Over more than two decades of capital-market history, high-yield bonds have nearly matched equity performance.

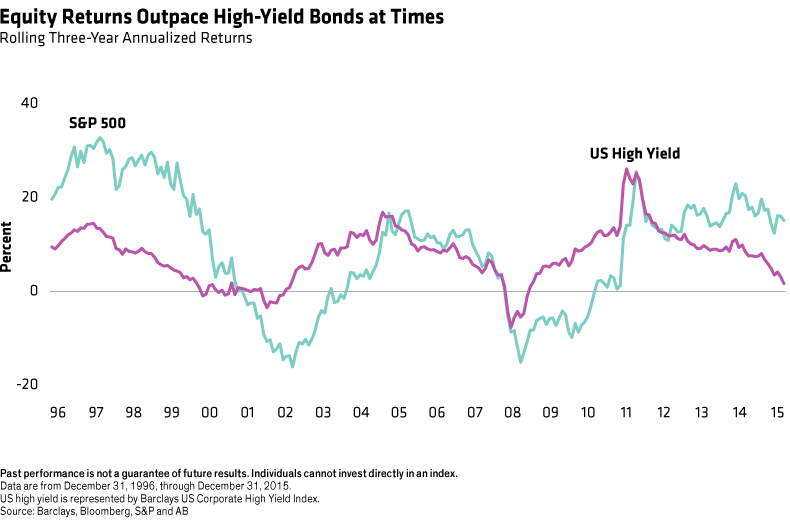

Equity Returns Outpace High-Yield Bonds at Times

Investors are paying attention to these improvements. Following the outflows in 2015, new capital has started to flow back to both stock and bond funds that focus on the developing world. Still, most global investors remain underweight, after reducing their allocation to emerging equities in recent years.

Keeping Pace with Equity Returns Over Time

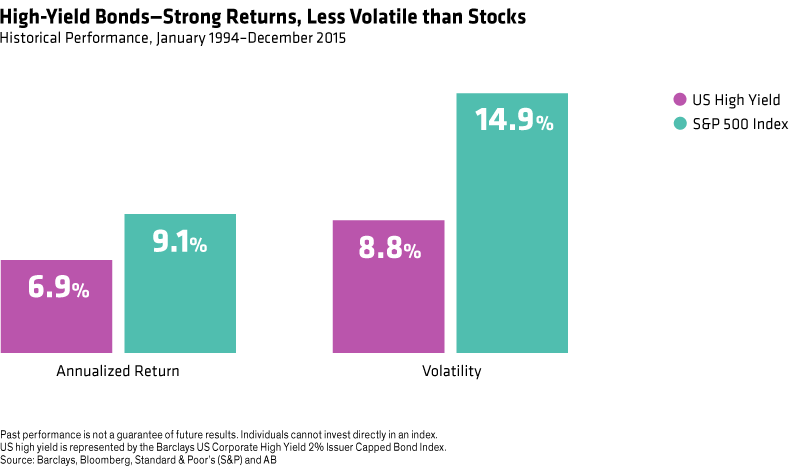

As for returns, high-yield bonds have stacked up well against equities. In fact, in over more than two decades of capital-market history, high-yield bonds have nearly matched equity performance—but with much lower volatility.

Since January 1994, stocks have produced an annualized return of 9.1%. High-yield bonds delivered a 6.9% return over that period. That’s lower than the return for equities, but still attractive, especially considering that this period spanned two full market cycles and countless rallies and sell-offs (Display below).

These two asset classes can’t be compared prior to 1983, because earlier high-yield index returns don’t exist. But the 9.1% annualized return for stocks is roughly on par with performance dating back to 1927, so these performance patterns seem fairly consistent over time.

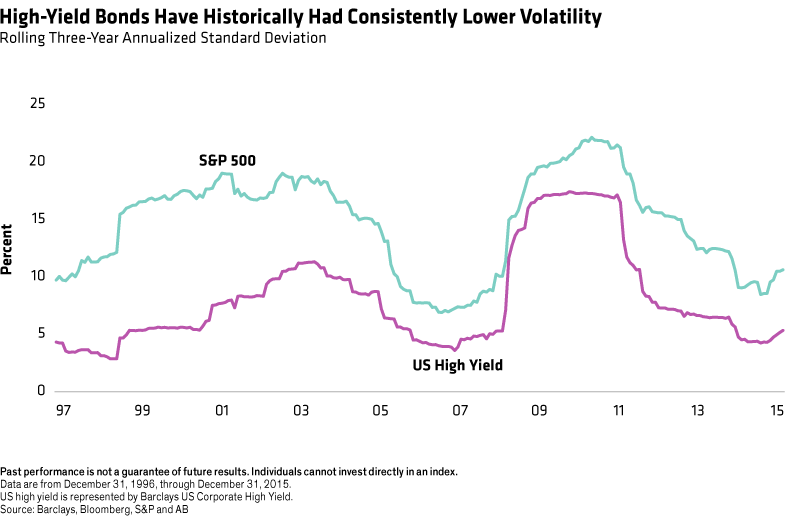

High-yield bonds haven’t always kept up with stocks—they’ve been outpaced by a good margin over certain time frames, such as when the technology/media/telecom bubble was inflating in the second half of the 1990s (Display below). But over the long haul, high yield has produced equity-like returns—with about half the risk of stocks, as measured by the standard deviation of returns.

In fact, high yield’s volatility has been lower than that of stocks (Display below), even during some tumultuous periods for capital markets. These attributes, combined with relatively low correlations to stocks and very low correlations to other bonds—have made high-yield bonds effective in a diversified portfolio.