Most portfolios should include well-diversified exposures to three categories of investments named for the roles they play, in our view. The mix of return-seeking, risk-mitigating, and diversifying assets that is right for you will depend on your circumstances, goals, time horizon, and risk tolerance.

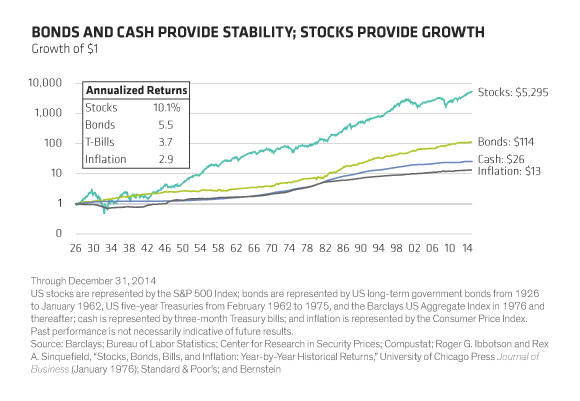

Risk-mitigating investments (high-quality bonds and cash instruments) are expected to provide stability and income. The long-term returns of investment-grade bonds and cash have been well below the returns of stocks, but bond and cash returns accumulate with fewer zigs and zags, as the Display below shows.

Risk-mitigating investments can also reduce overall portfolio volatility, because they tend to have very low or negative correlations to return-seeking investments. That is, prices for bonds or cash generally haven’t moved up and down with return-seeking investments, such as stocks—or they have moved in opposite directions.

Bonds are tradable debt instruments. Investment-grade bonds are rated BBB– or higher (up to AAA) by credit-rating agencies, signaling that the issuer is very likely to pay interest and repay principal on schedule. Bond prices fluctuate primarily in response to expected changes in prevailing interest rates and perceived credit quality. (Prices for most bonds fall when interest rates rise or perceived credit quality declines—and rise when interest rates fall or perceived credit quality improves.) Prices for some bonds also respond to changes in inflation or market volatility.

Cash instruments such as Treasury bills (T-bills) are debt with less than a year to maturity. They are typically less volatile than bonds. Their chief risk: Inflation could erode their purchasing power.

Return-seeking assets (stocks and high-yield bonds) are expected to grow more and be more volatile than cash or bonds. Their higher volatility makes diversification of these investments across region, sector, and style crucial.

Stocks are publicly traded ownership interests in a company. They offer significant appreciation (and depreciation) potential related to expectations for growth in companies’ earnings power. Many stocks are highly liquid (can be bought and sold quickly, with low transaction costs), and many provide regular income from dividends. Stock prices are vulnerable to inflation over shorter time periods but tend to withstand inflation better than bonds or cash because higher prices eventually feed into corporate revenue and earnings.

Over the long term, stock market returns have far exceeded returns for other major asset classes, despite occasional deep market losses and more frequent, smaller, dips. The S&P 500 Index of large-cap US stocks has beaten US bonds, cash, and inflation in more than 80% of all 10-year periods since 1926.

Venture capital represents ownership interests in early-stage, private companies. Most venture capital investments are made through partnership interests in a venture capital fund; others are direct, or “angel,” investments. Private equity represents ownership interests in typically more established private firms.

Venture and private capital can offer compelling investment opportunities—if you have a long-term horizon and don’t expect to need to draw on these holdings. Because they are not publicly traded, both are illiquid investments and normally require long-term commitments.

High-yield bonds typically offer high income, as well as significant appreciation and depreciation potential related to changes in perceived credit quality. Many high-yield bonds are issued by companies with credit ratings below BBB–, typically due to less steady cash flows or higher leverage. Others are issued by lower-quality governments, often in emerging markets. We characterize high-yield bonds as return-seeking, rather than risk-mitigating, because they offer higher expected return and risk than investment-grade bonds, and they have a fairly high correlation to stocks and low or negative correlation to other bonds.

Diversifying assets (principally real estate, commodities, and hedge funds) are expected to diversify both return-seeking and risk-mitigating assets. An allocation to these assets can improve portfolio expected return without adding risk, or reduce risk without sacrificing expected return. The return potential and risk of diversifying assets vary widely.

Real estate tends to be more resistant to the ravages of inflation than stocks or bonds. Real estate investment trusts (REITs) are liquid and generally make high income distributions. REITs are interest-rate-sensitive like bonds. REITs can also be as volatile as stocks and offer similar long-term return potential. Private real estate equity and debt are not publicly traded and thus less liquid.

Commodities include futures and forward contracts on oil and gas, metals, and agricultural products. Commodities can be extremely volatile. Like real estate, their prices tend to rise and fall with inflation or inflation expectations. Commodities and real estate do not always trade together, because they are subject to different supply and demand cycles. Unlike real estate, which provides an income stream, commodities often have a holding cost.

Hedge funds may invest in any asset class, sometimes using leverage or taking short positions (investing to profit from an investment’s price decline). Hedge-fund strategies vary widely but typically seek to generate returns primarily from manager skill, rather than market exposure, but some hedge funds take highly leveraged exposures to specific markets when betting on macroeconomic shifts.

Hedge funds typically have low correlations to stock and bond markets. Returns in any year typically vary widely across and within hedge-fund categories, so we think manager selection and exposure to a diverse group of hedge funds are crucial to success in this investment category. Most hedge funds are pooled vehicles (usually private partnerships) that restrict when capital may be invested and withdrawn.

This article has been adapted from Live Once, Plan Often, Bernstein, 2015.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.