From escalating climate threats to growing social challenges, the impetus for creating a more sustainable world has become impossible to ignore. But we can’t rely on governments and philanthropy to solve the problems. Investors have an important role to play by supporting private sector efforts to address the issues that will redefine life on earth for decades to come.

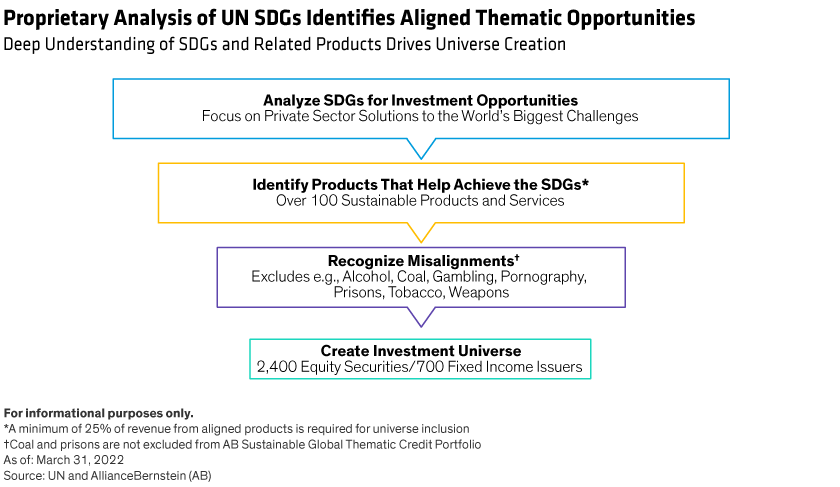

Yet investing efforts that aim to improve the world are under scrutiny. Sceptics claim that environmental, social and governance (ESG) investment criteria can be subjective at best and self-serving at worst. We disagree—so long as investors hold fast to objective criteria, adopting a recognized independent reference point for their investment process. As a prime example, the United Nations’ Sustainable Development Goals (UNSDGs) are a powerful and important initiative that aims to change the world substantively—and can help guide investors to companies addressing some of the most critical areas of importance to humanity.

Why Are the UNSDGs Important for Investors?

To transform aspirations into action, investors need a coherent framework for defining sustainability. The UNSDGs provide just that. Adopted by all 193 UN member states as a practical way to address sustainability issues on a long-term basis, they aim to define the most pressing tasks necessary to create a prosperous and sustainable future—economically, socially and environmentally. With 17 goals and 169 specific targets, the SDGs address issues including eliminating poverty and hunger, improving access to education and healthcare, and combating the negative impact of climate change.

Fulfilling these goals will require about US$90 trillion of investment over 15 years from 2015 to 2030, according to the UN. Public spending won’t be enough to get the job done. The private sector—and investors—must be part of the solution. So, investors seeking to contribute to a more sustainable future while also earning attractive financial returns can channel their capital into companies whose products and services are aligned with the SDGs. In effect, they provide a gold standard for responsible investors.

Our sustainable investing strategies across asset classes use the UNSDGs as a framework for identifying products and services that contribute to these sustainability goals. It provides us with a coherent methodology to actively target investment in issuers that address environmental and social challenges. We also apply fundamental ESG analysis to assess each company individually, rather than relying on top-down third-party scoring systems. And we designed the portfolios with the express purpose of helping create social benefits while aiming to generate strong financial returns.

Translating Sustainable Development Themes into an Investment Process

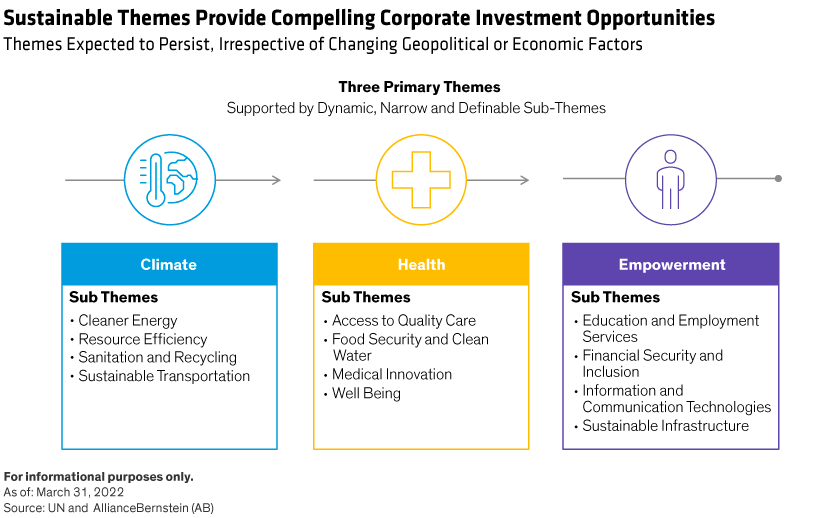

In our sustainable equity, fixed-income and multi-asset portfolios, companies that qualify for inclusion must derive a high proportion of revenue from SDG-aligned products or services that support three core themes: Climate, Health and Empowerment. (For sovereign bonds and asset-backed securities, we have adapted our framework and developed different guidelines and alignment criteria.)

Why these themes? Because they represent the biggest issues threatening our environment, economies and societies—and require massive private sector investment. Efforts to address the myriad effects of climate change are vital to our planet’s future. Healthcare is a basic human need that is being redefined by innovative services and treatments. And finding ways to create a better future for people marginalized by economic and social forces is crucial for developed and emerging countries alike.

This thematic approach aims to provide investors with access to the three major sources of sustainable development and growth via a structured methodology. And the themes require consistent capital investment, making them highly relevant for many years to come.

Choosing themes with a forward-looking view of the world can identify compelling investment opportunities and create differentiated portfolios. Many investors build portfolios by starting with a benchmark. But benchmarks are inherently backward-looking and don’t tell us what the future will look like. By focusing on climate, health and empowerment issues, we’ve designed our portfolios to thrive from future change. The three themes also provide diversified industry and regional exposure, making our strategies strong alternatives to conventional funds from a risk and return point of view.

Within each category, we’ve identified 12 sub-themes to further clarify the investment opportunities. Climate sub-themes include, for example, cleaner energy generation, resource efficiency and sustainable transportation.

Investment candidates are then subject to rigorous research, which integrates ESG research with disciplined security selection processes. For example, in equities, we evaluate candidates by calculating a bottom-up internal rate of return, similar to the approach used by private equity funds, to capture long-term return potential. In fixed-income portfolios, we’re aware that liquidity can be more limited in bond markets. So we adapt our filter methodology to ensure that the range of bonds on our approved list remains broad enough to source credits suitable for our portfolios.

The Right Choices, for a Lasting Difference

Our planet is precious. And the time available to create a sustainable world is short. We think investors should approach sustainability rigorously, using a durable process focused on objective criteria, thorough analysis and active management. In this way, we believe that a responsible investing agenda can both drive sustainable, long-term investment returns and foster a better future for our world.

The offering of the shares in our fund range may be restricted in certain jurisdictions. Prospective investors should read the Prospectus, which includes Sustainability-Related Disclosures, by visiting www.alliancebernstein.com and discuss risks and the Fund’s fees and charges with their financial advisor to determine if the investment is appropriate for them.

For investment professionals only. The value of an investment can go down as well as up and investors may not get back the full amount they invested. Capital is at risk.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.