How do you decide what to spend today, this month, or this year? Rather than make a series of ad hoc decisions, a budget can help you weigh all your needs and desires against your income—and set priorities. Creating a budget can also help you save for bigger-ticket items, like a new car, travel, or paying down debt.

Budgeting involves striking a balance between what you earn and what you spend. If these two categories don’t align and your expenses exceed your income, you could encounter cash-flow problems, run through your savings, or start accumulating debt. In today’s digital age, a number of apps can help you budget and track spending, including mint.com, goodbudget.com, and mvelopes.com, to name a few. In the meantime, here’s a checklist to get started:

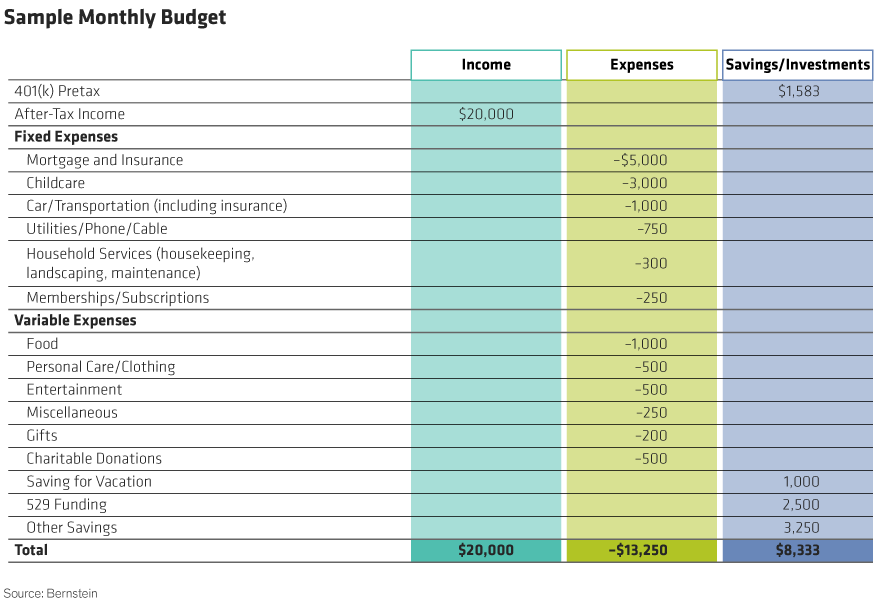

• List all your monthly expenses and sources of income. Review your bank statement, credit card bills, and receipts; remember to account for items that you paid cash for.

• Identify your fixed expenses, such as a mortgage, loan payments, and insurance premiums.

• Identify your variable expenses and divide them into must-haves (utilities, transportation, food, and clothes) and nice-to-haves (eating out, entertainment, travel, and more clothes).

• Set a spending target for each category, so that the sum of all categories is less than your after-tax income.

• If you must cut back, variable expenses are a good place to start; you may have to manage fixed expenses, too. Could you move to less expensive accommodations, or lease a less expensive car?

• Monitor your spending for a couple of months and revise your budget as needed. Chances are you’ll find that you forgot some expenses and that you need to adjust some spending across categories.

For more tips on becoming financially engaged, explore Women & Wealth, a new Bernstein podcast series designed to educate, empower, and inspire female investors, and for additional thought leadership, check out the related blogs here.

The views expressed herein do not constitute and should not be considered to be legal or tax advice. Please consult with your legal or tax advisor regarding your specific situation.