THE GROWING NEED FOR DIVERSIFICATION AND YIELD

In the post-beta-trade environment, return expectations for traditional portfolios are lower and volatility is likely to stay higher, as investors face a lower-growth environment and a host of geopolitical risks that seem to keep markets constantly on edge.

In this type of landscape, investors are hungry for sources of extra yield—but they also need to avoid stretching too far and taking on more risk than they bargained for to capture that yield. It’s also critical today to incorporate downside protection in case markets take a tumble.

These needs have led many investors to consider incorporating alternative investments into their portfolio design. Alternatives bring the potential for diversification and may offer a cushion that can take some of the pain out of market sell-offs. Investors have turned to private credit as a solution.

PRIVATE CREDIT MOVES INTO THE MAINSTREAM

As an asset class, private credit has delivered consistent absolute and risk-adjusted returns, helping many investors diversify their public market exposure while adding higher yields in a low-return environment.

Historically, only institutions and certain investors could access these types of illiquid alternative assets. But times have changed: Technology has emerged that modernizes subscription and reporting processes. Also, investors have become more willing to accept illiquidity in exchange for incremental return. These and other developments have helped alternatives spread further into the portfolios of individual investors.

New vehicle structures are being launched to serve this segment from a regulatory perspective, and financial technology firms are streamlining back-end operations. We believe that this is a paradigm shift that’s here to stay and that will continue to redefine the investment universe available to investors.

New vehicle structures are being launched to serve this segment from a regulatory perspective, and financial technology firms are streamlining back-end operations. We believe that this is a paradigm shift that’s here to stay and that will continue to redefine the investment universe available to investors.

A FUNDING GAP OPENS THE DOOR TO THE MIDDLE MARKET

This brings us to US middle market lending. The middle market is a vital part of the US economy that includes more than 200,000 businesses and nearly 48 million jobs. That’s about one-third of the private sector jobs in the country.

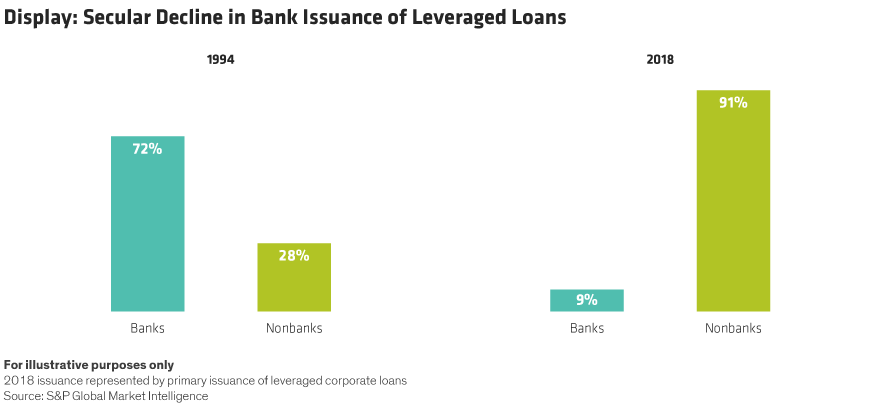

In the wake of the global financial crisis, new regulations mandated that banks increase their capital levels and tighten underwriting standards. As a result, they pulled back from a variety of businesses they were involved in before the crisis, including middle market lending. This accelerated the trend of resources being redeployed away from middle market lending businesses—a trend that had started amid the banking consolidation that emerged in the 1990s.

What resulted was a shortfall in the amount of credit available for businesses hungry to expand. This gap opened the door for nonbank lenders to step in (

Display), bringing alternative lenders much closer to middle market borrowers. This has presented investors with an opportunity to access a sector that has historically been rewarding.

WHAT MAKES MIDDLE MARKET LOANS SO COMPELLING?

Attractive Income: Middle market loans are less liquid than public fixed-income instruments, so they carry a significant yield premium. As of June 30, 2019, high-yield bonds yielded 6.3%. By comparison, middle market senior loan yields ranged from 7% to 8%, while yields on middle market second-lien loans ranged from 11% to 12%.