The Bank of England (BOE) raised its benchmark interest rate by 25 basis points last week, to 1.0%. That move was widely expected, but what happens next is up in the air. As with most of the world’s economies, the UK economy is being pulled in different directions, with inflation soaring and growth slowing.

What’s a central bank to do when faced with this dilemma? Unfortunately, there are no good answers. Raising interest rates to attack high inflation will exacerbate the growth slowdown; easing monetary policy conditions to shore up growth also means letting inflation run too hot for too long.

Growth-Inflation Dilemma Is Most Intense in the UK

That dilemma is more intense in the UK than in Europe or the US, with inflation running hotter—and more likely to stay that way. A big reason is that regulated energy prices in the UK are reset in both April and October. April’s increase was more than 50%, and another large reset is likely in October. The BOE’s forecasts reflect that trajectory—they now have inflation peaking at more than 10% in the fourth quarter—later and higher than we expect in other major economies.

At the same time, the growth slowdown is more apparent in the UK, which is also reflected in BOE forecasts. The central bank now expects the UK economy to contract in 2023 and expand only slightly in 2024. As with the inflation forecast, UK-specific elements in the growth forecast make the coming downturn more extreme than is likely elsewhere. Brexit, for example, will continue to weigh on UK trade, pulling growth down.

Policymaking Bodies Likely to See More Division

But the UK isn’t alone in facing this challenge—even if it faces the most pronounced version. Our forecasts for the US and the euro area show growth slowing during 2022 even as inflation remains well above target. This will make the BOE’s response an interesting case study for what may happen elsewhere in coming quarters.

It’s unclear what that response will be. Of the nine Monetary Policy Committee members at the BOE, three wanted to raise rates by 50 basis points last week, while two wanted to eliminate language from the statement suggesting that future rate hikes are likely. Such deep divisions within the policy-setting body of a central bank are unusual, but that may be a preview of things to come elsewhere.

For now, the US Federal Open Market Committee (FOMC) is unanimous in expecting policy tightening, but we expect that consensus to fray later this year as evidence of slowing growth mounts. The more hawkish members will want rates to keep rising until inflation has fallen significantly, while more dovish members will be quicker to respond to slower growth. The same is true for the European Central Bank (ECB): several members seem eager to hike as soon as July, while others are much more cautious. That gap will widen as the year progresses.

Splitting the Difference: Growth and Inflation

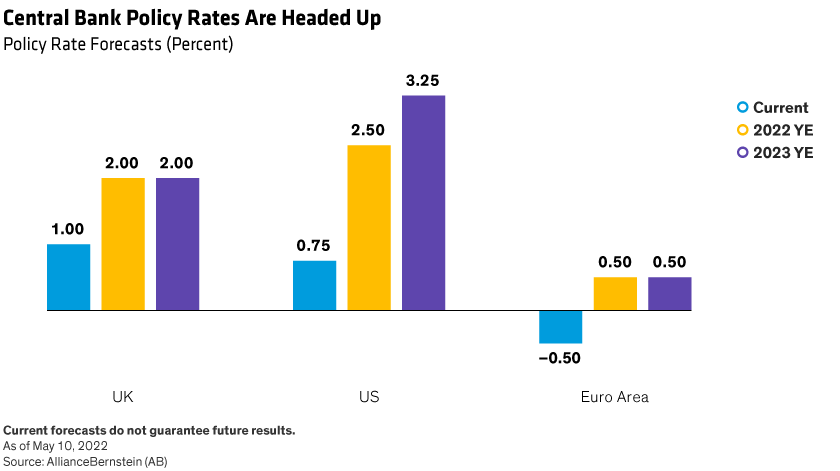

We expect all three central banks to try and split the difference when setting policy in such a challenging period. The BOE is likely to hike further—it’s simply too much to ask a central bank to keep rates this low with inflation close to 10%. We see UK rates peaking at 2.0% (Display).

The ECB seems likely to move rates at least into positive territory, but lower inflation makes the need for higher rates less intense; 0.50% is a likely ceiling this year. US growth momentum is much stronger than in either European economy, so we expect the Fed to be more aggressive. We do think the pace of hikes will slow during 2022, leaving the policy rate at roughly 2.5% by year end.

The BOE’s overarching message is that volatile economic conditions will likely necessitate flexible policymaking. In an environment that presents no good answers to the growth-inflation challenge, central banks have to be nimble—and so do investors.

Eric Winograd is Director of Developed Market Research at AllianceBernstein (AB).

The views expressed herein do not constitute research, investment advice or trade recommendations, and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.