Over the past 18 months, high inflation drove rapid monetary policy tightening, which weighed heavily on consumer spending power and corporate margins. As inflationary pressures now abate, we see eventual improvement in both real incomes and profits, which should enhance prospects for multi-asset investors.

Falling inflation and a coming end to rate hikes create a favorable environment for risk assets. And with interest-rate cuts likely over the next year, income seekers could continue to benefit from historically high bond yields.

Growth Picture Improves, with Goods and Housing Looking Up

Global economic growth has weathered not just the most aggressive tightening policies in decades but also a resulting dark patch of banking stress.

Strong labor markets, healthy consumer balance sheets and pent-up demand for services have underpinned resilient consumption. While job creation is likely to slow, improving real incomes could support continued growth. The goods sector is also recovering from a destocking cycle, and we expect modest improvement ahead. Even housing, which has been a significant drag, has started to stabilize.

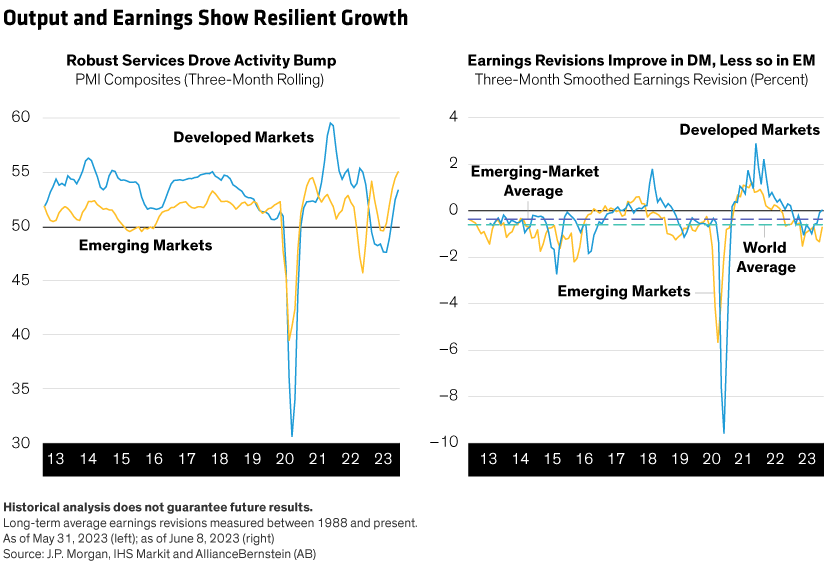

Two indicators in particular suggest that the climate is warming to risk assets. First, manufacturing and services may have bottomed across major economies (Display, left), while earnings revisions are up from recent lows and near historical averages, partly due to easing margin headwinds (Display, right).

However, the business investment cycle appears mature, and we expect business investment growth to slow meaningfully from here. Nonetheless, capital-spending intentions seem to be bottoming, too, suggesting that an investment slowdown could be shallow and short-lived.

Better Economies and Improved Margins Support Risk Assets

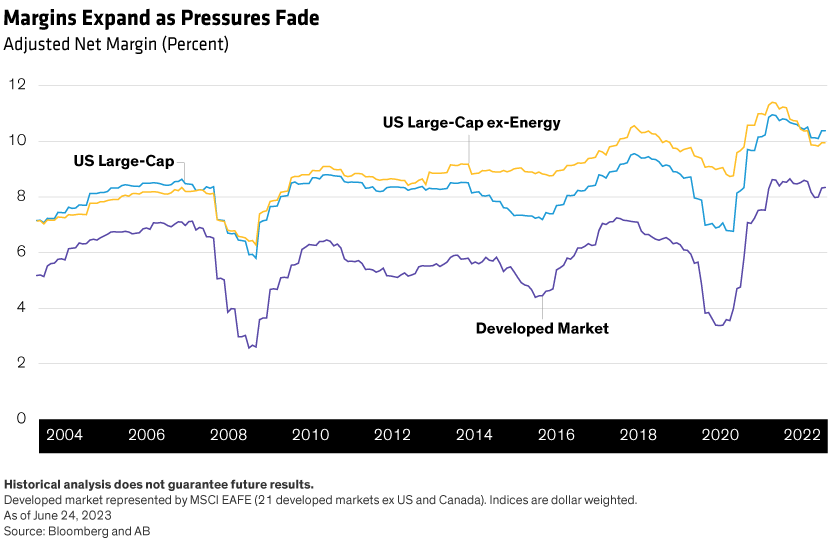

Despite robust sales growth over the last year, compressed corporate profit margins were a drag on earnings growth. However, early signs are emerging that margins are stabilizing (Display), and we expect improvement over the next few quarters.

We see four key drivers behind corporate margin improvements:

- Output prices are catching up to input costs, thanks to easing inflationary pressures across commodity-exposed sectors like consumer staples.

- Supply chains are inching back to normal, with cheaper shipping costs closer to pre-pandemic levels and excess inventory drag starting to fade.

- The travel sector, especially hotels and airlines, is experiencing better operating leverage and pricing power.

- Cost-cutting measures have started to bear fruit among companies that were the most challenged by shrinking margins, such as software/media and shipping.

While top-line growth will likely slow from here, expanding margins should also start to improve corporate earnings. Progress may be offset if some of the more robust, out-earning sectors like energy and autos drop back to normal levels. But we expect overall margins to improve, which could bring broader earnings growth closer to its long-term averages over the next 12 months, absent a recession.

Implications for Equity Allocations

Cross-asset tactical allocation decisions must balance long-term strategic considerations with prevailing macro and market conditions. As the economic climate claws back to normal, we believe it’s prudent to modestly increase exposure to risk assets, including equities.

Developed-market stocks seem especially appealing. We favor quality growth and US equities, based on improving cyclical prospects and steady favorable conditions for technology—which leans strongly to US names. Tech had a strong run recently, which we expect to continue in the near term. And while its rally was dominated by a handful of stocks, we still see select opportunities across the sector. We also think emerging-market equities will likely benefit from policy support in China as well as the recent bottom in the global manufacturing cycle.

Select Credit Exposure Can Boost Income Potential

High-yield corporate bonds seem compelling in the current environment, with the ICE BofA High Yield Index carrying a yield of about 8% at midyear. Credit often feels the brunt of a downturn early, as investors quickly turn cautious. In the current cycle, we’re also monitoring refinancing risks in the event rates stay higher for longer.

Quality and issuer selection are important, however, since not all issuers are alike or will benefit similarly from a better macro environment. We prefer high-yield bonds at the upper end of the credit spectrum, such as BB-rated issuers, which have historically been less vulnerable during economic slowdowns.

Sovereign Bonds Are Improved Diversifiers…with Higher Yields

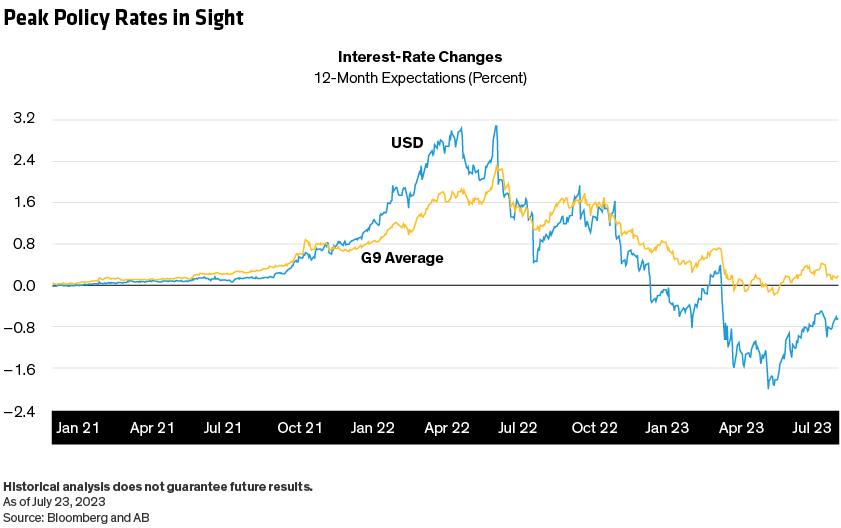

With yields their highest in years and terminal rates—the expected peak of interest rates—likely in sight (Display), we see a favorable outlook for bonds. As inflation eases, real interest rates should continue to rise. This should both improve consumer spending power and give policymakers some flexibility for rate cuts, even without a recession. Moreover, correlations between stocks and bonds are once again turning negative, making bonds more attractive again as diversifiers to risk assets after failing in that role during 2022.

Choose Diversifiers Carefully as Economy Shifts

Multi-asset investors should constantly look beyond stocks and bonds for other diversification sources, too. These investments include real estate, commodities and alternative sources such as factor-based strategies and risk premia—reliable, nimble building blocks to complement larger asset classes as market climates change.

For now, we think a near-neutral allocation to diversifiers is warranted until the economic direction becomes a bit clearer. We also believe modest exposure to commodities is prudent, as we see better supply and rising demand, especially as goods sector activity hits bottom.

Economic growth has held up well against high inflation and rising rates. Shrinking margins, which dragged down earnings growth, could reverse course over the next 12 months. However, monetary policy is likely to remain tight, keeping growth subdued and possibly increasing debt-refinancing risks. For multi-asset investors, it’s vital to stay selective and flexible during what could be a long journey to a full recovery.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.

MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.