COVID-19’s resurgence in China has cast doubt over the government’s ability to meet its 2022 growth target of around 5.5%, which officials affirmed in March, before the scale of the latest outbreak became clear. Because of the outbreak, we have lowered our 2022 China growth forecast to 5%.

But the situation is fluid, and the latest growth forecasts may be overtaken if the outbreak worsens. The next two months will be important in providing clarity on the economic impact and government actions.

Until then, we’re adhering to three key assumptions: first, that the government still has a strong desire to achieve its growth target; second, that its policy response will be sufficiently robust and timely; and third, that the outbreak will be brought under control in time for activity to recover strongly for the rest of the year.

China Is Still Pro-Growth

After the Chinese government intervened last year to rein in what they regarded as excesses in the technology, private education and housing sectors, many investors formed the view that the government had de-emphasized growth as a policy objective. But we see that as a misreading of the situation. Although the government has moved beyond simple growth to multiple objectives, growth remains very important, as demonstrated by the strong target set in March.

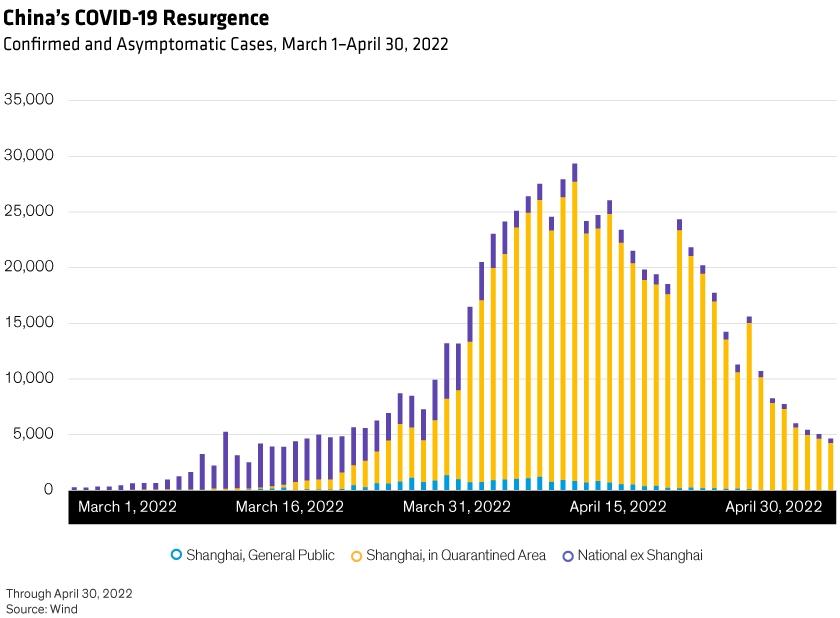

Many investors, however, questioned the government’s ability and determination to achieve the target, and the latest outbreak (Display) has intensified bearish sentiment.

An important feature of China’s political system is that maintaining the growth target is necessary to incentivize local governments. At its April meeting, the Politburo—the chief decision-making body of the Chinese Communist Party—sent a very strong pro-growth message while acknowledging the challenges facing the economy. It pledged, for example, to “increase the strength of macro policy and strive to achieve economic goals” and to “plan for incremental policy tools” in a timely way.

Policy Needs to Be Big and Bold

To be effective, these actions need to be sufficiently large-scale and prompt. China has a good track record in this respect: when exports fell during the global financial crisis, for example, the government launched a stimulus package worth RMB¥4 trillion (equivalent to US$610 billion today). The result was a strong, rapid, construction-led rebound in GDP growth.

While today’s circumstances don’t warrant such a dramatic response, they require action. Before the latest COVID outbreak, we had assumed that growth in government spending on consumption and investment would be faster than the average of 2020 and 2021, and that household consumption growth would recover roughly to pre-COVID levels.

Since then, under pressure from the virus and lockdowns, the outlook for household consumption has deteriorated, so that our revised forecast envisages even more fiscal support. Consistent with this, the Politburo meeting and another high-level conference hosted recently by President Xi Jinping emphasized the need for more infrastructure spending.

It’s not yet clear what the incremental policy tools mentioned at the Politburo meeting will be, but this is another area in which the government has been creative and decisive. During the 2015–2016 downturn, for example, it set up a special fund to boost public investment in construction. The fund, managed by the policy banks, played a key role in stabilizing growth.

Monetary and credit policy, which are already supportive, will need to provide additional accommodation, in our view. Maintaining desirable credit growth is an important goal for the People’s Bank of China (PBOC), and the central bank has several tools it can use. There could be another 0.10% cut in policy rates.

There is a possible constraint here, however, from concerns that a rate cut could adversely affect capital flows and foreign-exchange rates. The renminbi has recently come under pressure because of an acceleration in the appreciation of the trade-weighted US dollar index, the COVID outbreak’s disruptions of exports, and a build-up in depreciation expectations. While depreciation pressure could remain in the short term, we see little scope for depreciation to be large and persistent. The PBOC, however, may wait for a suitable window in the currency market before boosting credit demand.

We cannot rule out a reduction in banks’ reserve requirement ratios, though the scope for more cuts is limited. In local housing, we expect an extension of measures, such as relaxation of purchase restrictions, lower mortgage interest rates and down-payment ratios, to help stabilize the sector without creating opportunities for speculation.

Next Two Months Will Be Critical

For our revised growth target to be met, the COVID outbreak needs to be brought under control soon. This is a difficult risk to assess because the economic impact of COVID arises not just directly from the virus but also from how authorities respond and whether lockdown measures will ease or become stricter.

If COVID and lockdown measures during the next month or so are worse than our baseline assumptions and lead to a very low growth rate during second-quarter 2022, the government will be hard pressed, in our view, to achieve more than 5% growth this year. The Purchasing Managers’ Index and logistics/supply-chain data for April have shown further sharp declines since the previous month.

The risks, in our view, skew to the downside. If second-quarter growth disappoints, further policy measures will almost certainly be necessary. In addition to those aimed at stimulating demand, they may include steps to ease the stress on firms and households experiencing reductions in earnings and income.

For investors monitoring the situation, the key event to watch will be the July meeting of the Politburo, where second-quarter data will be scrutinized. How COVID-19 and the economy perform between now and then will be critical.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.