Currently, most married couples don’t have a federally taxable estate. A higher basic exclusion—$22.8 million per couple*—together with the portability of that exclusion has simplified estate planning for many couples in recent years. But that may change. The fate of the exclusion starting in 2026 is uncertain, causing an estate planning conundrum: Will your estate be taxable in the future? Unfortunately, the answer is not straightforward.

The answer is unclear

The Tax Cuts and Jobs Act (TCJA) increased the basic exclusion amount from $5 million to $10 million. As such, many estates that were once taxable, no longer are. But many provisions of the TCJA, including the enhanced basic exclusion amount, are set to expire after 2025. Together with portability of the deceased spousal unused exclusion (DSUE) amount, and considering the effect, if any, of state transfer taxes, additional alternatives and variables now influence estate planning. Unfortunately, the confluence of these variables belies that there’s one clear-cut optimal plan design. Instead, an analytical framework is essential to effectively evaluate the multiple planning alternatives available today.

Planning basics

Estate plans for wealthy couples are generally designed to defer the payment of estate taxes until the second death. For example, in a traditional credit shelter trust plan, the decedent’s assets, up to his or her applicable exclusion or state exemption, are left to a non-marital trust to which the surviving spouse may have access during life but will not become part of the survivor’s estate at death.

The introduction of portability in 2010 changed this traditional estate plan—by providing relief to couples that failed to properly divide assets between them to facilitate a traditional credit shelter trust plan at death. Now, the surviving spouse can use the unused portion of the deceased spouse’s applicable exclusion amount.

The increased basic exclusion amount of $10 million equates to an inflation-adjusted applicable exclusion per spouse of $11.4 million**. However, under the TCJA, it automatically reduces to $5 million after 2025 as indexed for inflation. This “sunset” creates an interesting dynamic for deaths occurring between 2019 and 2025. During those years, portability elections have the potential to lock in a fixed DSUE amount of more than $11.4 million. However, uncertainty remains as to how the DSUE amount from these deaths will be treated beyond 2025.

This ambiguity requires estate planning to embed flexibility depending on how future tax law changes affect the benefits of a traditional credit shelter trust compared to a portability plan.

Credit shelter trust…or portability?

Comparing a traditional credit shelter trust to portability requires a forecast of the range of probable values for the survivor’s estate over time. The lower the probability that the survivor’s estate will become larger than the total of his or her own applicable exclusion and the DSUE, the more favorable a portability election.

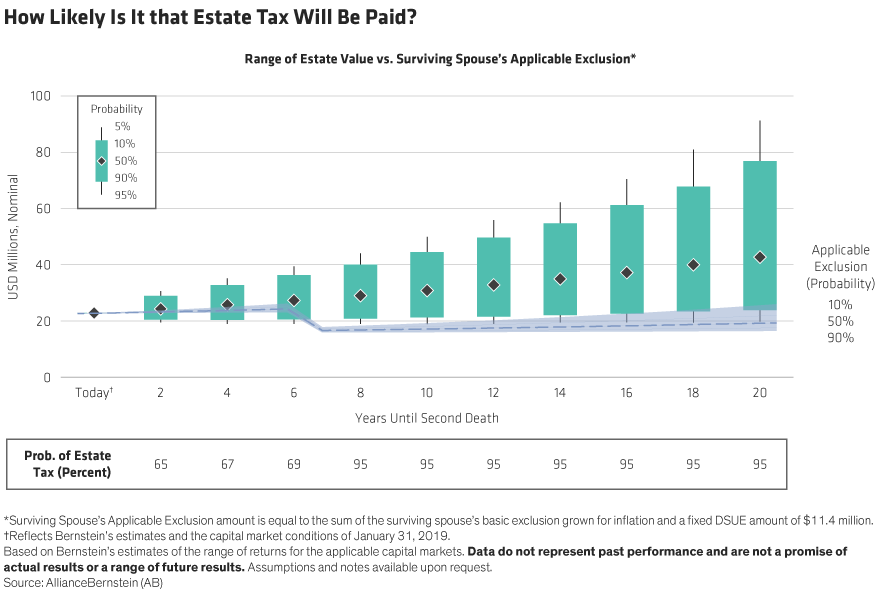

Let’s walk through an example: A married couple has a combined total estate of $22.8 million split evenly between them. Assuming the first death occurs today, and all the deceased husband’s assets are transferred directly to his surviving wife, her estate increases from $11.4 million to $22.8 million. We suppose the survivor holds those assets in a balanced portfolio of 60% global stocks and 40% intermediate-term municipal bonds. For illustrative purposes, we restrict the surviving spouse’s spending from her portfolio to zero, which is a highly unlikely scenario. In comparing the projected range of the surviving spouse’s estate to the projected combined applicable exclusion, we can infer that there is an extremely high probability of an estate tax under current law. This conclusion favors funding a credit shelter trust plan at the first death to reduce future estate taxes (Display).

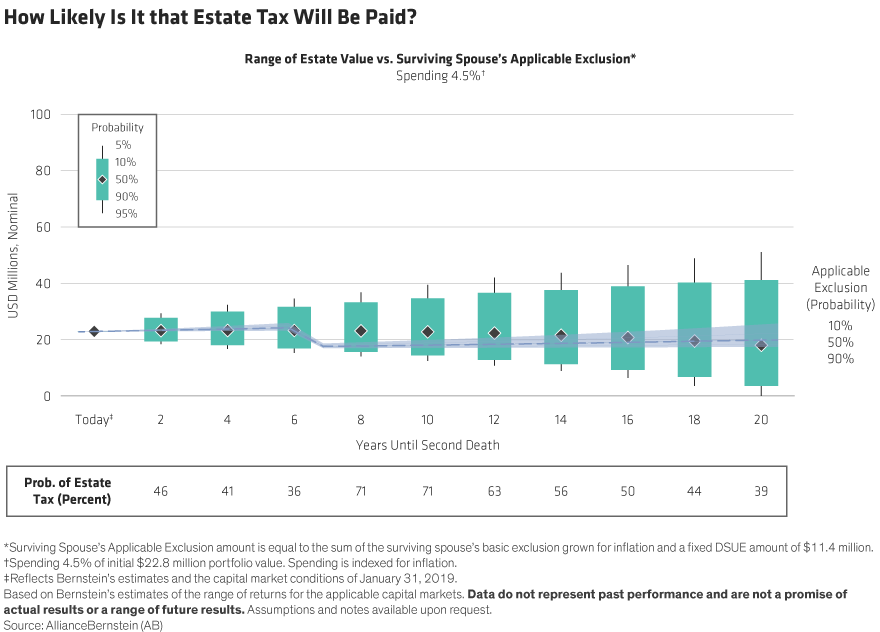

The answer becomes less obvious when the surviving spouse has a more realistic spending rate. If we assume a 4.5% inflation-adjusted spending rate for the survivor, the probability of an estate tax decreases significantly from the no-spending scenario. However, even with a 4.5% spending rate, the odds of incurring an estate tax are significantly increased after the sunset—from 36% in year 6 to 71% (Display). These scenarios attest to the fact that time horizon and variables, such as the spending rate, can dramatically influence the probability that an estate will be taxable at the survivor’s death.

Flexibility is key

The doubling of the basic exclusion amount and its portability complicate estate planning for some married couples. Due to the multitude of ever-changing variables (including state tax law considerations), adding a provision to a will that provides flexibility to opt into or out of portability is strongly recommended. Quantifying the income and estate tax implications of various planning alternatives—both now and shortly after the death of the first spouse to die—may be one of the most important services an investment or estate planning professional can render.

*Inflation adjusted.

**Reduced by the value of any lifetime taxable gifts.

The views expressed herein do not constitute and should not be considered to be legal or tax advice. The tax rules are complicated, and their impact on a particular individual may differ depending on the individual’s specific circumstances. Please consult with your legal or tax advisor regarding your specific situation.

This blog is an excerpt from an article originally published in the Tax Management Estates, Gifts, and Trusts Journal, Vol. 44, No. 4, 07/11/2019. Copyright © 2019 by The Bureau of National Affairs, Inc. (800-372-1033) http://www.bna.com