While the election is now behind us, some unknowns remain, including what tax legislation will be enacted under the new administration. For many investors holding concentrated stock positions with large embedded capital gains, this raises the question: should I make a preemptive move? After all, with Democrats now holding unified control, the tax landscape could change dramatically. Yet as with many investment decisions, there’s no one-size-fits-all approach. Your personal circumstances, tax bracket, and time horizon all factor into the decision-making process. We know that concentrated stocks increase portfolio risk, and certain tools mitigate that risk in a tax-efficient manner. But will they remain relevant?

Changing Landscape for Capital Gains

Before comparing options, let’s consider the likelihood and scope of potential tax change, especially around capital gains. Assuming Democrats have full legislative freedom to enact their stated proposals, the top marginal federal rate could revert back to 39.6% from the current 37% threshold for income above $400k/year. But the bigger adjustment comes for those with an income above $1M/year. That’s because any realized capital gains above that threshold would be treated as ordinary income.

Make a Move…or Stay the Course

Faced with these potential changes, investors have options—in both the short term and long term. Consider a 50-year-old investor who holds $1M of Tesla shares purchased at a very low cost basis. Should she sell the position immediately, and pay the prevailing capital gains rate of 20%?

If she’s not ready to divest today, she could later hedge or swap the position through the use of options or exchange funds. Options represent the traditional route but require frequent rebalancing if you’re hedging over a multiyear horizon. That helps explain why exchange funds have become a more popular solution. Formed as Limited Partnerships, exchange funds allow for tax-free exchanges where an investor contributes her security in exchange for shares in a broadly diversified fund. The fund retains the contributed security while typically offering exposure to a roughly 80% equity/20% real estate allocation.

Another popular option? Donate the security into a Charitable Remainder Unitrust (“CRUT”). These trusts provide an income stream back to the donor—usually a fixed percentage of the portfolio value over time—with any remainder going to the charity (after a set number of years or upon the death of the donor). The donor receives an immediate tax deduction during the first year equal to the expected charitable remainder, while the payouts are taxed based on the composition of the trust. (Note that capital gains tax would apply when funded from single-stock contributions.)

Should You Stay or Should You Go?

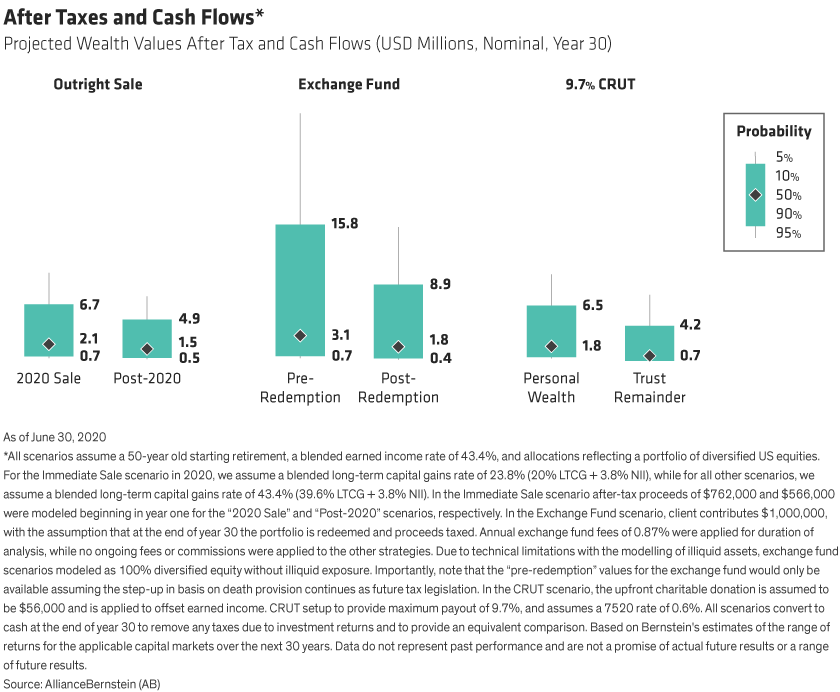

What are the long-term benefits of these three options? To quantify, let’s return to our investor and consider the advantages under each scenario assuming a 30-year investment horizon and AGI > $1M (Display).

With an outright sale, she could move the after-tax proceeds to a portfolio consisting of 100% diversified equities. Selling before year-end at lower rates would generate a much better outcome of $2.1M compared to only $1.5M gained by liquidating at the beginning of next year (assuming no market movement in between). But she’d have to move quickly.

If she needs more time, contributing the assets to an exchange fund produces better results. Assuming a higher tax environment going forward, assets held long term in an exchange fund outpaced the expected growth from an upfront sale. That’s because the full assets grew for a longer period before being taxed while withstanding lower volatility given the diversified portfolio structure. The median “pre-redemption” amount of $3.1M represents a significantly higher pretax valuation we’d normally see under a step-up on death provision. At the same time, the “post-redemption” value of $1.8M proves more compelling than an immediate sale when taxed at a 39.6% rate.

She could also harness superior asset growth with CRUTs. In the median case for a CRUT offering a maximum payout, personal assets grew to $1.8M by year 30, with $700k left over for the charity. Keep in mind that since these are lifetime income payouts, her longevity drives the amount of value received by the investor and charity. A premature death results in the lion’s share of the value going to the charity, while the investor captures the bulk if she outlives expectations. Finally, investors anticipating lower future personal tax rates—perhaps due to retirement—may find this strategy particularly attractive due to the larger after-tax cash flows.

Strategies That Endure

Now that Biden is president-elect and the Democrats have a slim majority in Congress, what will tax policy look like? Investors may want to consider accelerating sales of appreciated securities—especially if they expect their capital gains tax rate to significantly increase. But longer term, solutions like Exchange Funds and CRUTs remain effective vehicles for risk diversification and asset growth, no matter who comes into power.

1CRUT setup to provide maximum payout of 9.7%, assumes a 7520 rate of 0.6%.

The views expressed herein do not constitute, and should not be considered to be, legal or tax advice. The tax rules are complicated, and their impact on a particular individual may differ depending on the individual’s specific circumstances. Please consult with your legal or tax advisor regarding your specific situation.