Communicating with children is not always easy. When it comes to discussing family wealth, it can be even harder. Especially if children have limited knowledge about the extent of the family’s money, and the plans for future wealth transfer. Sometimes it’s simpler to discuss wealth and engage the next generation in financial decisions through active participation. Philanthropic giving is one way to get started. Philanthropy can help the next generation discover the family’s values while learning about money and how to manage it.

Why Family Engagement Matters

At some point, heirs need to become aware of the magnitude of the family’s assets. Waiting until children gain control of them is probably too late; setting up heirs to successfully navigate wealth decisions needs to start early. But many parents grapple with revealing the level of affluence. They worry that the knowledge might adversely impact their children’s relationships—between siblings, and with friends and peers—while it could also demotivate kids to achieve their own financial success. Beyond revealing the assets, setting up heirs for success means clarifying family values and conveying expectations for the resources.

Engagement Through Philanthropy

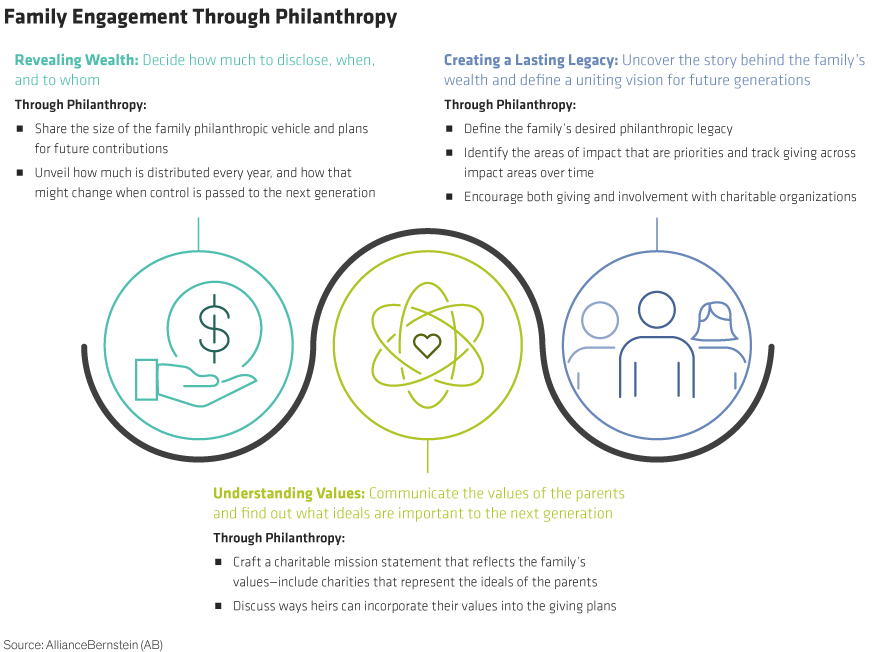

Philanthropy gives parents the opportunity to clarify and communicate their values—discuss their ideals, discover those shared with the next generation and some that are unique to each heir—coalesce around a vision for the family’s legacy, and begin to make decisions together (Display). It allows heirs to become engaged while easing the anxiety many parents feel about disclosing the wealth. The next generation can begin to test drive decision making, guided by their parents through conversations about money and investments, without a focus on personal wealth.

Unfortunately, there is no single recipe to follow when engaging through philanthropy. Because each family’s circumstances are unique, an engagement plan needs to be exclusively designed. There are several things to keep in mind, including:

- Engagement should be individualized: An engagement plan should be age-appropriate for the heirs—centered primarily around their ability to understand financial and philanthropic concepts and align with their priorities and interests. For example, the focus for grade school–aged children should be on philanthropic awareness. Middle and high schoolers can be actively involved through volunteerism, while older teens and adult children can assume a financial philanthropic role. Personalizing engagement will allow heirs to understand the goal of the engagement through an appropriate, positive activity.

- Engagement should be forward-looking: Heirs need to understand how the family circumstances and expectations change when generational leadership shifts. Some of that understanding comes in the form of educating the next generation about current charitable giving. But equally important is allowing heirs the ability to express their interests and goals for philanthropy, and how their objectives may impact the current philanthropic plan. For example, a family foundation that is expected to grow larger upon the death of any parent will need to decide whether to increase the size of current grants, or fund new grants with the additional assets.

These discussions will get heirs involved now—allowing them to work with family advisors, learn about investments, and make investment decisions together while parents supervise—setting up a strong mechanism for future decision-making and solidifying a successful transfer to the next generation.

When, and How Much?

Determining when to engage the next generation, and how much should be revealed is not an easy decision. The answers often depend on the family’s structure, their unique circumstances, and the individual children. Every family is different—and even within a family, each child is unlike the next— and those differences often guide the conversations. But regardless of the timing or amount of information revealed, practical learning is usually more beneficial than just verbal communication. That’s why family engagement—revealing wealth, understanding values, and creating a lasting legacy through philanthropy—makes sense. It’s also very rewarding!

This is the second of a two-part series introducing family engagement. The first installment, Are Your Heirs Prepared? provides a roadmap for how to engage heirs about family wealth.

For more tips on becoming financially engaged, explore Women & Wealth, a new Bernstein podcast series designed to educate, empower, and inspire female investors, and for additional thought leadership, check out the related blogs here.

Business owners deserve a partner who will support them right from the start. For more thought leadership for entrepreneurs and business owners, check out the related blogs here.

The views expressed herein do not constitute, and should not be considered to be, legal or tax advice. Please consult with your legal or tax advisor regarding your specific situation.