Emerging markets offer investors plenty of opportunity, but managing downside risk effectively is critical. A flexible framework that integrates multiple asset classes can help.

It Isn’t Just Returns—It’s the Path of Returns

Today’s markets may seem calm—and the economic backdrop looks solid. But don’t underestimate the risks. The monetary-policy safety net is being slowly withdrawn and geopolitical risks loom. A sudden surprise in either of these areas could trigger a market downturn and sizable losses.

So, managing both upside and downside can make a big difference during this cycle, especially with many investors nearing retirement age and getting ready to start tapping into their savings. It’s not just the level of returns that matters—it’s managing the path of those returns.

More of the Highs and Less of the Lows

Emerging markets are a good case in point. Stocks are enjoying a bull market supported by strong fundamentals, attractive valuations and an improving technical picture. But going “all in” can be risky. For one thing, emerging-market (EM) stocks are more volatile than developed-market stocks are, with drawdowns that tend to be more frequent and severe.

Is there a way to grab a lion’s share of EM returns with less downside?

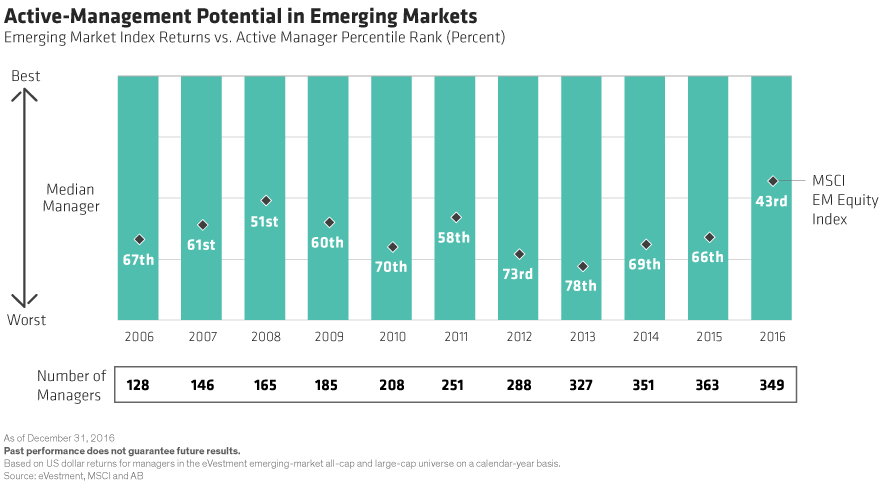

Going active can be a good first step. EM indices aren’t built very well: following one too closely can produce unwanted exposures to countries, sectors and securities—and unexpected risks. A better approach is to use research to develop an information advantage and apply that edge through active stockpicking. After all, the average equity manager beat the MSCI Emerging Market Index nearly every year from 2005 through 2016 (Display), so good research can stand out.

Introducing EM Bonds as a Volatility Reducer

Investors can also look to improve the risk/return profile of an EM equity portfolio by integrating EM bonds. They’re highly correlated to EM equities, but with lower volatility. EM bonds tend to go up and down when EM equities do, but the highs typically aren’t as high and the lows aren’t as low.

What does this mean for investors? By adding EM bonds, they can maintain exposure to emerging markets with potentially less risk than with an all-equity EM portfolio. And combining stock and bond universes creates a much bigger opportunity set for active management.

Using Currency Exposure to Hedge Risks

Investors can go even further by actively managing currency exposure. Attractive currencies offer opportunities, and currency can be a valuable tool for hedging risk.

For instance, countries like Brazil, Mexico and South Korea offer exciting investment opportunities, but each has specific tail risks: low-probability, high-severity developments that could undermine otherwise profitable investments.

Let’s say that negative geopolitical or macro events impact one of these countries. That country’s stock market and currency would both likely fall. By taking a short position in the currency, investors can profit from the decline—providing a cushion against an equity sell-off. Using currency as a hedge allows investors to maintain access to attractive equity opportunities while reducing country-specific risk.

With an active, integrated multi-asset strategy, investors may be able to access the potential of emerging markets with a more favorable risk profile. Over the long run, we think that’s a formula for better outcomes.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.