When it comes to accepting donations, most charities are pretty flexible. As long as a contribution has a positive monetary value, the recipient is unlikely to quibble. Yet even though charities may not seem overly selective, that’s not to say donors shouldn’t be.

Gifts can come in many forms, including real estate, art, publicly traded securities, and privately held investments. And, of course, cash—it’s uncomplicated, scalable, and easy to transfer. But does cash give the donor the best bang for the buck?

Charity Benefits Donors Too

Few donors make philanthropic decisions solely based on ancillary financial rewards. That said, a principal financial advantage of charitable donations—beyond the humanitarian benefit—is profiting from the allowable tax deduction. The current US tax code rewards charitable giving, permitting deductions up to 50% of adjusted gross income (AGI) in the year a cash gift is made. For other offerings, such as appreciated publicly traded stock, the allowable deduction is up to 30% of AGI in the same year, but that deduction can be carried forward for five years should the gift exceed the 30% threshold.

Given the higher allowable deductibility and ease of use, gifting cash would seem to make the most sense. But when you delve into the intricacies of how these deductions work, cash may not come out on top.

Understanding Deductions

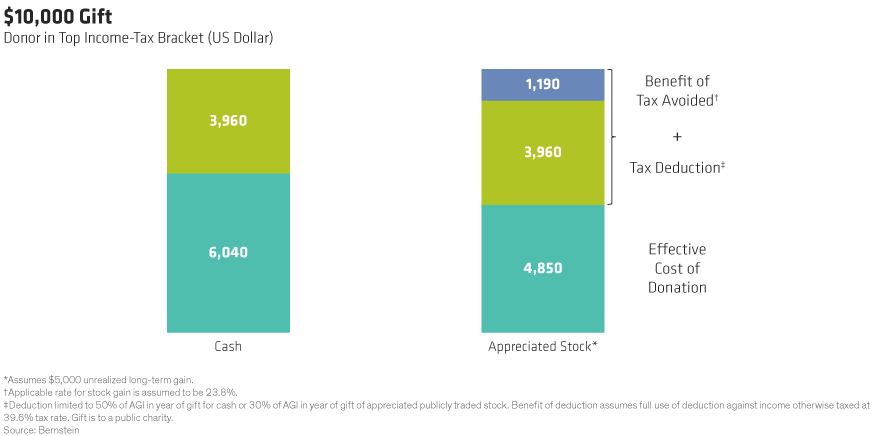

A gift of cash, like any charitable donation, reduces a donor’s ordinary federal income taxes. For instance, if you make a cash donation of $10,000, the taxes owed are reduced by your tax bracket percentage. If you fall in the top tax bracket of 39.6%, then your taxes are reduced by $3,960, making the effective cost of the gift only $6,040 (Display).

Gifts of appreciated stock, however, offer a greater benefit. They reduce or eliminate the tax on capital gains as well as decrease ordinary income taxes. For example, donating $10,000 of a publicly traded stock that was purchased one year ago for $5,000 could cut the effective cost of the gift to $4,850. In essence, this saves the donor more in taxes than when they give the same amount in cash. How?

First, as with the cash bequest, the donor receives the same $3,960 federal tax reduction when donating appreciated stock. In addition, the donor avoids taxes on the gain of the stock’s market value. In our example, the stock appreciated by $5,000 during the time it was owned, ending the year with a value of $10,000. By gifting it, the donor circumvents the capital gains tax of $1,190, (capital gains tax rate of 23.8% x $5,000 increase in market value.)

By gifting $10,000 worth of appreciated stock, the donor receives a larger tax benefit compared with donating the same amount in cash. Meanwhile, the charity receives the same benefit either way. Considering this, when making a charitable gift, donors should contemplate not only the recipient and the amount but also the type of donation. The goal is to maximize the philanthropic benefit for all.

The views expressed herein do not constitute and should not be considered to be legal or tax advice. The tax rules are complicated, and their impact on a particular individual may differ depending on the individual’s specific circumstances. Please consult with your legal or tax advisor regarding your specific situation.