Planning for transferring wealth to the next generation often focuses on maximizing the amount of wealth. But handling substantial financial assets can be a complex undertaking. Are your future family leaders equipped for the challenge?

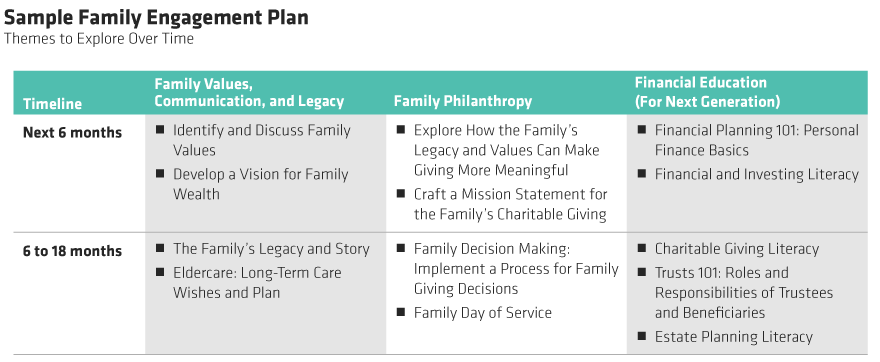

Cultivating the next generation as stewards of family wealth requires more than just knowing the numbers (Display). They need to share a common vision, internalize and support the family and philanthropic legacy, and get comfortable with past and future decisions. This starts with a plan to engage your family so they understand the wealth, understand your family’s values, and gain the financial knowledge to make informed future decisions.

The Roadmap

For many families, the next generation has not been intimately involved with deploying their family’s wealth and understanding its future intent. Some may not even be aware of the wealth at all. But because they will likely take the reins someday, involving future family leaders early is crucial. We believe there are three areas of engagement that need to occur.

#1. The Wealth—what do they know?

This step involves assessing how much the next generation knows. Have you talked about money as a family in the past? Sometimes, they may know about the wealth but not the magnitude, or the knowledge may not be universal among all members of the next generation. This is the step where each family works through concerns and articulates the goals or vision for the next generation.

Some important questions to consider are:

- Do you believe that your children are prepared to responsibly handle this knowledge? What are your concerns for how it could impact their relationships (professional, social, family) or future life decisions?

- How much detail should you share with your children at one time? Should you spread the information over different conversations, or discuss it all at once?

- What role do you want the family wealth to play in each child’s individual success?

#2. Family values—should they be static or dynamic?

The values of the family’s matriarch or patriarch are an important driver of how the wealth is utilized. The next generation needs to understand its family’s values that intersect with wealth so they can carry out those values as they steward the assets. For some families, philanthropy is an important value. For others, maintaining wealth for many future generations is the guiding principle. A meaningful discussion will identify common and unique values across the family and can serve as a guide to addressing differing principles. For example, if the matriarch was a purveyor of art and wanted to focus philanthropy on art-related organizations, but the next generation was more interested in other causes, how should this difference be resolved? This step walks through these values, and assesses how and if they should be adhered to or can be changed.

Some important questions to consider are:

- Have you communicated and conveyed your values and do your children understand them related to your wealth, philanthropy, or guiding life principles?

- How do your values sync or differ from their values?

#3. Financial know-how—can they participate in and lead financial discussions?

Basic understanding of finance and investing are needed to steward wealth. But by no means does financial literacy require acumen akin to professional advisors. But being able to comprehend aspects of the wealth and make well-informed decisions are key components to guiding wealth. This step develops a customized education plan for the next generation. It includes a basic understanding of investment types, such as stocks, bonds, and alternative assets, an explanation of asset allocation and how it is determined, and financial planning basics such as putting together a budget and understanding retirement plans.

An Engaged Family Is a Cohesive Family

Wealth is a tremendous responsibility. How you discuss it with your family and your vision for its future use should be an integral part of your wealth plan. Your next generation will likely be the future stewards of your family’s legacy. Do you want to leave that heritage to chance or guide them now so they can make optimal decisions in the future?

For more tips on becoming financially engaged, explore Women & Wealth, a new Bernstein podcast series designed to educate, empower, and inspire female investors, and for additional thought leadership, check out the related blogs here.

Business owners deserve a partner who will support them right from the start. For more thought leadership for entrepreneurs and business owners, check out the related blogs here.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.