There’s no sugarcoating it: 2018 was hard on emerging markets. But as Nietzsche (and Kelly Clarkson) said, what doesn’t kill you can make you stronger. And as 2019 begins, we see many pockets of strength—and opportunity.

There are still headwinds buffeting emerging-market debt (EMD), as there are with all risk assets. Interest rates are rising, the US dollar is strong and market liquidity is declining. In these conditions, investors can’t afford to chase high yields while ignoring an asset’s underlying fundamentals.

Happily, fundamentals in much of the EMD universe are still strong, leaving the sector well insulated against external shocks in 2019. And after last year’s sell-off, valuations are attractive. Consider the positives:

1. EM countries are still the world’s most powerful growth engine. In a world of slowing growth, emerging markets are expanding more rapidly than developed ones—and they’re likely to widen the gap in the years ahead. The International Monetary Fund (IMF) forecast that EM economies would grow 4.7% in 2018, well above the 2.4% rate of the world’s advanced economies. And this growth differential is expected to widen in the years ahead.

While we expect global growth to slow somewhat in 2019, we think much of this expectation is already priced into EM assets.

2. External vulnerabilities have declined considerably. In the past, large current account deficits throughout developing economies meant many were wholly dependent on foreign investors for their short-term financing. That’s not the case today. Outside of a few outlier countries, emerging markets have reduced current account deficits and attracted more foreign direct investment—a more stable source of financing because it is usually long-term in nature.

3. Valuations are compelling—historically and relative to other risk assets. After 2018’s sell-off, asset valuations for bonds and currencies are broadly attractive. EM currencies are trading well below their historical long-term average, while the US dollar looks overvalued and unlikely to appreciate so rapidly the coming year with US economic growth expected to slow to trend. And last year’s broad sell-off has left EM bond spreads—the extra yield these assets offer over US Treasuries—substantially wider than they were 12 months ago. That means they’ll provide more cushion than they did in 2018 as US interest rates rise (Display).

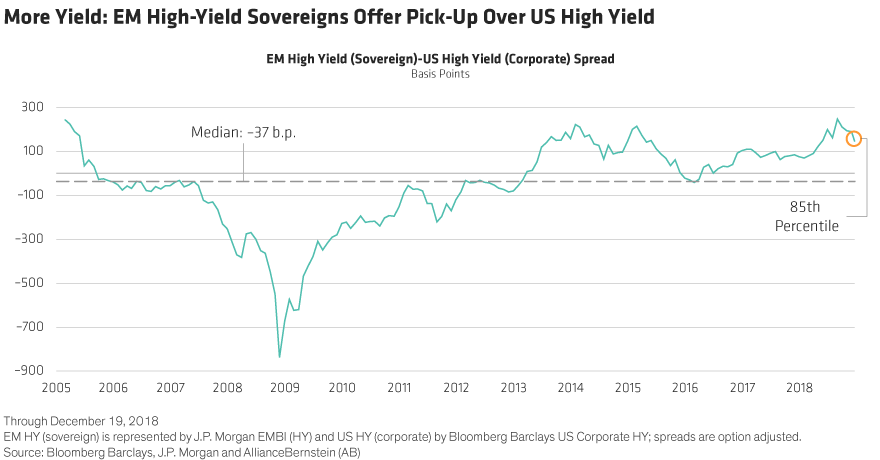

Real yields are near historical highs relative to those on developed-market (DM) bonds, and high-yield EM sovereigns have rarely traded at a higher premium to US high-yield corporate bonds. (Display)

Among US-dollar-denominated investment-grade EM bonds, volatility has declined and is now comparable with the volatility of US investment-grade corporates. This is partly because the buyer base has improved: these assets tend to attract large institutional investors as well as local investors with long investment horizons.

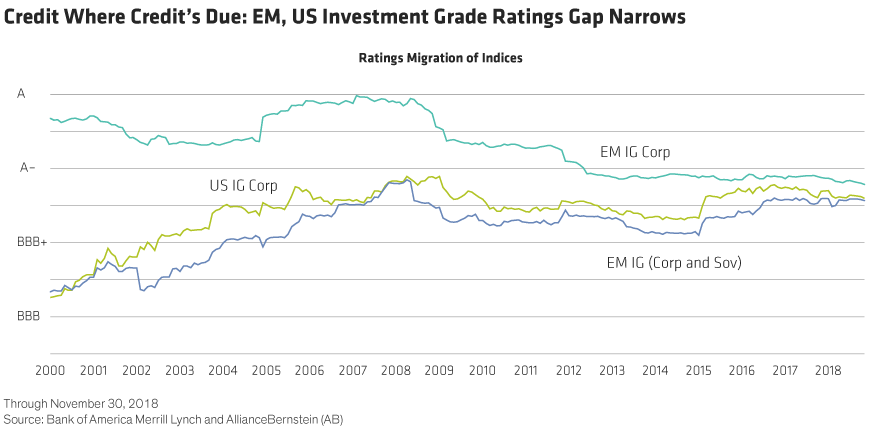

And unlike US investment-grade bonds, the average credit quality of investment-grade EM bonds has improved in recent years—so much so that there’s never been such a small gap between the average ratings of the two (Display).

The Technical Backdrop Is Much Cleaner

Need another reason to consider EMD exposure in 2019? How about this: the supply/demand dynamics are likely to favor investors. Net issuance of EM sovereign and corporate debt is expected to be lighter than in recent years. Net EM sovereign issuance, for example, is likely to be just half of what it was in 2018.

At the same time, positioning in the market is cleaner than it was. This is the result of heavy selling last year, particularly by crossover investors who dip into and out of EM assets, depending on prevailing economic and credit conditions. The result: dedicated EM investors who have done their homework can step in and snap up attractive assets that were unfairly punished. And with supply limited, increased inflows are likely to drive up asset prices.

Sifting Through the Risks As Liquidity Declines

Of course, macroeconomic and geopolitical risks still loom, and they’re likely to keep overall market conditions volatile in 2019. Worsening trade tensions or a larger-than-expected slowdown in China’s economy could slow growth and pressure some EM assets, as could a US recession. Uncertainty surrounding Brexit and Italy’s debt sustainability also bears watching.

But when it comes to individual countries, there’s still variation in macroeconomic stability, governance and fiscal policy. But remember, financial conditions have tightened and liquidity isn’t what it once was. In this environment, investors must be selective.

For example, we see potential in Brazil, where a new government is pushing an ambitious agenda of privatization and pension reform, and trying to reduce bloated public sector debt. We also see tactical opportunities in Turkey, where a shift toward more orthodox policies has staunched a sell-off in the lira and lower oil prices have reduced the country’s current account deficit.

Elsewhere, political risk warrants caution. Mexican President Andrés Manuel López Obrador’s populist tendencies and doubts about his commitment to keeping the energy sector open to foreign investment are a concern. In Argentina, investors will have to weigh highly attractive yields against the possibility that its reformist government loses power in elections later this year.

To sum up, investors still need to do their homework. With volatility likely to stay high, it’s important to carefully manage overall portfolio risk—economic, political and otherwise. That means staying active and taking advantage of market downturns to pick up assets at broadly attractive prices.

EM assets had a turbulent 2018. But they remain one of the most rapidly growing sectors in the global fixed-income market. At current prices, careful investors have a unique opportunity to add long-term value to their portfolios.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.