The market for financial hybrid securities is growing as banks worldwide implement stringent new capital rules. But not all hybrids are alike, so investors can’t afford to take a one-size-fits-all approach.

These securities do have important common features. Because they were created to comply with the Basel III global banking regulations that aim to improve banks’ ability to withstand financial stress, all of them can be written down or converted to equity if the issuing bank runs into trouble. This process ensures that shareholders and creditors will bear the cost of any future bank rescue, not taxpayers.

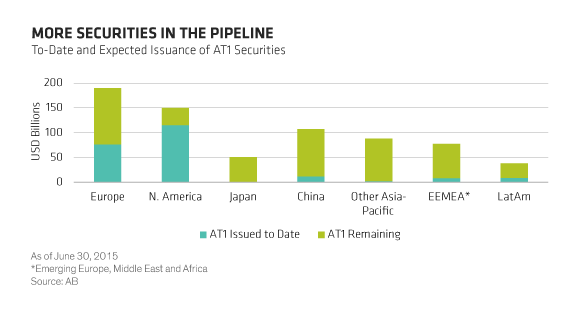

Banks around the world have already issued more than $200 billion of Additional Tier 1 (AT1) securities, which would be the first bonds to absorb losses in a crisis, and we expect issuance to nearly double in the years ahead (Display 1).

Even so, these securities have important structural differences that can affect performance, and pinpointing the most attractive opportunities requires disciplined analysis and global expertise.

It’s the Economy—and the Credit Cycle

The first thing managers need to navigate this growing market is a deep understanding of regional economic conditions and credit cycles around the world. For example, banks in the US and Europe are several years into the process of building up capital and reducing risk, leaving their banking sectors stronger and healthier than they were before the financial crisis.

At the same time, the economic backdrop has brightened considerably in the US and the UK, while the euro area appears to be in the early stages of a recovery. As we pointed out in earlier posts, this combination of stricter regulations and improved fundamentals makes US preferred securities and European AT1 debt attractive.

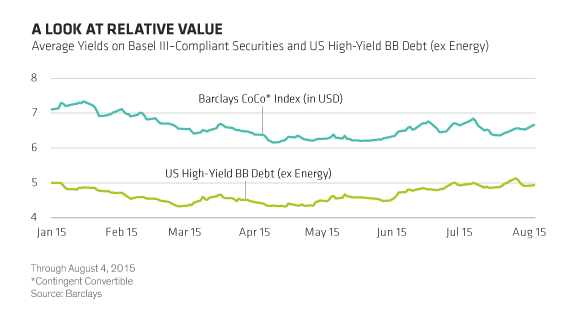

With stronger balance sheets, US and European banks are less likely to run into the kind of trouble they did in 2008. That strength helps offset the risk of losses on these assets and means investors can pocket the high yields they offer in exchange for their lower perch in the capital structure. So far this year, yields on these assets have been above those available from BB-rated US high-yield debt (Display 2).

Things look different in other parts of the world. Managers might want to take a more cautious approach in countries more sensitive to commodity prices or in those that have recently undergone credit booms and rapid home price increases. A slowdown in economic growth in these instances could lead to a spike in bad loans and trigger increased volatility in banks’ outstanding hybrid securities.

Of course, it’s also important for managers to do their homework when it comes to individual banks, no matter what their country of origin, which means having a strong handle on a bank’s fundamental health and credit metrics. Put another way, managers should be comfortable investing in a bank on a stand-alone basis.

Regulatory Regimes: Read the Fine Print

Variations in local regulatory regimes matter, too. For instance, in the US, any form of exceptional government support for banks—think the 2008 bailouts—would trigger the mandatory write-down or conversion-to-equity provisions on US preferred securities.

That’s not so in Japan, where the rules were written to give the government the flexibility to support banks in certain circumstances, without automatically triggering write-downs and exposing investors to losses. Astute managers need to understand these subtle differences.

Understanding Structural Nuances

At a more micro level, managers will need a deep understanding of the structural features of individual securities. Again, while the structure is broadly similar across securities and regions, there are subtle differences. These differences can sometimes cause the market to mis-price securities, providing astute investors with opportunities to boost relative value in their portfolios.

An AT1 security from a European bank priced in US dollars might, for instance, trade differently than one priced in euros. Investors also need to be aware of the varying supply-and-demand factors in different markets, which can affect how these securities are priced.

Raising the Regulatory Bar

As with any investment, there are risks associated with these Basel III–compliant securities. For some investors, the possibility of being wiped out in a crisis may be too big a risk to bear. But as we’ve noted, the level of risk in this sector varies, depending on the individual security, the issuing bank, and the regional economic and regulatory environment.

What’s more, global regulators have shown no sign of easing up on banks. Regulations are becoming more stringent and are being applied more widely. As a result, many banks will continue to reduce leverage and hold more capital as a cushion against losses—things that should be music to any bondholder’s ear.

We think those factors make hybrid securities a promising way to potentially boost returns in a low-yield environment. But global know-how and thorough analysis are critical for making the most of this growing opportunity.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.