Investors who manage interest-rate and credit risk separately may overlook the crucial interplay between the two.

The Problem With Divide And Conquer

It's not easy to shift money quickly from one portfolio to another. For one thing. nobody who manages assets for a riving has a crystal ball. It's hard to forecast interest-rate changes or credit events. Anyone can get lucky once or twice. But even the most seasoned investors struggle to get it right consistently.

Even if crystal balls did exist, they probably wouldn't do bond investors much good, because credit markets—especially high-yield bonds—are relatively illiquid. With about 5.000 global credit issuers and a dizzying array of securities, it can be a major challenge to buy or sell a specific bond or block of bonds.

Some investors may try to address this hurdle by putting their bonds on autopilot—and taking active managers out of the equation. But that's not much of a solution. Strategies that passively track a market index can't pick and choose their exposures at all—they're locked into exposures just because those issuers are part of the index.

What's more, most passive managers don't even try to own every security in the index. They compensate by buying more of the biggest ones. This should worry investors, because bond issuers with the biggest weights in indices are countries or companies that issue the most debt. If any of these issuers run into trouble, there's no way passive investors can limit their exposure.

Finally—and maybe most importantly—investors who manage interest-rate and credit risk separately, whether in active or passive strategies, may overlook the crucial interplay between the two.

This is something market participants haven't had to think much about over the last decade. Interest rates plunged after the global financial crisis, inflation evaporated and central bank policy—not the real economy—became the most important variable for global bond markets. For years, investors could almost ignore interest-rate risk. At the same time, central banks' easy money policies made companies less likely to default, leaving investors tree to load upon credit risk to boost returns.

With Bonds, Combine And Conquer Is Better

But the long bull market for bonds was the exception that proves the rule. More recently, the macroeconomic sands around the world have started to shift. The global economy is gaining traction, and interest rates have started to rise.

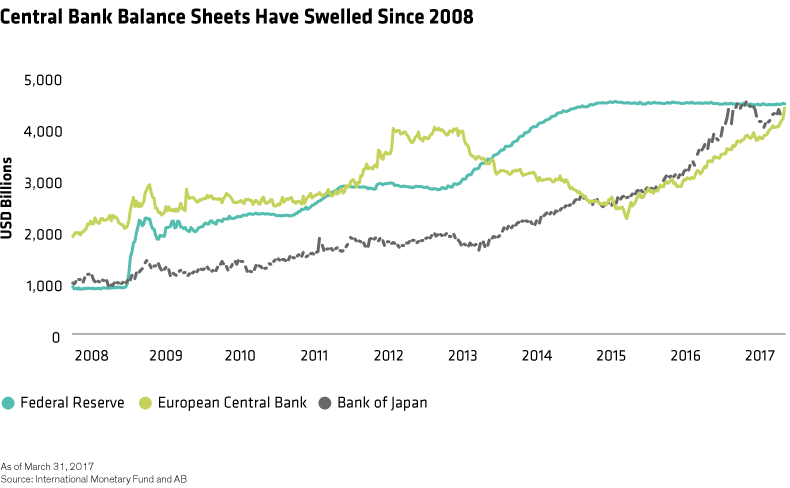

The US Federal Reserve began lifting borrowing costs in 2015 and may soon sell some of the US Treasuries and mortgage-backed bonds it acquired during the crisis. If the world economy strengthens further and inflation rises, the European Central Bank and Bank of Japan may soon follow suit. How the three go about shrinking balance sheets totaling nearly US$13 trillion could have major implications for market stability (Display).

Governments, meanwhile, are moving toward more expansionary fiscal policies, which could stoke inflation, especially in economies at or near full employment. At the same time, many corporate bond valuations are stretched, and credit cycles are diverging across sectors and regions, with some nearing the end of a multiyear expansion .

In other words, investors today must pay constant attention to interest-rate and credit risk. That means having a manager who understands how the two interact and has the flexibility to tilt toward one or the other, depending on rapidly changing conditions.

Doing this effectively calls for a "combine-and-conquer" approach: pairing the two groups of assets in a single strategy known as a credit barbell and letting managers adjust the balance as conditions and valuations change.