While fixed-income markets have become global, the core bond strategy for most US institutional investors remains US-centric.

The Potential Benefits of a Bigger Pond

The most obvious potential benefit to globalizing comes from a significantly increased opportunity set. The Barclays US Aggregate Bond Index as of year-end 2015 represents about $18.1 trillion in outstanding debt and about 9,700 issues. Its global counterpart, the Barclays Global Aggregate Bond Index, clocks in at about two and a half times that size: $43 trillion in outstanding debt and more than 17,100 issues. That’s a much bigger pond to fish in.

Going global in debt also diversifies an investor’s economic and interest-rate risk. A US-only investor is affected by one business cycle, one yield curve and a single monetary policy. Globally, there are many different countries, economic cycles, business cycles, monetary policies and yield curves. And although over short periods these cycles may closely align, over long periods the economic and business cycles of these countries have not been highly correlated.

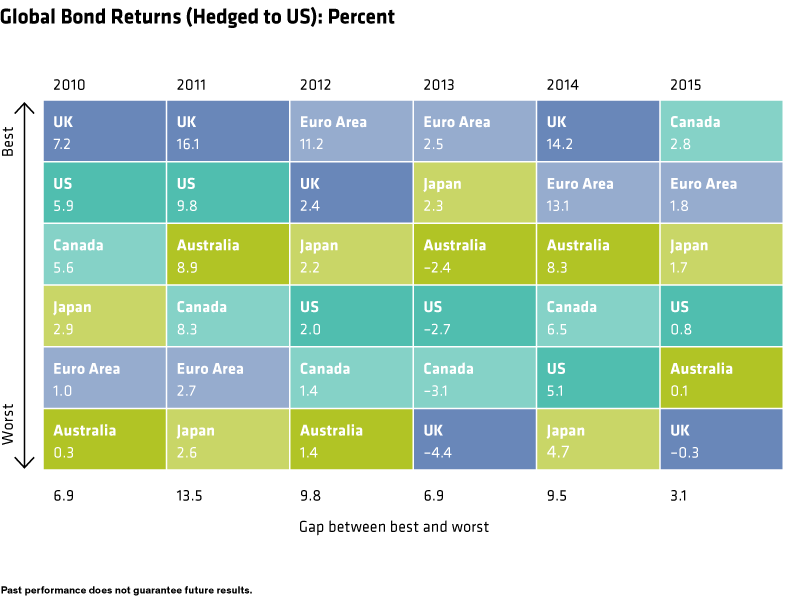

We've illustrated the potential diversification benefits of going global in the display below. This "quilt chart" shows annual hedged returns of various countries' bond markets over the past five years. (That they are hedged returns is important, because—spoiler alert—hedging will be key to our global approach in a core bond framework.)

Two features of this chart are striking. First, the array of returns, from top to bottom, differs every year. That’s because business and interest-rate cycles vary from country to country. Second, the gap—that is, the difference between the best-performing country and the worst-performing country each year—is big. For example, in 2015 Canada outperformed the UK by 3.1%.

If we were to examine the gap between the sector returns of the typical US core or core-plus option—the returns of US Treasuries, agencies, mortgages, corporates and other sectors in the US Aggregate, for example—in most years (barring the extremes of 2008 and 2009), we would see a difference of just a couple of percentage points between the best- and worst-performing sectors.

So having such a large gap between country returns provides much more potential opportunity for an active manager to add value in a global portfolio: to use research to overweight countries that are likely to perform better and to underweight countries that are likely to underperform.