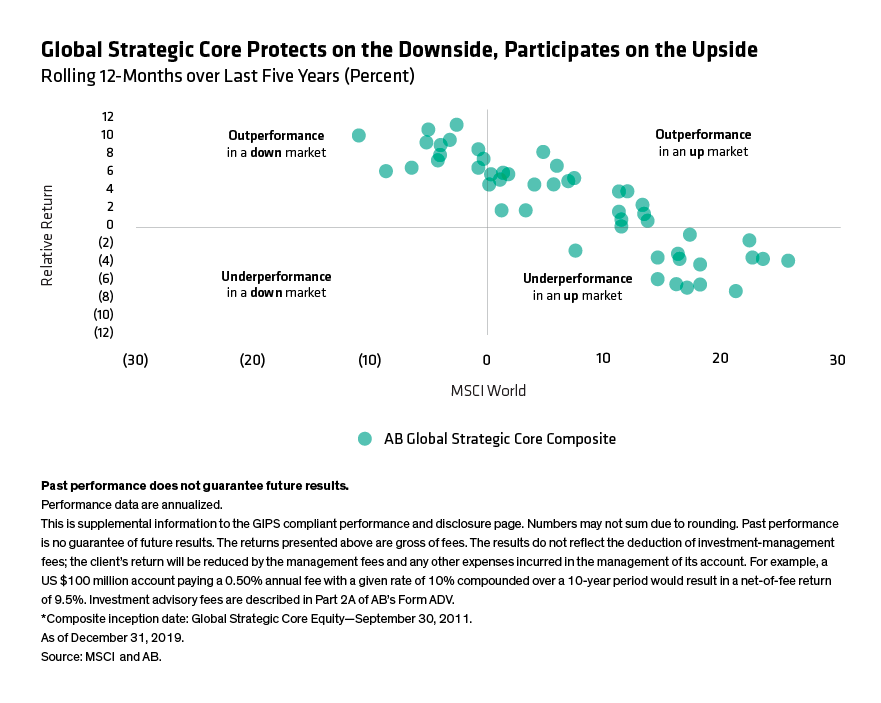

Chris: We designed our Strategic Core Equity services to be more defensive. They’re explicitly meant to provide capital protection if markets are selling off, and to do so, we seek an upside/downside capture of 90%/70%. We’ve been able to meet that goal over the last five years. And that has allowed us to outperform in down cycles, with roughly 70% market participation (Display).

Performance Disclosure

It does mean that we underperform when the market is rising. For example, in 2017, in our global portfolio, we returned 21% versus 22% for the market. I feel very comfortable going to my clients and saying that’s what we expected to do. The math works in your favor. So, when you get drawdowns like in 2018, we performed very strongly in protecting capital, which improves the returns over time. And it can actually work over the course of a year. If you have choppiness along the way, you pick up the return in the down times and get enough of the up market so you end up with higher returns over time.

Our long-term relative return target is slightly lower than concentrated portfolios, in the 2%–2.5% range. But we’re going to do it with less absolute risk and a higher Sharpe ratio. How do we go about it? By balancing quality, stability and price—higher quality features, lower-beta/lower-risk and price discipline when buying stocks. Some might say it’s a boring portfolio, but boring can be beautiful in getting you better risk-adjusted returns over time.

Eric: In our value equity portfolios, we’re trying to pick idiosyncratic stocks that have attractive valuations and catalysts for improvement. If you look across our value services, we really don’t own a lot of the weakest parts of the market. For example, we don’t hold any of the more distressed parts of the European financials industry.

But we are finding plenty of opportunities among companies that generate strong cash flows yet are undervalued by investors. Many of these are in industries or countries that investors have just broadly shunned without respect to company-specific fundamentals. Others are simply misunderstood or overlooked by investors.

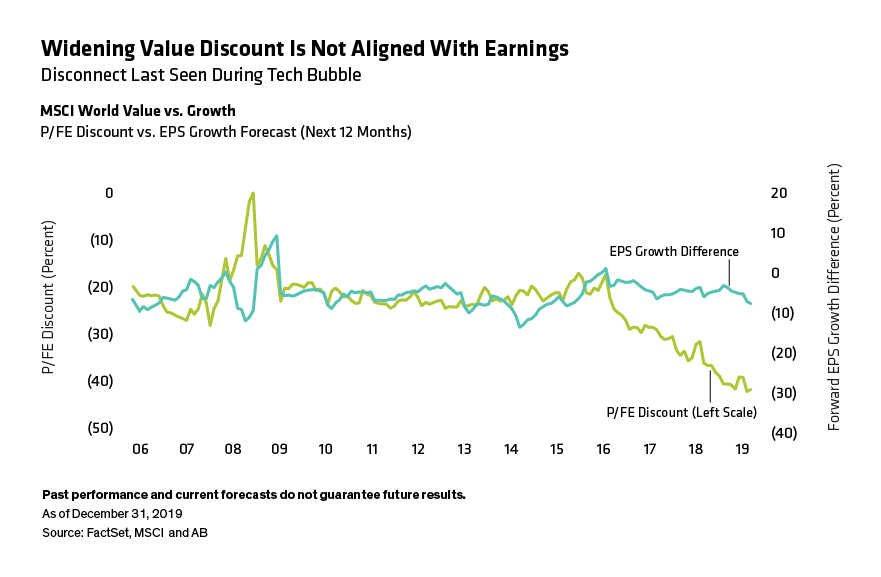

There’s no question that weakness among value stocks has been a headwind to performance for most of the last decade. But we’ve really seen a divergence of company fundamentals and valuations. When you look at the difference in the earnings growth rate between the MSCI World Value Index and MSCI World Growth Index over time, it’s been pretty consistent. Growth companies have higher earnings growth than value companies. That’s not surprising. And generally, value companies trade at a cheaper valuation than growth companies. But what you have seen over the last two years is an obvious divergence in which value stocks have become even cheaper despite really no change in the earnings growth rate differential (Display). So, investors have largely fled value stocks, and that’s created a lot of opportunities for us. As an example, our Global Strategic Value portfolio has higher forecast earnings growth for the next year than the broad MSCI ACWI Index—at a cheaper valuation. That’s pretty compelling.

Past performance, historical and current analyses, and expectations do not guarantee future results. There can be no assurance that any investment objectives will be achieved. The information contained here reflects the views of AllianceBernstein L.P. or its affiliates and sources it believes are reliable as of the date of this publication. AllianceBernstein L.P. makes no representations or warranties concerning the accuracy of any data. There is no guarantee that any projection, forecast or opinion in this material will be realized. Past performance does not guarantee future results. The views expressed here may change at any time after the date of this publication. This document is for informational purposes only and does not constitute investment advice. AllianceBernstein L.P. does not provide tax, legal or accounting advice. It does not take an investor's personal investment objectives or financial situation into account; investors should discuss their individual circumstances with appropriate professionals before making any decisions. This information should not be construed as sales or marketing material or an offer or solicitation for the purchase or sale of any financial instrument, product or service sponsored by AB or its affiliates.

The views expressed herein do not constitute research, investment advice, or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.