After weathering the global financial crisis and an era of heavy regulation, the US banking sector has gotten what looks to be a clean bill of health. We think this opens a lot of possibilities for equity investors.

When the US Federal Reserve released the results of its Comprehensive Capital Analysis and Review (CCAR) in late June, it marked a dramatic moment for beleaguered US banks. In one fell swoop, the annual stress tests confirmed that banks aren’t mired in a regulatory quagmire anymore. Instead, they’re strong American companies that seem fully recovered from the global financial crisis of 2008.

AN ENCOURAGING END NOTE TO A CHALLENGING FIRST HALF

The CCAR results were welcome after a less-than-stellar start to 2017. Banks had rallied sharply in the second half of 2016, but they underperformed in the first half of this year despite the good news of multiple Fed rate hikes (in December, March and June), which tend to be supportive for the banking sector.

What was it that held banks down in the first half, then?

For one thing, intermediate-term interest rates fell. The market sees this as a big negative for bank stocks, although we argue that the relationship is actually much more nuanced. Oil prices fell, a development that has the potential to take some air out of price levels—this could hamper economic growth and ultimately slow the Fed’s path for rate hikes. Loan growth and capital-market activity were also subdued in the first half of the year, so much of the boost from higher short-term rates was offset by sluggish top-line trends.

STRESS TEST BREATHES NEW LIFE INTO BANKS

But then there were the stress-test results, which seem like a game changer.

The strong grades reenergized banks, which responded by boosting their stock dividends and ramping up plans for share buybacks, exceeding the market’s expectations. Both actions are positives for equity investors. As a group, banks are expected to return almost 100% of their earnings to shareholders through dividends and buybacks over the next 12 months—some could even top 100%. In other words, a nearly decade-long capital buildup is over.

Of course, the stress-test results don’t eliminate the risks in banking. Loans can still go bad, and if interest rates stay low, bank margins will remain depressed. But at least now banks are playing on a level field again.

EMERGING FROM AN EXTENDED GAME OF “SURVIVOR”

We’d describe the landscape this way. Banks are cyclicals: the fortunes of better banks are directly tied to US economic growth, and to some extent the global economy. But banks didn’t benefit from the upcycle in the last few years because the US government kept moving the regulatory goalposts—and because quantitative easing kept interest rates low, squeezing profit margins.

Banks have already suffered through the trials of the global financial crisis, and they spent years out of favor, saddled with a heavy, costly regulatory burden that hurt profitability. We see that burden lifting, and we believe compliance costs should start to decline—providing a big boost to profit margins in the coming years. And with the days of “trapped capital”—huge amounts of capital held under layers of regulatory requirements—behind them, banks are returning almost 100% of cash flow to investors. That’s better than the S&P 500 Index.

SLOW REAWAKENING AHEAD—BUT WITH MUCH POTENTIAL

Of course, after many years of navigating layers of heavy regulation, it’s likely to be a relatively slow reawakening for banks. Dividend payout ratios have crept up to between 30% and 35% for most companies in the sector; that’s still well below the precrisis average for many banks. In our assessment, improving conditions could bump that ratio up beyond 40% over the next few years.

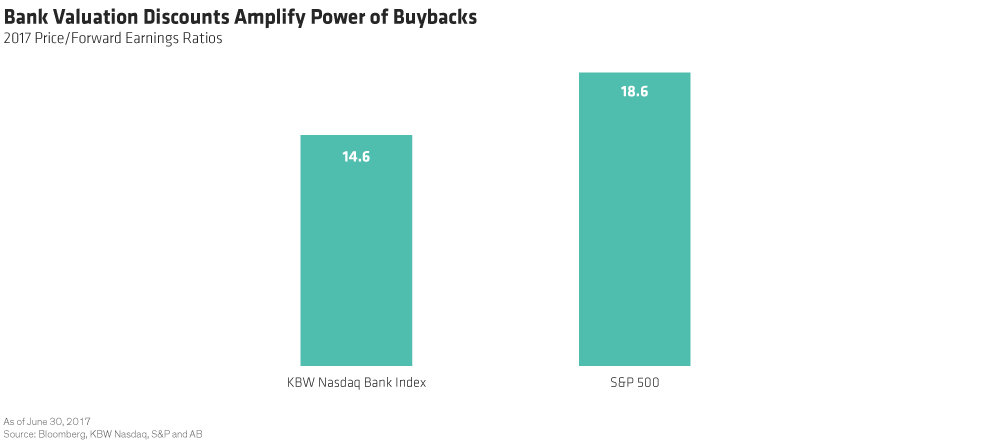

Given that banks plan to return about 100% of their earnings to shareholders, there’s plenty of room to increase stock buybacks, in our view. And buybacks from companies whose stock is trading at lower price/earnings ratios pack more punch in terms of future earnings power than buybacks at higher P/E ratios. For example, banks are trading at 14.6 times calendar 2017 earnings, much lower than the ratio of the S&P 500, which trades at 18.6 times earnings (Display). Lower stock prices equal more shares repurchased and a bigger boost to earnings per share (EPS). That’s simple math, but it’s powerful math.

So, even if top-line growth is only modest, we think the combination of a shrinking share base and shrinking compliance costs could boost the bank sector’s EPS impressively moving forward. And if dividend payout ratios rise as we expect them to, it points to impressive dividend growth ahead.

Of course, business conditions can change: there could be a recession or some other big macro development. But in our view, the higher-quality banks, those with repeatable business models, moderate and stable risk/credit profiles, and strong capital return plans in place, have come through both the crucible of the financial crisis and the regulatory fires. They seem increasingly likely to reward shareholders.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.