Global developed equity markets rose in apparent harmony during the second quarter, as if they were all singing from the same sheet. But beneath the returns, multiple risks are fomenting disquiet, and five points of dissonance warrant closer attention.

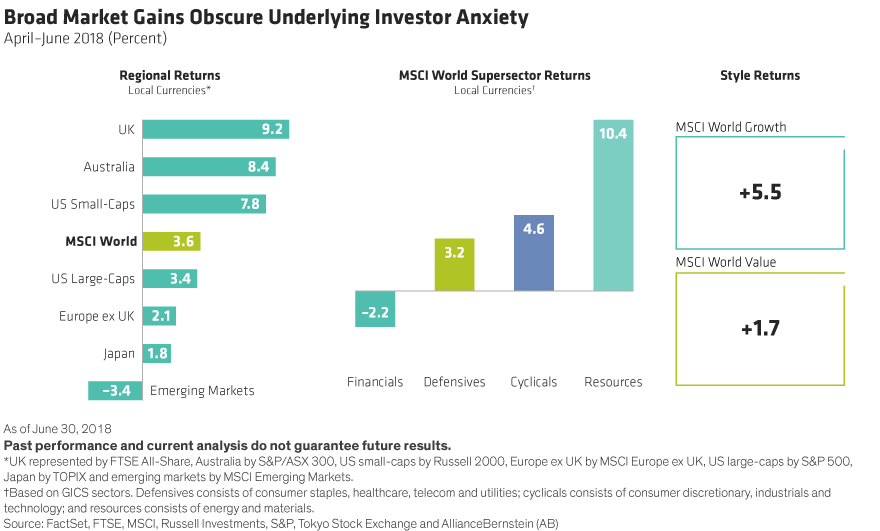

Considering the hazards facing investors today, equity returns seemed surprisingly sanguine in the second quarter. US, European and Japanese large-cap stocks all advanced at a healthy clip in local-currency terms (Display, left). US small-caps and UK stocks stood above the pack. Only emerging markets underperformed. Resources stocks surged as oil prices increased (Display, center). Almost everywhere, growth stocks continued to outperform value stocks by a wide margin (Display, right).

Volatility Eases, Though Risks Abound

Volatility eased in the second quarter after spiking earlier in the year, despite a barrage of unsettling headlines and a shaky geopolitical landscape. Investors can’t ignore the threat of a global trade war or concerns about European unity triggered by Italy’s political quagmire. Despite the US–North Korea détente, US relations with traditional allies are fraught after a stormy end to the G7 summit in Canada. Meanwhile, the US Federal Reserve and European Central Bank continue to signal that a decade of monetary-policy easing is nearing an end.

So what was driving returns in the second quarter? Clearly, a strong earnings season, especially in the US, has set the tone, while global economic growth continues to gradually rise. But beneath the surface, five complex issues could be decisive for investors as the year unfolds.

-

Narrow markets are deceptive—Equity returns have been skewed in recent quarters by the strong performance of mega-cap technology and new-media stocks known as the FAANGs (Facebook, Amazon, Apple, Netflix and Google). In the second quarter, these five stocks accounted for 48% of the S&P 500 return and 26% of the MSCI World return. But it’s dangerous to rely on such a small group of stocks as a long-term strategy, whether in the US or China, where internet and e-commerce giants like Alibaba Group and Tencent have been powerful return drivers. In the US and in emerging markets, the 20 largest stocks account for more than 30% of the index, and have influenced performance patterns substantially this year. High-growth companies present compelling opportunities, but portfolios should be positioned for a scenario in which these companies stop leading the market and market returns broaden.

-

Profitability matters—Earnings growth shouldn’t be the only yardstick for choosing stocks. In the US, some large companies that are growing fast are not improving their profit margins. And to sustain profit margins in a world of disruption, companies must show that they can reinvest in their businesses for the future. Beware of companies that are making too many acquisitions to grow: this is often a sign that they aren’t really reinvesting strategically in their businesses.

-

Risks are changing—In the late stages of an economic cycle, companies typically overinvest or add too much capacity. Remember the telecom cable glut before the crash in 2000 or the real estate bubble in 2008? Today, even though we’re in the ninth year of a global economic recovery, cyclical overinvestment risk isn’t really a big concern. Instead, there’s a lot more risk tied to policy decisions today. Will falling unemployment lead to inflation? When will inflation pick up? How might populist political agendas affect sectors, industries and markets? Investors must think creatively about how new types of risks could affect stocks and portfolios.

-

Sector performance could diverge—Consumer staples and utilities have underperformed much more sharply in the US than elsewhere this year, as these sectors are highly sensitive to interest rates, and the US is further ahead in the rate-hike cycle than Europe. Consumer industries are also much more vulnerable to technological disruption in the US than elsewhere, in our view. As oil prices rose, energy stocks outperformed more outside the US, where markets are more concentrated in these sectors.

Different markets offer different sector mixes. In the US, the S&P 500’s largest sector is technology, with 26% of the benchmark. But the MSCI Europe only has about 5% in technology, while its biggest weight is in financials. In Japan, industrials top the TOPIX at 23%. These differences are significant. That’s why simplistic valuation comparisons across regions are misleading. The composition of each market defines its risk/reward profiles—and sets the prices investors are willing to pay.

-

Emerging-market fears look overdone—Investors are pulling money from emerging-market (EM) funds after a rough six months. But is the EM rally really over after just two strong years? Our research suggests that EM countries and companies are much more resilient to a strengthening dollar and rising US interest rates than in the past. Volatility in emerging markets has actually been declining, and despite some of the headline fears, from Turkey’s currency crisis to political turmoil in Argentina or Brazil, the opportunities for investors in emerging markets are diverse. Turkish and Indonesian stocks tumbled by 15% and 14.2% respectively in the first six months of the year, while both Russian and Colombian stocks rose by more than 10%, in local-currency terms.

There are no simple answers to any of these issues. But one thing is clear: solid headline returns don’t tell the whole story about the state of global equity markets today. With so much uncertainty still unresolved, only active investing strategies can be mindful of the complexities beneath the surface when searching for sources of sustainable equity returns.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.