Corporate executive Louis Gerstner once said, “in the end, an organization is nothing more than the collective capacity of its people to create value.”

From the perspective of a company leader, that makes sense: a strong culture drives better decisions and—based on a large body of research—better outcomes over time. Employees who are more satisfied are better motivated and more likely to stick with a firm over time. Independent studies indicate that these results translate directly into higher productivity, lower turnover and greater customer loyalty.

So, even though culture may seem intangible, it can make the difference between success and failure, and cultivating human capital is essential for building a business with staying power. But how can investors gauge the strength of corporate culture?

Culture Is a Long-Term Proposition

For one thing, investors have to adjust their lens, because culture exists on a different time scale from the familiar parts of the investment world. Culture is measured in years—not quarterly results or the news cycle. Company reports don’t say much about culture, and it’s hard to distinguish cultural effects from day-to-day stock fluctuations caused by financial disclosures and the news cycle.

But establishing a strong culture from day one can help ensure sustainable success. It’s the connective tissue that enables firms to consistently deliver and adapt to rapidly changing industries, weather the tough times with stability and maintain forward vision. And good leaders look closely at how all of a company’s systems interact.

By evaluating culture as an integral part of fundamental company research, and by engaging with management regularly, investors can gain better insight into promising businesses before their potential is reflected in stock valuations—and can spot potential cultural stumbling blocks.

Engagement Is the Key to Cultural Assessments

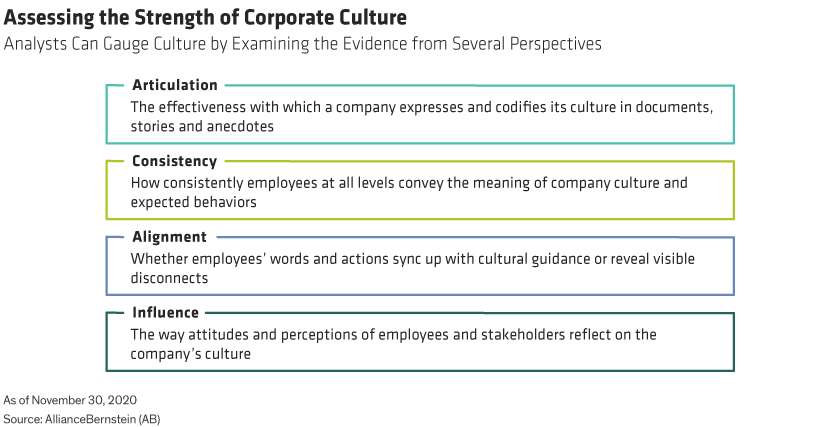

The only way to make those assessments is to get up close and personal by engaging with company leadership. Firms rarely report on culture—and, even if they do, it doesn’t mean culture is strong or effective. Active managers must build an information mosaic and evaluate the evidence from several perspectives, including articulation, consistency, alignment and influence (Display).

Cracking the Culture Code: Asking the Tough Questions

Company cultures are diverse, so there’s no one-size-fits-all approach for making these cultural assessments—and it takes a lot of legwork to determine if a culture is set up for success. That’s a big reason why we maintain an inventory of questions in our ESIGHT engagement and collaboration platform to kickstart cultural engagement.

The questions range from how a firm defines culture to how much it invests yearly in talent and whether employees are satisfied or dissatisfied. Here are a few examples of questions, taken from a longer list, that we ask management teams about their cultures:

1) How do you define your company’s culture, and what have you done recently to enhance it? What challenges are you facing?

Investors need to assess whether a company has a strong sense of culture, and if its leaders and people can define and articulate it consistently. Culture shouldn’t stand still, either: look for ongoing efforts to strengthen it. These could take the form of implementing or upgrading rewards and recognition programs or an initiative to bolster work-life balance. Opening new channels for employee feedback—both formal and informal—is also encouraging.

Company leaders should be attuned to cultural challenges, too. These may include disengaged or unhappy workers, excessive employee turnover and inconsistent or one-directional communication among the rank and file. If evidence of these issues surfaces during company engagement, and if management isn’t talking to the investor about it, it’s a red flag.

2) How do you measure employee engagement and satisfaction? What percentage of employees were surveyed for engagement and satisfaction in the past year, and what were the results? What areas need improvement?

Not only should companies be collecting employee feedback, but also they’re ideally sharing it with the board of directors and developing a plan of action to address gaps. It’s important to request specific examples of changes that have been implemented based on employee feedback. If a firm is asking workers for feedback and not acting on issues that emerge from the process, it’s a cause for concern.

One aspect that should be front and center in culture-conscious firms is talent: acquiring it, developing it and doing everything possible to keep it. Investors should be looking for firms with robust training programs for employees at all levels: job skills and people skills. Far-reaching equity-compensation plans are culture boosters, too, instilling ownership that helps drive better performance.

The bottom line: if company leaders truly value talent, they’ll back it up with commitment and action.

3) How has the firm responded to negative and public incidents of peer firms regarding unethical behavior, misconduct or regulatory violations?

Even well-managed businesses must continually strengthen and reinforce the ethical and cultural framework that governs behaviors. High-profile missteps at peer firms within their industries or in the broader public sphere should be catalysts for forward-thinking leaders to reexamine their company’s own policies. This question is intended to start a conversation about how management is reacting.

The #MeToo movement is a good example: some companies already had channels in place to address sexual harassment, but this global movement was a wake-up call to bolster employees’ resources and reevaluate existing practices. Some firms that didn’t react faced substantial backlash from within; those with stronger cultures responded swiftly, thoughtfully engaging employees.

4) Describe the benefits of providing employees with adequate incentives to maintain health and wellness.

Some firms are lagging on employee-wellness programs, some are leading and others fall somewhere in the middle. There are certainly concrete ways to evaluate the programs themselves, and wellness programs are prized by employees. In posing this question, though, investors should be looking to gauge the level of a company’s wellness commitment based on the way management can connect those programs to the impact on elevating the business.

Companies should drill into specific benefit areas: for example, the operational benefit transmitted via higher productivity to better quality work, reduced operating costs and more satisfied customers. Reputational benefits are another focus area: can leaders link effective wellness programs to its brand perception as a firm that cares about its people and whose values align with those of its customers?

On the Lookout for Cultural Disconnects

During engagements, investors need to determine whether culture is uniform or if “disconnects” exist. For example, ask people at different levels of seniority about strategy, culture, vision and values: if these pillars are articulated consistently, it’s an indicator of an open culture with good communication; if not, the company could suffer from communication gaps—or a closed culture.

It’s also important to understand what incentives are provided to employees across the entire company. If executives and senior management receive leading benefits but other employee groups don’t, a hostile culture can result. Good companies demonstrate that all employees are valued.

Investors should also check for alignment between management’s statements and the firm’s stated culture. We saw misalignment in a recent case, with a consumer discretionary firm that had suffered from unfortunate acts of violence at some of its locations. The firm deems its people to be its greatest asset, but rather than reinforce a commitment to employee safety and well-being—and possibly detailing next steps—we instead were presented with data indicating the isolated nature of the incidents. Leading with that aspect of the story didn’t seem to ring true with the cultural values.

Extracting Cultural Insights from Big Data

The onset of data science has added an important dimension to assessing companies’ human capital and corporate culture—with a data-driven lens.

For example, we noted that diversity and inclusion were cited as big factors in the success of a business-services provider, so we engaged a third-party firm to conduct background interviews to get the perspective of former employees. While the results were generally positive, we did see a possible issue related to human capital practices around gender that warranted further investigation.

In subsequent engagements, we learned that the firm was replacing its human capital head and adding a head of diversity and inclusion. One place we turned for evidence of the impact was web-scraped employee reviews: We subsequently saw a positive trend in employee sentiment ratings over time, and natural-language processing revealed a decline in comments referencing gender issues.

With data science, investors can track trends in companies’ culture and values ratings over time and compare it with peer firms. This is good investment practice any time a firm undergoes a reorganization or leadership change. The data may reveal signs of a toxic post-merger culture or improved sentiment after a leadership change: one firm’s CEO approval rating jumped from 50% to 95% after a change at the top.

Coronavirus: Culture Gets a Stress Test

The COVID-19 pandemic has put many corporate cultures to the test, requiring rapid adaptation at breakneck speed and to enable mass remote work while protecting employees. It also left many firms facing tough decisions as demand shock pressured profits, among them furloughs, severance pay and compensation—including executive compensation adjustments.

To facilitate engagement, we rapidly incorporated COVID-19 issues into ESIGHT. So far this year, we’ve conducted nearly 200 company engagements that focused specifically on companies’ social responses—and 100 engagements on human-capital development.

Some company cultures have fostered responses that stand out, including a healthcare firm whose measures included full pay and benefits for all employees regardless of health status, higher pay for frontline workers and repurposing cafeterias to deliver meals to those in need. Another firm, in financial services, established an employee relief fund to support employees and their families in times of crisis, contributing to cultural continuity in an unprecedented time.

The Data Science Angle to Pandemic Responses

Data science has shed light on which cultures are adapting to COVID-19 and which may be struggling. Employees’ own words can be extracted from employee review sites, giving analysts a valuable lens into worker sentiment, whether they feel like “merely a number,” react to “lackluster efforts to protect employees and customers” or praise leadership for making it “very easy to transition to a full-time work- from-home arrangement during COVID-19.”

Sentiment metrics can also be tracked and could have a long-term impact. Will companies whose navigation of the crisis was viewed positively by employees be better able to attract and retain employees? We’ll track this data over time to understand whether the cultural ramifications of COVID-19 could impact long-term company and stock performance.

Culture is a big factor in assessing the long-term prospects of companies, even if it plays out over a much longer time frame than quarterly financial results and earnings calls. Assessing culture may be less tangible than a profit-and-loss statement and requires effort to dimension, but overlooking culture leaves out an important part of the equation for success.

Michelle Dunstan is the Global Head of Responsible Investing at AllianceBernstein (AB)

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.