Currency carry trades haven’t worked so well lately. But instead of discarding them altogether, we think investors should just put them aside for now and focus on more promising return sources from other asset classes.

For years, carry trades had delivered solid returns before running into their recent weak patch, and there are good reasons why they’ve faltered. But no strategy works all the time, and in years to come, carry trades may well start to pay off again. So, they still belong in investors’ multi-asset tool kits.

How Currency Carry Trades Work

Carry trades involve selling (or going short) developed-market (DM) currencies with low interest rates and buying (or going long) ones with high rates.

A typical carry trade would work like this: an investor might borrow ¥1 million from a Japanese bank, where borrowing costs are set at 0.1%, and use the money to buy a bond priced in Australian dollars that yields 5.5%. By exploiting the gap in interest rates, the investor stands to make a profit of about 5.4%, if the currency exchange rate doesn’t change.

But exchange rates do change, and that’s where the risk in carry trades comes from—the unexpected moves in exchange rates. In this scenario, a fall in the Australian dollar relative to the yen could eat into—or even offset—the gains from the difference in interest rates.

Diminishing Returns

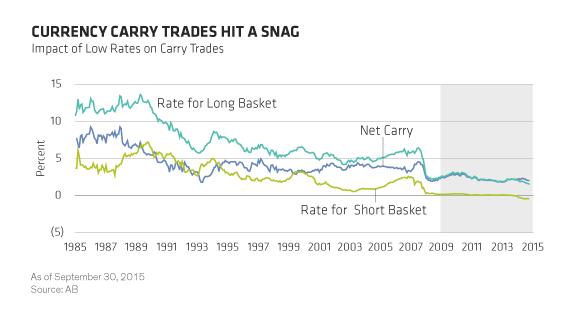

Over the past several decades, the positive interest earned from carry trades has usually been large enough to outweigh modest exchange-rate moves. But since 2009, currency carry strategies have resulted in flat or negative returns. (Display).

What’s gone wrong?

To start with, exchange rates have fluctuated more in recent years, because countries with relatively high interest rates have been cutting them. Central banks in Norway and Australia—both large commodity producers—cut rates this year to record lows to help cushion their economies from a sharp decline in the price of oil and other natural resources.

When countries with high interest rates start to cut them, investor demand for their currencies declines, their currencies fall in value, and the gap between high and low interest rates narrows, making carry trades less profitable.

Zero Interest Rates Upend Carry Strategies

The global financial crisis created another handicap—zero interest rates. Because rates are already near zero in the US, Japan and the eurozone, going lower would require a move into negative territory, something most central banks are reluctant to allow. That effectively means those rates won’t fall any more.

On the other hand, central banks in places like Australia still have plenty of room to cut rates, and currencies like the Australian dollar plenty of room to decline in value. As a result, the interest-rate gap between high-yielding currencies and low-yielding ones is closing more quickly than it would have if high- and low-rate central banks had been easing policy at the same time. That means carry trades will continue to struggle.

Carry Will Recover—but Not Yet

These dynamics will change when some of the central banks with zero or near-zero interest rates—the Federal Reserve and the Bank of England come to mind—start raising them. If they keep at it for several quarters, the US dollar and sterling could become attractive carry trade targets relative to currencies from weaker economies with lower interest rates, such as the euro.

But this won’t happen overnight. The rise in US rates, once they start to go up, will probably be much more gradual than in past cycles. That means it will take time before DM currency carry trades start to match the sort of returns seen in years past.

The Importance of Being Flexible

In the meantime, we think investors should focus more of their active risk in fixed-income and equity strategies. Within currencies, we see better opportunities in emerging-market carry.

It’s easy to get hooked on strategies that deliver consistently strong returns, but focusing on just one can be dangerous. All strategies go through periods of low or negative returns, just as stocks, bonds and other asset classes do. That’s why it’s important to invest in a wide range of strategies—and to know which ones work best in which conditions.

We think a nimble, integrated and dynamic multi-asset approach that taps many sources of risk and return is a better way to go. This way, investors can move quickly when a once profitable strategy like the currency carry trade starts to recover.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.