It’s hard to forget deep market drawdowns that erode your wealth. But it’s just as hard to miss out on market upswings. Either way, extreme moves leave investors at a crossroads—live with the anxiety of investing in falling markets or forge ahead when you feel like the train has already left the station. The result? Investment paralysis often sets in as investors wait for the “perfect entry point,” a timing strategy that’s historically proven ineffective. How can hesitant investors muster their courage? Dollar-cost averaging may be the answer.

A Little at a Time

Dollar-cost averaging (DCA) involves systematically investing set amounts in the market at fixed intervals. This staged entry allows investors to buy more of a stock’s shares when the price falls and fewer shares when it rises. But more importantly, it offers a sense of security. Finding a comfortable pace can help alleviate the concerns of those who’ve endured a steep market decline. And it can reassure investors concerned about buying at the top. But does it deliver the best returns?

It seems intuitive that dollar-cost averaging adds value when markets fall—investors can buy shares at lower prices. But what about on the way up? As stock prices rise, investors still benefit from DCA, but at a cost. During market upswings, if there’s a choice between buying immediately or slowly (consistent purchases over time), diving in produces a higher return. But if the options include waiting for the opportune moment (such as a pullback) or gradually wading in, then the latter wins out. Despite this, investors often look to read the tea leaves. Is today’s all-time high market a sign it is due for a correction, making waiting to invest a better option?

Scared of Heights?

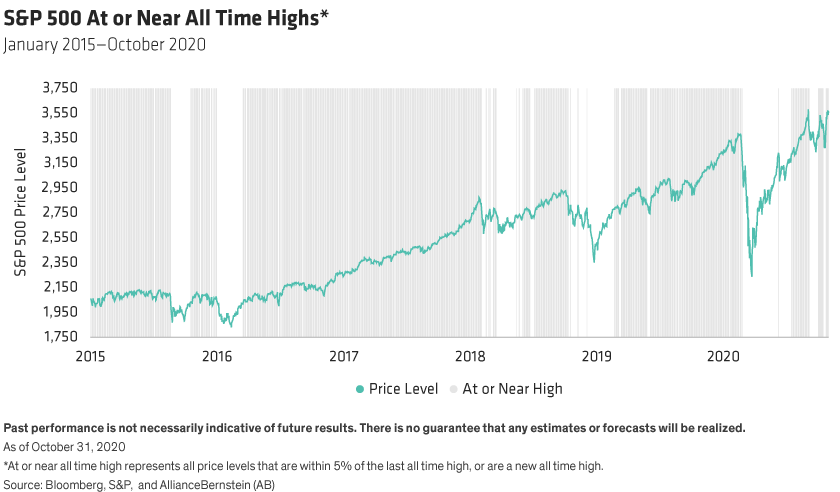

Although “all-time highs” garner media attention, in reality, they’re not unexpected. Equity markets generally track economic growth over time. Typically, during expansionary periods, US stocks have also moved higher, frequently setting all-time highs. Since 2014, the S&P 500 has hit near-record highs 75% of the time, and despite March’s recent pullback, it crested again in June (Display). But if an investor avoided the market over that period, she would have missed returns of 11.1% each year.

What does this mean for investors? Forging ahead immediately produces the highest return. The next best option is dollar-cost averaging. Waiting for a pullback often generates the worst returns. The reason is simple: A market high does not necessarily herald an imminent drawdown. If anything, history tells us that a new peak is likely forthcoming. So, by waiting for a market dip, you increase your chance of missing subsequent market gains.

Does this hold for market highs in the wake of steep drawdowns? In other words, would US stock market recoveries from bear markets—downturns of 20% or more—serve as a better jumping in point? It turns out they aren’t. Recovering markets are no better at forecasting negative returns than peak markets.

Since 1928, investors earned an 11% average return over any given rolling 12-month period,* regardless of whether the market was at an all-time high. If an investor felt a bit cautious and decided to wade in over a three-month period, she would have made 9% (or 2% less) (Display). But if she were trying to time the best entry point and did not invest in the first three months after stocks hit an all-time high (regardless of if the market was up or down), she would have only made 8%–3% less. The longer an investor waits or the longer it takes to dollar-cost average, the lower the overall return.

Best Isn’t Always Easiest

It’s taken years for memories of the losses from the Global Financial Crisis to fade—and some may still be basing investment decisions on that harrowing experience. The recent steep decline, though fully recovered, may also weigh on investors’ minds for the foreseeable future. While fully investing immediately remains the optimal strategy, it’s not always the emotionally easy one. That’s why dollar-cost averaging serves a fundamental purpose—it strengthens an investor’s ability to act. DCA is not about the first year; rather it pays dividends over future years as it reassures investors to bridge the gap between their current allocation and their ideal one.

*Calculated on a monthly basis.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.