Hybrid schedules. Mental and physical wellness. Fairness and equity. The US workforce emerged from COVID-19 with very different attitudes toward these needs—and in many ways, public-health uncertainty magnified financial uncertainty. More workers today say they’re stressed about money—that anxiety can be a big hit to mental wellness, which can ultimately impair corporate financial health.

Even as existing workers’ priorities shift, employers are drawing from a very different post-pandemic labor pool, with job seekers expecting more. There’s more focus on work-life balance, diversity and inclusion, and better benefits—especially retirement plans that foster stability and a sense of security. With the tightest labor market in decades, people are more willing to change jobs to fulfill their expectations, causing mobility trends to spike. A record 47 million Americans quit in 2021 during this “Great Resignation,” per the Bureau of Labor Statistics, seeking new jobs or heading into retirement.

Uncertainty About Retirement Income Is Up

In this competitive environment, firms should revitalize their employee value proposition, starting with addressing workers’ desire for long-term financial security. Based on a Mercer survey, the average person spends 13 hours per month worrying about personal finances, and the retirement dimension undoubtedly plays a big part: 58% of respondents in an Employee Benefit Research Institute/Greenwald Research survey said preparing for retirement “makes them feel stressed.”

Between the COVID-19 economic shock and heightened political and market turmoil in recent years, participants have become even more wary financially. Over 60% admit the harsher backdrop has sapped confidence in their retirement planning ability, according to AB’s Inside the Minds of Plan Participants survey. And most fear they won’t have enough income to maintain their standard of living once they’re in retirement. Nearly one-third said the pandemic alone altered their retirement course, either shrinking savings or delaying retirement dates.

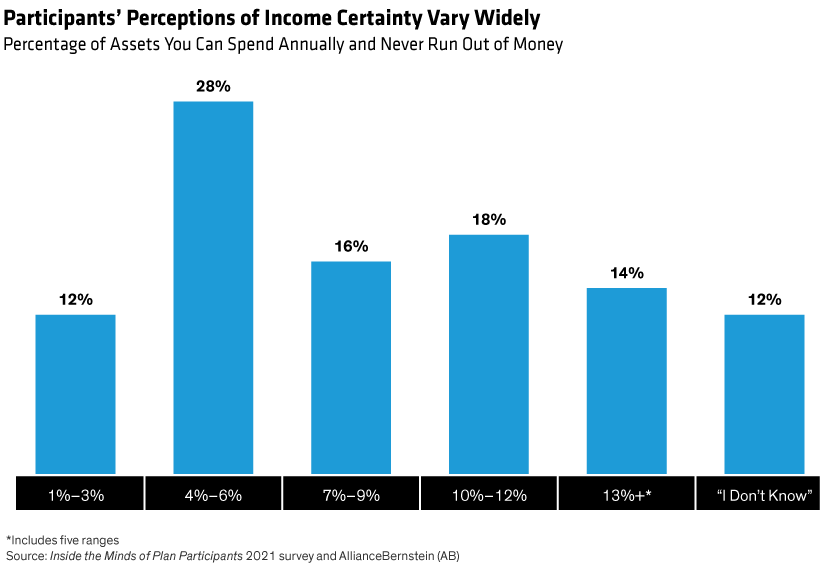

These trends are especially concerning when one in three participants says future income is the only reason for saving. Despite the high stakes, many don’t have a clear picture of how much they can withdraw in retirement. Among survey respondents, 28% believe they can take out 4%–6% annually without outliving their money (Display). Our research and other analyses suggest that the rate is much lower, yet only 12% of participants selected the lowest withdrawal range of 1%–3%.

Based on these results, it’s highly likely that participants will overspend initially and either run out of money or be forced to cut back sharply in a downturn. The other risk: participants withdraw far too little because they’re left with no other option. All this puts retirement income front and center, with an urgent need to boost participants’ confidence by enabling them to lock in an income stream for life.

Income Awareness and Access Help Increase Retirement Clarity

Exactly what does retirement income security look like? The answer is different for every DC plan participant, given diverse financial situations, life goals and preferences within plans. However, a few broader insights can be helpful starter guides for building a better retirement plan.

For example, our surveys show that most workers want more help from their plan in understanding how the choices they make will impact their retirement income. Giving participants the ability to pre-experience the future effects of today’s choices can help them plan appropriately. That’s why it’s important not only to encourage participants to save, but also to demonstrate the future income their assets will generate. With more clarity comes greater confidence—and likely better enrollment and contribution rates.

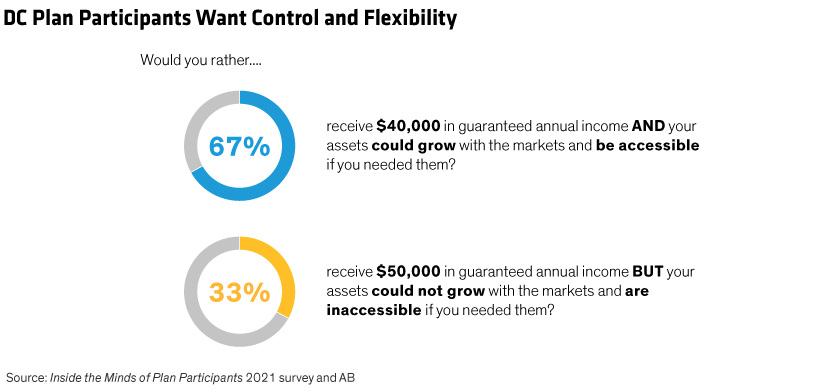

Participants also want control and flexibility when drawing retirement income. Given a choice, 67% preferred access to their assets after retirement along with growth potential—even if it means receiving $10,000 less in guaranteed annual income at the beginning of retirement (Display). Not all income strategies offer this level of access and exposure to market growth, so plan sponsors need to weigh them carefully—especially the bottom-line impact of explicit fees and implicit costs.

Employee Financial Pressures Weigh on Companies, Too

When it comes to retirement planning, the stakes for employers are high, too, because anxious employees can hurt balance sheets and create costs that impact bottom lines. Concern about making ends meet in retirement force many workers to delay it, costing employers on average $50,000 per person for every year they wait, according to a Prudential Financial study. Employees under financial duress are also twice as likely to leave, a PwC survey showed, and respondents from that survey were quick to say it also makes them less productive and more absent.

All this amplifies mental anxiety and physical stress—based on World Health Organization estimates, this siphons $1 trillion in global productivity annually. In our view, employers that target the sweet spot of workers’ post-pandemic values will have their pick of the talent pool—and potentially shore up their balance sheets with more productive workforces. There’s a lot for companies to work on, but one area stands out as the top priority for most people: retirement income security.

Without Retirement Security, Employee Wellness Efforts Come Up Short

Since financial security and mental wellness are so intertwined, alleviating money woes should also help ease employees’ minds. As we see it, an effective retirement income solution is a key part of a firm’s broader commitment to employee wellness.

Indeed, more companies are ramping up wellness efforts since the pandemic, and we see financial well-being as a key pillar. It ranks right up there with diversity, equity and inclusion, professional development, employee satisfaction and community support—they’re the through lines of a company’s philosophy. Scrutiny of companies’ wellness commitments is growing—not just among prospective workers, but also from ESG-aware investors who see long-term value in firms that nurture and support their people.

In fact, we believe these aspects of well-being will soon be common success metrics in evaluating a company’s ability to compete for talent and outperform its peers. Given heightened concerns about running out of money in retirement—and greater expectations from employees in the wake of the pandemic—DC plan sponsors that provide the needed tools could have a leg up on the competition.

This blog was originally posted on BenefitsPRO.com

Jennifer DeLong is Managing Director, Head—Defined Contribution, and Andrew Stumacher is Managing Director—Custom Defined Contribution Solutions at AB.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.