Athletes that have reached the top of their game have spent a lifetime honing their skills, not letting any opportunities pass them by. That same determination should be applied to their hard-earned cash—to maximize every available opportunity to achieve a lifetime of financial success.

Strategize

The most effective cash strategy depends on several factors, including your lifetime goals, near-term spending needs, and how comfortable you are with taking risk. To design an ideal plan, consider these questions:

- Do I have enough to sustain the lifestyle I really want?

- Can I now buy the house I’ve always dreamed of?

- How should I invest the proceeds?

- The market keeps setting record highs; is this a good time to buy in?

- Should I fully invest or wade in over time?

While it may feel overwhelming, answering these questions will help you set priorities. Try to envision what happiness looks like—and how your newfound wealth might help you build a legacy and reach specific life goals.

A Game Plan

By putting some thought into it, you’ll gain insight into the most favorable strategy for your unique needs. A plan that includes buying your dream house this year may look vastly different from one where all your lifestyle needs have been met and you’re more focused on establishing a legacy.

Take Mr. James, a 27-year-old athlete who recently signed a $40 million five-year second deal—consisting of a $10 million upfront signing bonus with the remaining $30 million paid over the life of the contract. Though he plans to pursue a second career after his playing years, Mr. James conservatively assumes he’ll retire from the game at 32 years old. He’d like to be able to comfortably spend $350,000 per year while growing his wealth, and also make sure he doesn’t have to worry about money for the rest of his life.

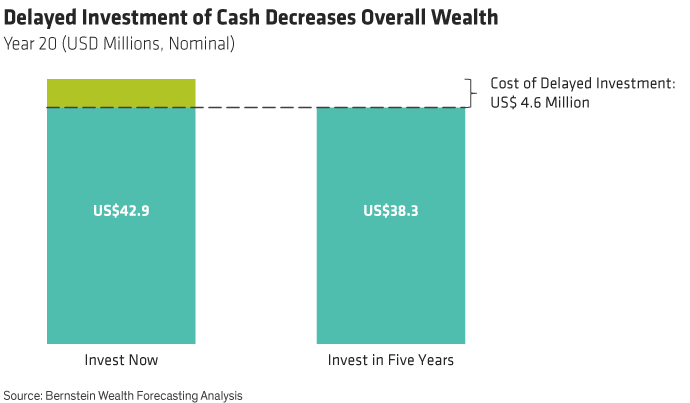

At first, Mr. James seemed comfortable with a moderate asset allocation. But when it came time to put money to work, he held back. Will a few months delay meaningfully impact his long-term wealth building? Not likely. But lingering in cash over several years could. For example, setting aside all the contract proceeds until he retired—while waiting to invest—reduced his projected wealth in year 20 by $4.6 million (from $42.9 million to $38.3 million) (Display).

Wait on the Sidelines or Join the Huddle?

Mr. James wavered, wracked by concerns about losing some of his hard-earned wealth simply because he bought into the market at the wrong time. But with investing, there is no perfect entry point. Since the 1940s, an investor who bought at each market bottom earned 11.5% on average versus 9.6% for an investor who bought at each market top. Today’s markets may appear toppy, but that’s not uncommon. Since the market has historically trended higher, it trades near its all-time high roughly 43% of the time. The “perfect moment” only exists in hindsight—it’s more prudent to design a plan to put your money to work as soon as possible.

Mr. James still felt conflicted, a common sentiment among athletes—or anyone coming into significant wealth for the first time. Successful athletes are usually calculated risk-takers in their careers, doing everything in their power to stay healthy and create a competitive edge. But markets that appear irrational can be disconcerting. Many athletes fear watching wealth drain away just because they’ve bought in at an inopportune moment. Some prefer taking their time by investing in stages—an approach called dollar-cost averaging (DCA). DCA is best practiced by determining an investment time horizon over a period of months and contributing cash to a portfolio on a consistent schedule.

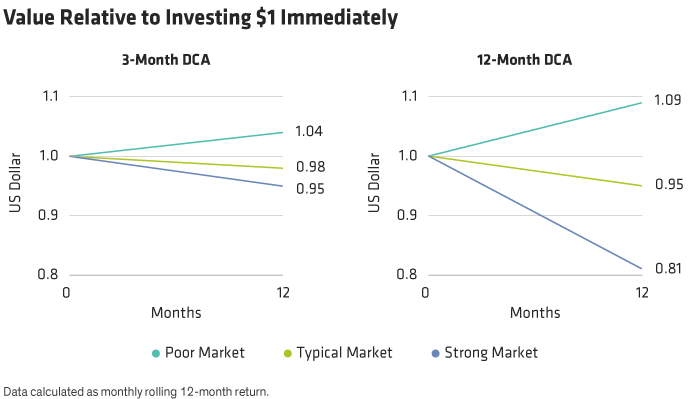

Since markets tend to climb over the long run, DCA typically generates less wealth than going all in at one time. But DCA can serve as a hedge in deteriorating scenarios because a staged entry means that all of the money won’t be invested at the peak before a downturn. Mr. James acknowledged this cost-benefit trade-off but still felt more comfortable pursuing a staged entry. He also understood that the contract itself is similar to a DCA strategy, since it pays out over several years.

When implementing DCA, time spent staging the entry was the key determinant of how much wealth was created or lost (Display). In other words, by phasing in, investors give up some of their returns. The longer the phase-in, the lower the relative return in typical and strong markets, but in poor markets, the effect is positive. For example, in typical markets, Mr. James could expect to lose 2% of his wealth when wading in over 3 months, but more than twice that amount if he waits a year to fully invest. In strong markets, the effect becomes even more pronounced—he would reduce his wealth by 5% using a 3-month strategy, but by nearly 20% over 12 months. On the flip side, if markets are weak, the benefits are also substantial. Instead of a potential loss if he invested immediately, Mr. James could see a relative return roughly 4% and 9% higher over a 3- and 12-month DCA.

The Long Game

Many investors are unnerved by the thought of investing a large sum. As you deploy your cash, consider your wealth goals. Besides weighing how to allocate the funds—across traditional stock and bond portfolios and alternative investments—think about how best to align your personal values with your investments, while keeping your community or family in mind. Your Bernstein financial advisor can help you navigate the key planning and investment decisions along the way to ensure your financial success.

The views expressed herein do not constitute research, investment advice, or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.