With volatility rising, many equity investors are thinking proactively about downside protection. But traditional safe havens may not do the job. Defensive equity positions can be found today in surprising places—like the energy sector.

After nine years of S&P 500 Index gains, investors are becoming increasingly nervous about the bull market’s durability. Rising interest rates, a return of inflation and geopolitical concerns have fueled volatility.

Rethinking Defensive Exposures

In the past, when investors sensed cracks in the market’s foundation, they flocked to more defensive sectors, like consumer staples. That sounds logical: if the economy is weakening, invest in companies with resilient businesses that sell what consumers can’t do without, such as household products, food, beverages and cigarettes.

But consumer habits are changing. Young consumers are focusing on healthier fresh foods. They’re not as brand loyal as their parents. Branded-goods companies are losing both leverage and pricing power with distributors. And of course, we can’t forget the 800-pound gorilla in the room: Amazon.

Investors should look beyond traditional safe havens, in our view. Companies with high-quality management teams, strong balance sheets and stable/growing dividends, supported by improving business trends, can often be found at better valuations in sectors that aren’t typically seen as defensive.

Rising Oil Prices Create a Positive Dynamic in Energy

The energy sector is a case in point. After years of challenges, energy companies look a lot more compelling. In recent months, oil prices have started to increase gradually driven by several factors, including geopolitical pressures, OPEC discipline, sanctions on Russia, renewed sanctions on Iran and higher oil extraction costs.

Let’s consider this scenario: A continued rise in oil prices could push inflation higher. In turn, the Federal Reserve might increase interest rates faster than expected to keep inflation in check. While this could slow the US economy, rising oil prices would support energy stocks. In this environment, we believe energy stocks could play a role as a nontraditional defensive position.

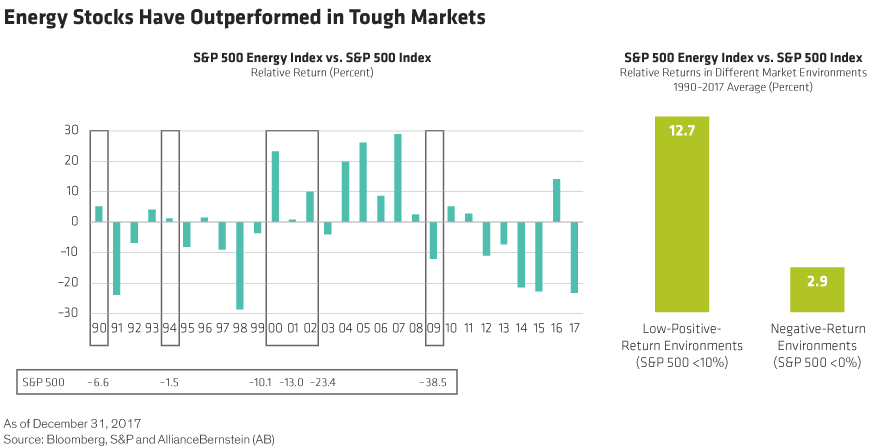

Energy Stocks Have Outperformed Challenged Markets

That might seem counterintuitive, given that energy is often seen as a volatile sector. But in fact, over the past 28 years, energy stocks outperformed challenged markets several times (Display, left): in 1990 and 1994; after the tech bubble burst from 2000 to 2002; and during the global financial crisis in 2008. On average, the energy sector outperformed the S&P 500 by 2.9% in negative-return years and by 12.7% in low-return years (with an S&P 500 price return below 10%), since 1990 (Display, right).

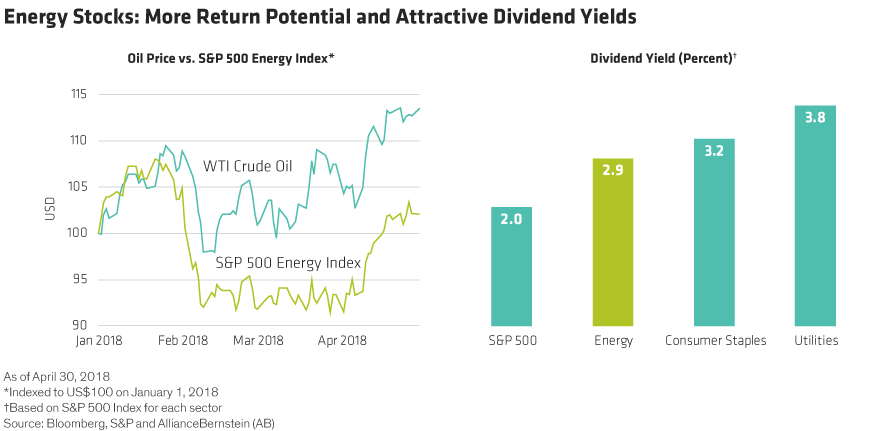

This year, energy stocks have advanced by 2%, outperforming the S&P 500. But they’ve lagged gains in West Texas Intermediate (WTI) crude oil, which has been up 13% (Display). We believe that this disconnect offers an investment opportunity, particularly among integrated oil companies. Within the sector, look for companies with attractive valuations and dividends that rival consumer staples companies, supported by improving fundamentals.

Think Creatively About Defensive Exposure

Dividend yields of traditional defensive companies can be misleading in a tougher operating environment. For example, Coca-Cola offers a juicy dividend yield of 3.6%. But the company’s revenues have declined sequentially since 2013 as consumers have flocked to healthier alternatives. And Coca-Cola shares trade at about 20 times expected 2018 earnings—an expensive proposition for a defensive investor.

Downside protection should be a priority today. But market conditions require creative thinking about how to reduce volatility. Make sure your portfolio manager can discern between defensive stocks with challenged businesses and stocks that might not sound defensive but offer a combination of characteristics that can support stable returns in a potentially unstable environment.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.