As consumers suffer the biggest inflation hit in 50 years, bond investors must anticipate how quickly prices will stabilize, when interest rates will fall and which fixed-income markets can provide the best pay-offs.

We believe that—although the battle with inflation is not completely won and risks of resurgence remain—inflation is now more likely yesterday’s than tomorrow’s problem. Accordingly, we favor adding interest-rate risk (duration) to fixed-income portfolios. And we think UK and European Union (EU) sovereign bonds could be among the biggest beneficiaries of falling inflation.

Banking Crisis Advances Peak in Rates

Central banks have responded to high inflation with successive interest-rate increases to curb demand, and markets are alert to any signs that conditions have changed so rates can plateau and ultimately fall.

We believe the banking crisis in the US and Europe is an important precursor to that change. The crisis has forced banks to cut back on lending, tightening credit conditions and squeezing economic growth. This tightening in conditions is doing part of the central banks’ work for them and brings forward the point when they can stop hiking rates.

Meanwhile, we think the lagged effect of past rate hikes on economic growth will start to hit home in the next few months. In the US, the Fed has described future rate increases as data-dependent, but the 25 b.p. rate hike in May will likely be its last before pausing. The Bank of England (BoE) and European Central Bank (ECB) have increased rates less aggressively than the Fed and, facing higher inflation, remain committed to future rate hikes even as economic growth falters.

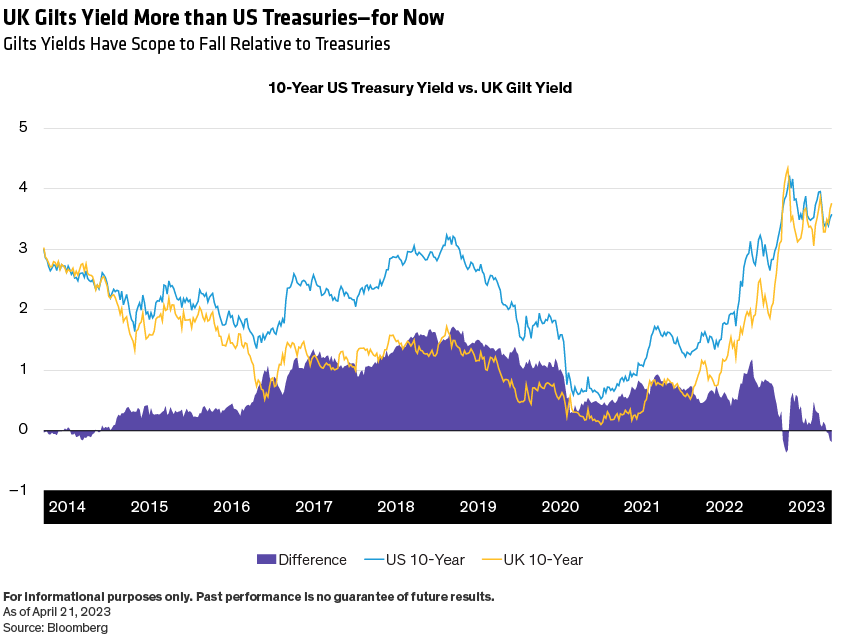

As a result, 10-year UK Gilt yields are currently higher than US Treasury yields (Display).

That premium is very unusual and last occurred fleetingly in September 2022 during the UK’s liability-driven investing crisis that resulted from a short-lived experiment in expansionary policy. We think that the BoE and ECB will need to pivot from their hawkish stance soon, creating room for UK and euro yields to fall and prices to rise.

Base Effects May Curb Future Inflation

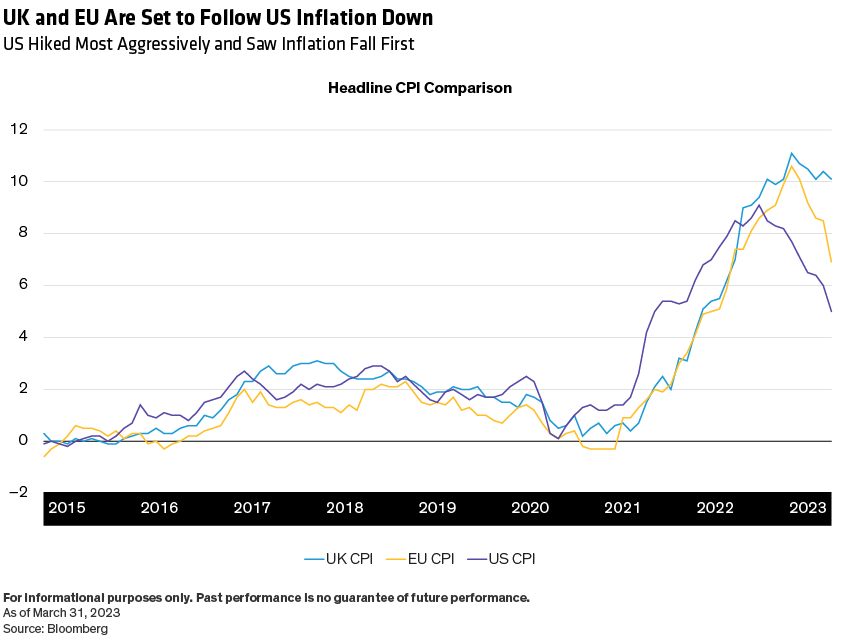

Markets remain nervous about the inflation outlook as data has stayed stubbornly high, especially in the UK and EU. But we think that the arithmetic of base effects will lead future inflation prints in these regions lower, following the path already evident in the US (Display).

Notably, energy costs have been a key driver of rising prices across industries, including transportation, manufacturing and agriculture. Crude oil prices surged in 2021 before peaking in early March 2022 at around US$120 per barrel for West Texas Intermediate (WTI). Now, just over a year later, the WTI price is hovering around US$75, not far above its prepandemic level. We expect to see the benefits from lower energy input prices ripple across a wide range of CPI constituents.

Changes in Mortgage Rates Matter More in Europe

Homeowners’ sensitivity to rate increases also drive changes in UK and EU inflation relative to the US. While 30-year fixed-rate mortgages prevail in the US, across Europe it’s more typical to have shorter-term fixes, or floating-rate mortgages.

In the UK, for example, around 15% of home-owners have variable-rate loans, while a further 17% have fixed-rate loans due to be remortgaged this year at higher rates, with the peak reset months falling in April through June. Most of these home-owners last borrowed at rates below 2% (according to the UK’s Office for National Statistics) and will need to renew at rates up to three times higher. Thus, the shock to household finances from higher monthly mortgage payments will impact consumer spending and economic activity far more in the UK and EU than in the US.

Starting from higher levels, inflation should fall more steeply in the UK and EU this year than in the US, we believe: UK CPI, for instance, may fall from 10% to 5%. But while markets want to believe in a lower inflation scenario, bond prices will likely only react when better CPI numbers actually start to come through. By that stage, we think tomorrow’s problem will be starting to manifest, in the form of weakening economies and labor markets.

Consider Downside—as Well as Upside—Risks

What could go wrong with this thesis? Against a volatile global backdrop and with policy still tight, it’s possible we could face a renewed crisis in the banking sector. However, this would likely benefit longer-dated sovereign bonds. The fallout from a turn for the worse in Ukraine or other troubled areas would be harder to read. And a renewed spike in energy prices would revive inflationary pressures.

Overall, we believe there is now a stronger case for adding duration across most bond markets. We think the hiking cycle is nearing its end and, once central banks pause their rate rises, investors will anticipate the cuts that typically follow on a three-to six-month timeline. The UK and EU look to us to have the most upside.

John Taylor is Director of Global Multi-Sector and Nicholas Sanders is Portfolio Manager—Global Multi-Sector, both at AllianceBernstein (AB).

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.