European stocks have outperformed US equity markets in recent months, after several years of underperformance. Is this the start of a longer trend? It’s too soon to say, but some unfolding developments could signal a reversal of fortune for a long-unloved asset class.

The MSCI Europe Index has gained 4.7% (in euro terms) from September 1 through October 31, versus the S&P 500 Index’s 4.0% (in US-dollar terms). So far, the outperformance has been modest, and it could quickly reverse. But macroeconomic signals, regional earnings drivers and even a potential easing of political risk may help stem a tide of outflows from European stocks, in our view.

Economic Outlook: Back from the Brink

Signs of improvement in the economic outlook could favor European stocks. Markets are currently pricing in a lot of bad economic news. But some commentators are detecting signs that the recent slowdown in economic growth could be bottoming. For example, services in general continue to look resilient. Given the amount of pessimism in markets, we believe that any upside surprises in economic data could support an accelerated equity rally.

To be sure, US company earnings still look better than their European peers, based on companies that had reported their third-quarter earnings through the end of October. And a higher percentage of US companies are beating consensus forecasts. But European-listed companies, especially outside the UK, on average have earnings that are more sensitive to the economic cycle than those of larger-capitalization names in the US. As a result, any lifting of the economic gloom will tend to benefit the European market more, in our view.

From a technical point of view, after massive outflows from European equities in recent years, many investors are heavily underweight Europe. So far in 2019, more than half the outflows from equities globally have been from European markets, even though European stocks account for only about one-fifth of the MSCI All Country World Index. If this trend reverses, we think it could potentially drive a powerful rally.

Political Risk Fears May Be Overdone

These potential catalysts are often overshadowed by fears about political risk. Perceptions of political risk have made many investors cautious about Europe since the 2008 financial crisis. But we believe that these risks in Europe have in fact eased. While a no-deal Brexit cannot be completely ruled out, it looks much less likely than it did in the summer. The new Italian government is taking a less confrontational approach to European rules on fiscal policy than its predecessor.

Bond markets are currently signaling far less concern about a possible eurozone breakup than back in the 2011/12 crisis years. And even though the risk of political gridlock looks to be increasing in several large countries, US experience shows that this is not necessarily bad news for markets.

While politically driven sentiment can have a big impact on short-term market performance, valuation is the most powerful driver of long-term returns. The discount of European stocks versus the US looks large today (Display). Of course, much of this disparity reflects the very different sectoral composition of the two markets. Investors are happy to pay more for fast-growing technology-related stocks that are more heavily represented in US large-cap equity indices. Conversely, the heavier weighting of banks in Europe drags down average European valuations. But even adjusting for these sectoral differences, we believe that European stocks look cheaper than usual versus US stocks today.

Relative to bonds, the valuation case for European equities is even more compelling. At the end of October, the MSCI Europe ex UK Index had a dividend yield of 3.20% versus –0.41% for the 10-year Bund. The European Central Bank’s easy monetary policy is unlikely to change soon, which should continue to provide powerful support for European equity markets, in our view.

Look Beyond the Benchmark

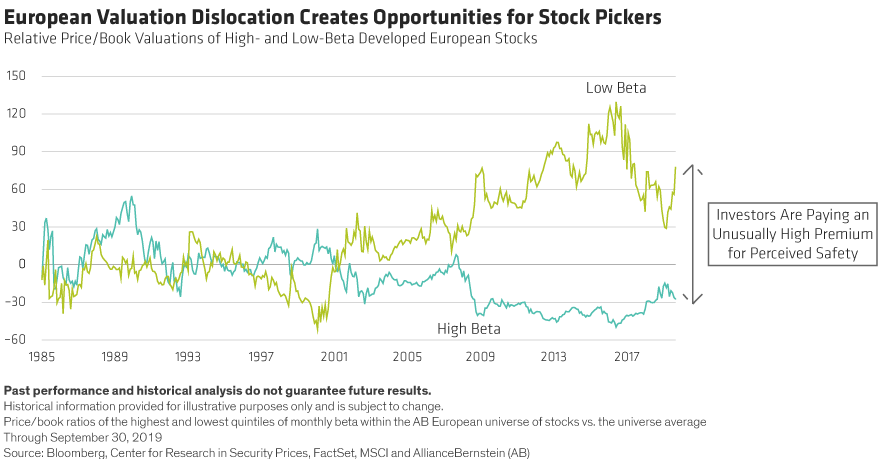

To take full advantage of opportunities available in European equities, we think investors should look beyond the index. Many investors continue to prefer safety stocks, which is driving big valuation distortions within the European market. The extreme gap in valuation between less volatile lower-beta stocks in Europe and their typically more cyclically exposed, higher-beta counterparts remains wide (Display). This is creating many opportunities for stock pickers to find companies with mispriced attractive cash flows, both in beaten-up cyclicals sectors and in more economically resilient parts of the market. Passive investments in regional benchmarks cannot capture the strong return potential of companies like these.

We aren’t advocating a big tactical shift in investors’ regional equity exposure: Over the long run, well-diversified global exposures make sense. But for investors who currently have little or no exposure, we do think that the growing potential for a re-energized European equity market deserves closer attention today.

Nicholas Davidson is Senior Portfolio Manager—Equities at AllianceBernstein

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time. AllianceBernstein Limited is authorised and regulated by the Financial Conduct Authority in the United Kingdom.

MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein