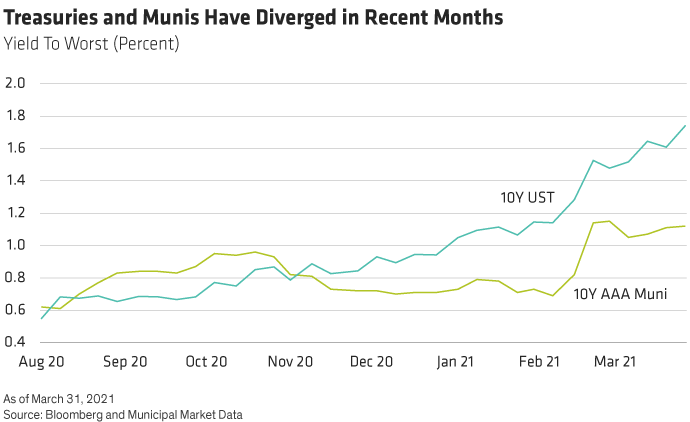

With the US economy moving closer to a full reopening, equity markets have continued to rally while interest rates and inflation expectations have risen in anticipation of stronger growth ahead. So far this year, the yield on the 10-year US Treasury has risen 64 basis points to its current 1.56% level. The pick-up in interest rates has renewed hopes that municipal bond investors will finally begin seeing higher yields, too.

However, the 10-year AAA municipal bond yield has risen just 22 basis points and currently sits at 0.93%—climbing less than half as much as the 10-year Treasury. On the bright side, and as a result, municipals outperformed Treasuries during the first quarter, with the Bloomberg Municipal Index down just -0.35% versus -4.25% for the Bloomberg US Treasury Index.

But not all the news has been great. Muni investors are still waiting for a step-up in yields that would offer them more income in the future. History has shown that municipals tend to move directionally—though not completely in lockstep—with Treasury bonds, due to their tax-exempt status. However, beginning in November 2020, municipals began to diverge, even from the directional path (Display 1).

Why Haven’t Muni Yields Risen More?

This disconnect begs the question: Why haven’t muni yields risen more? For starters, because there’s been too much cash chasing too few bonds.

Consider last October, when issuers raced to market ahead of anticipated election volatility. Issuance totaled $73 billion, the largest amount for a single month in the last two years. This effectively pulled issuance forward, while creating a dearth of supply in the months that followed. Yet even as supply dwindled, demand for tax-exempt municipal bonds remained robust fueling a strong technical tailwind. According to Morningstar, the market has experienced inflows every week in 2021 (except one), totaling $32 billion year-to-date. These inflows are even more remarkable given the broader “risk-on” sentiment across other major asset classes.

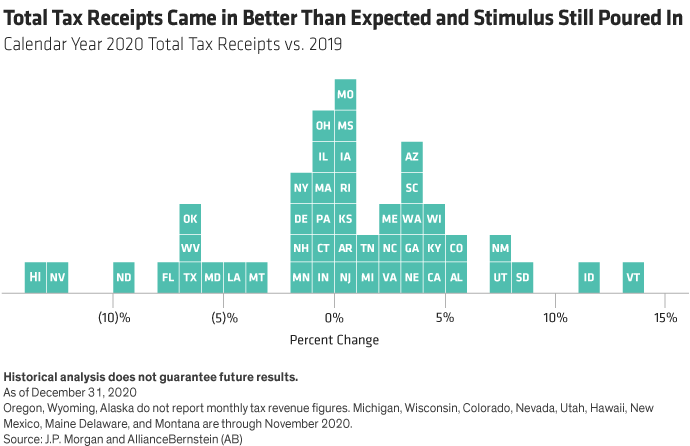

What explains muni’s persistent appeal? Significant federal support for state and local governments has boosted investors’ comfort with the asset class. For instance, the CARES Act—which was passed last March—provided $150 billion in direct aid to state and local governments along with considerable funding for hospitals, education, transportation, and airports. In addition, the Municipal Liquidity Facility established by the Federal Reserve allowed municipalities to secure short-term financing.

More recently, the American Rescue Plan provides an estimated $650 billion to state and local governments, tribal governments, territories, school districts, and public transportation systems. For many issuers, this new aid eclipses their pandemic-induced budget deficits. This extraordinary backing, combined with the failure of apocalyptic revenue shortfalls to materialize, further eased concerns of widespread impairment among investment-grade municipal bonds (Display 2).

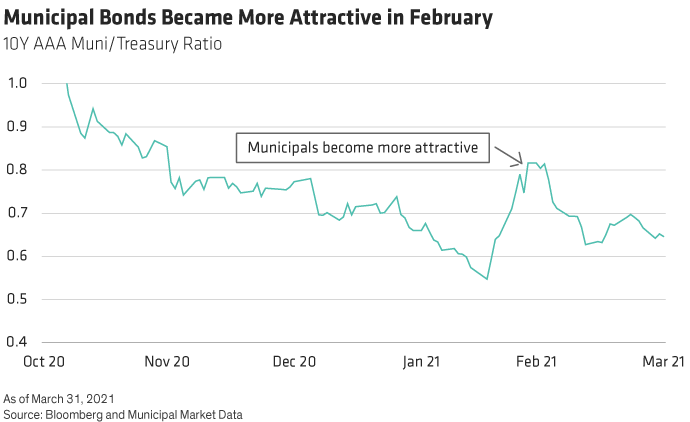

Demand has also become a stabilizing factor following periods of municipal underperformance. Take February, when municipals underperformed US Treasuries as investors hit the pause button due to historically expensive valuations. This caused yields to rise and municipals to become more attractive on a relative basis. Improved valuations then sparked an increase in demand, leading to municipal outperformance in March as Treasury yields continued to climb (Display 3).

Muni bonds enjoy one final advantage. After passing the American Rescue Plan, the Biden administration is likely to shift its focus to tax reform and infrastructure. The recently announced American Jobs Plan includes an increase in the corporate tax rate to 28% (from 21%). In addition, the administration has stated that they plan to increase taxes for individuals earning over $400,000. Either way, it is becoming increasingly clear that future tax hikes are on the table—further strengthening demand and providing another tailwind for the tax-exempt asset class.

Does This Mean Yields Won’t Rise Further?

Despite rising yields, munis have performed well compared to the sell-off across the broader interest rate market. But several factors could drive municipal yields even higher down the road. High-grade municipals have reverted to historically expensive valuations—which may hamper their ability to deliver returns comparable to those of the past two calendar years.

What’s more, the interest rate environment remains unstable as evidenced by the remarkable move in Treasury yields. While we do not foresee a similar yield spike over the next three months, further interest rate volatility could prompt an exodus from tax-exempt bonds, driving yields higher. Though this scenario could cause short-term discomfort, it would boost income going forward—which, as bond investors, we would welcome.

Those who hoped 2021 would boost their municipal portfolio’s yields may be disappointed so far. We remind investors that these low yields reflect strong year-to-date performance. As the economy continues to improve, we believe municipal yields will eventually normalize their relationship with US Treasuries—an environment that favors active, flexible municipal bond managers.

The views expressed herein do not constitute research, investment advice, or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.