Down nearly 80% from its December 2017 high, Bitcoin’s reversal has been extraordinary—though not unexpected. While some investors profited before the fall, we remained wary of their speculative nature, noting that even advocates failed to agree on how cryptocurrencies should be valued. In short, we deemed future valuations too uncertain to recommend for investment purposes.

One year later, our view hasn’t changed.

While the final chapter on Bitcoin and other cryptocurrencies has yet to be written, we still struggle to size up their worth. Why? Because they don’t fit the criteria investors have historically used to determine value. For instance, unlike other assets, cryptocurrencies:

- Lack a compelling “use case” (they were intended as a private payment mechanism, but anonymity hasn’t attracted the masses)

- Fail to generate a stream of cash flows (as with stocks and bonds, businesses, and real estate)

- Hold no aesthetic or cultural appeal (like art or precious metals)

The second point is particularly vexing, as it lays an important marker down. In theory, successful investing focuses on buying reasonably predictable cash flows that the market perceives to be undervalued. In the absence of such cash flows, how can investors determine whether they’re truly buying at a discount?

Prying Eyes

Then there’s the privacy angle. The ability to trade anonymously online (albeit slowly, and at considerable cost to traditional payment mechanisms) remains one of cryptocurrencies’ key selling points. But is confidentiality really that compelling?

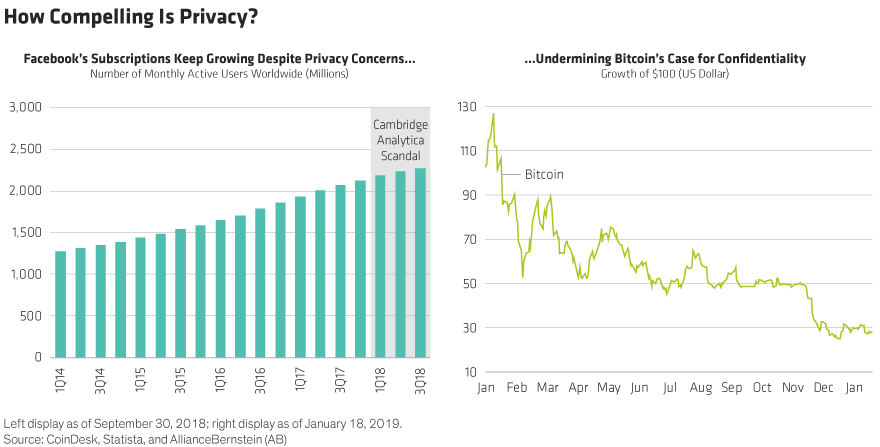

Not judging by consumers’ behavior in other online realms. Take Facebook. The company lost $120 billion of market capitalization in July 2018 as investors tried to dimension the long-term cost of ensuring greater data protection, and the potential impact on future revenues. So far, despite questions over the handling of user’s personal information, consumers have stuck with the platform. The absence of widespread defections seems to suggest that relatively minor changes to business models can assuage privacy concerns (Display). This reinforces our conviction that consumers are highly unlikely to abandon traditional online businesses for payment mechanisms like Bitcoin simply as a matter of secrecy.

Healthy Skepticism

So where does that leave investors? Unfortunately, many were caught up in the Bitcoin frenzy, as rising prices wreaked havoc on their objectivity—a common phenomenon that can prove difficult to guard against. As Warren Buffet famously warned, “extraordinary excesses can be created by combining an initially sensible thesis with well-publicized rising prices.” In these situations, “an army of originally skeptical investors” can succumb “to the ‘proof’ delivered by the market.” 1

That helps explain how Bitcoin evangelists found themselves justifying high prices with vaguely possible rationales. As the idea caught investors’ eye, proponents pointed to a number of theories—including the amount of electricity consumed to mine bitcoins or valuing the payment system using “network economics,” just to name a few.

In contrast, we believe investment research should be a skeptical endeavor with a clear focus on conserving capital. Cryptocurrencies could still rebound, but the hype surrounding their prospects has clearly deflated. While new technologies often appear to have unlimited promise, sound original research that tests conventional wisdom tends to prove more reliable in the long run.

An information edge can mean the difference between getting ahead—or being left behind. That’s why many of our entrepreneurial clients look to us as a source of intellectual capital. For more insights on disruption, check out the related blogs here.

The views expressed herein do not constitute research, investment advice, or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.

________________________________________________________________________________________________________________

[1] Berkshire Hathaway Letter to Shareholders, 2011.