US healthcare stocks have been in the eye of a market storm. After a year of turmoil and declines, we believe equity investors should take a fresh look at this unloved sector.

The Russell 1000 Healthcare Index has fallen by 3.7% over the 12 months through June 30 (Displayabove). Recurring concerns around potential drug-pricing controls and the high-profile crisis at Valeant Pharmaceuticals have driven investors away from the sector, which is usually a top target for exposure to stocks with defensive characteristics, also known as low-beta shares.

Wide Return Dispersion vs. Utilities

Instead, investors have preferred to seek safety in utilities stocks—another low-beta sector. The Russell 1000 Utilities Index returned 28.7% over the 12-month period through June. Our research shows that the return dispersion between the US healthcare and utilities sectors is wider than it’s ever been in the last 21 years. The last time the dispersion was nearly this wide was in July 1999. Back then, healthcare stocks rebounded sharply over the next 12 months to outperform utilities by 29% through July 2000.

While we are not forecasting 29% outperformance over the next 12 months, at current price/earnings ratios, healthcare stocks are meaningfully cheaper than utilities. They also trade at very attractive valuations versus their own history.

Dividend Data May be Misleading

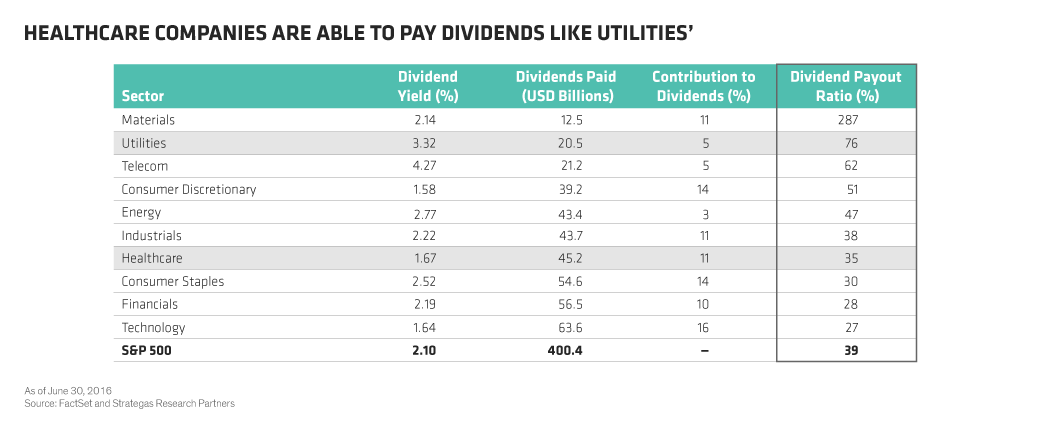

Digging deeper, we find that the dividend data on the two sectors can be somewhat misleading. Utilities have a 3.3% dividend yield, compared with healthcare’s 1.7% yield. But utilities are actually paying out 75% of their earnings to shareholders—more than double the ratio of healthcare companies (Display).

If the payout ratio were consistent across the two sectors, healthcare companies would show a dividend yield of 3.6%. In other words, the current yield data might make utilities look appealing, but healthcare companies actually have a much greater ability to grow dividend payouts. What’s more, over the next five years, healthcare companies are expected to grow their earnings by 10% over the long term, outpacing utilities’ expected growth of 5%, according to Morningstar.* We believe investors need to look beyond current yield and analyze the dividend growth opportunity, which, in our view, favors healthcare companies.

Investing in an index isn’t the best way to capture the opportunity, in our view. The S&P 500 and Russell 1000 Growth indices have about 15% and 17% in healthcare stocks, respectively. And many dividend-focused ETFs currently have more than 25% allocated to utilities.

Active investors can take greater exposure to the recovery potential of healthcare stocks while also sifting through the sector to focus on companies that are less vulnerable to potential pricing pressures and have strong recovery potential. Many of these companies offer higher-quality earnings growth than utilities groups and provide the same type of defensive characteristics that can help protect a portfolio from bouts of market volatility.

_______________________________________________

*Based on Morningstar’s long-term earnings growth forecasts using established sector ETFs as proxies.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.