First, bank loans don’t always behave like floating-rate instruments should. The reason is that bank loans are callable. Last year, 73% of outstanding bank loans were refinanced or repriced as high-investor demand drove down yields and credit spreads. The share of bank loans trading above par rose above 70% in early June of 2018 before falling as supply finally started to outstrip demand.

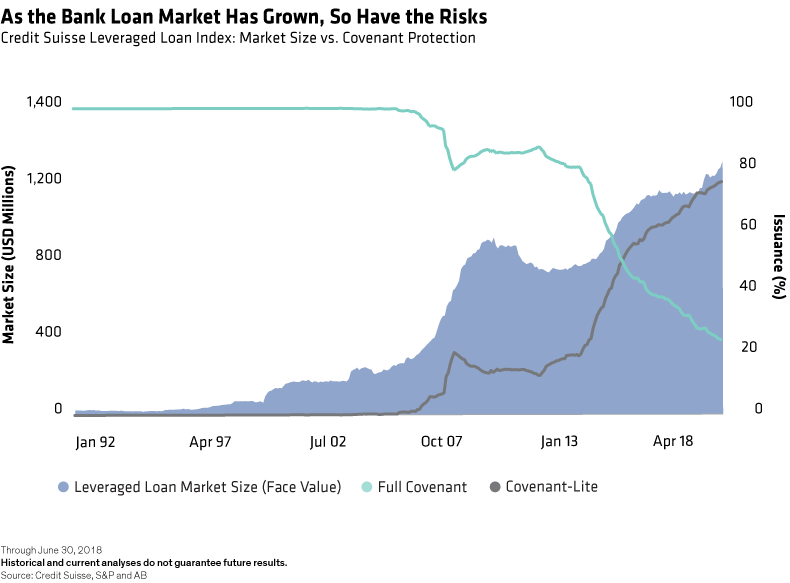

Second, the quality of today’s bank loans has declined. Lately, borrowers have been offering less covenant protection for lenders. Before the global financial crisis, less than 20% of the high-yield bank loan market was what’s known as covenant-lite. Today? It’s around 75% and growing (Display).

Bank loans have also surpassed high-yield bonds as the most popular way to finance leveraged buyouts—the riskiest type of corporate takeover. This trend suggests that default risk is a lot higher than many investors realize. And when those defaults happen, we think recovery rates are likely to be a lot lower than they’ve been in the past.

Bank Loans' Prices Matter More Than Interest Rates

Many investors have rushed into bank loans without understanding the risks.

Should fixed-income investors simply buy high-yield bonds instead? Not necessarily. Both segments are expensive today and have a thinner cushion against future losses. This matters, because the US is in the late stages of one of the longest credit expansions on record. When the cycle turns, both bank loans and high-yield bonds are likely to underperform.

But we think bank loans’ underperformance will be more severe. As we’ve seen, high demand has driven up the average bank loan price. And our research shows that average price has historically been a better predictor of performance than the level of interest rates.