Investors focusing on climate change often overlook Chinese firms. We think that’s a mistake. Chinese companies are playing an indispensable role in the global transition to a greener future—and carefully selected shares offer attractive return potential.

Most environmental funds have little or no holdings in China. Five of the 10 largest global environmental equity funds by assets under management had no exposure to China at all at the end of 2022, according to our research based on Morningstar data. Four of the remaining five had less than 5% of their holdings in China.

All Environmental Roads Lead to Chinese Companies

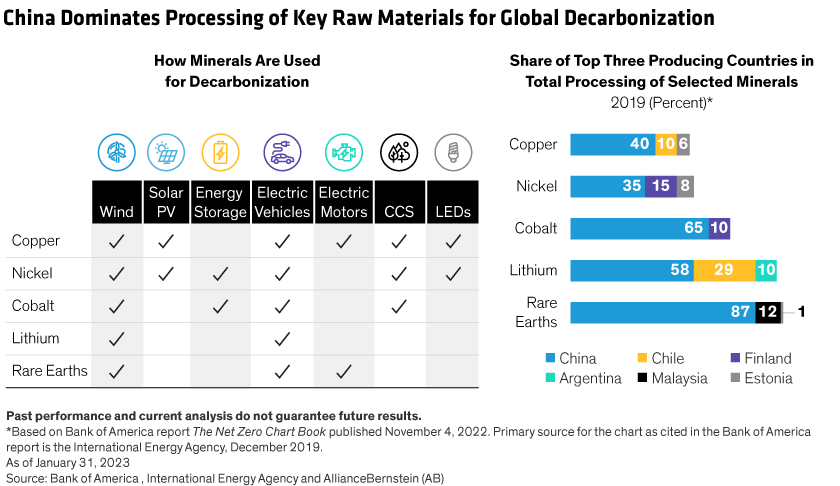

That seems like a missed opportunity. Accelerating decarbonization efforts around the world require Chinese products. Demand for solar energy, wind power and electric vehicles (EVs) draw on vast global supply chains. And Chinese companies dominate some global markets for raw materials, products and components that enable the green transition.

For example, Chinese copper and nickel are essential ingredients for wind turbines, solar panels and EVs. China also processes 58% of the world’s lithium and 87% of rare earths, which are used to manufacture wind turbines and EVs (Display).

Energy Transition: Here Comes the Sun and Wind

Solar energy installations are mushrooming. China accounts for 37% of global solar energy demand and is also the world’s largest consumer of solar equipment. About three-quarters of the global solar manufacturing supply chain is in China, according to BloombergNEF data.

Businesses and homeowners around the world seeking to install solar power will need equipment that relies on raw materials such as polysilicon, which China dominates. China also manufactures 97% of the solar wafers and 81% of the solar cells used around the world, according to BloombergNEF.

As a result, Chinese solar equipment makers are poised for tremendous growth both from increased demand in China and from other countries pressing ahead with net-zero agendas. Examples include JinkoSolar and JA Solar, two large integrated solar module suppliers, with a combined global market share of about 32% in 2022.

Chinese companies are also prominent in wind energy. Ming Yang Smart Energy Group is a leading Chinese wind turbine manufacturer, especially in offshore wind. The company has a 22% market share of global wind installations outside China as of 2021, making it second only to Siemens Gamesa Renewable Energy, the Spanish-German wind engineering group.

Empowering the EV Revolution

China is already the world’s largest EV market—and Chinese automakers are intensifying competition for EVs with global carmakers. For example, BYD of Shenzhen makes electric cars and buses and is the world’s second-largest EV supplier globally, after Tesla. When including plug-in hybrids, BYD is the largest supplier of vehicles powered by new energy sources, with an 18% global share.

Beyond the carmakers, the EV supply chain is brimming with opportunities. For example, about 75% of battery cells for EVs are manufactured in China, along with about 70%–80% of the cell components. As global demand for EVs continues to grow, fueled by subsidies, China will remain a dominant player in all the supply chains through the coming decade, according to Tom Moerenhout, Adjunct Associate Professor at the Center on Global Energy Policy at Columbia University’s School of International and Public Affairs. Dr. Moerenhout discussed China’s role in the global EV revolution in a workshop series last year conducted by AllianceBernstein and Columbia University entitled The Making of a Green Giant: Decarbonization with Chinese Characteristics.

Examples of Chinese EV enablers include CATL, the largest global EV battery maker with a 32% market share. The company is a supplier to some of the biggest US, European and Japanese carmakers.

Infrastructure Solutions for Environmental Efficiency

Achieving net-zero goals requires infrastructure solutions for EVs, alternative energy, as well as initiatives to make more efficient use of energy, water and environmentally friendlier materials. Copper miners, undersea electrical cable makers and smart grid solution providers are all contributing to the global efforts to upgrade and streamline infrastructure.

NARI Technology is a good example. The company is a provider of equipment for power grids, supplying technology solutions in areas including system automation, smart grids, renewable energy and energy conservation. NARI has a market share of 30%–40% in key product categories.

How to Invest in China’s Net-Zero Enablers

International investors may have some concerns about investing in Chinese companies given the significant influence of policy decisions on the economy. However, we believe a disciplined approach focused on Chinese enablers of the global energy transition that is aligned with China’s long-term policy objectives can help mitigate regulatory risks.

Investors who understand the nuances of China’s policy and the economic landscape can find resilient, long-term opportunities. China’s commitment to reaching carbon neutrality by 2060 is a key long-term policy trend that should support companies involved in the transition.

There are plenty of companies to choose from in sectors ranging from industrials to utilities, materials, consumer discretionary and technology. We’ve identified about 400 Chinese onshore and offshore stocks that are participating in the net-zero transition and have a market capitalization of at least $1 billion. From this pool, investors can find the strongest candidates by looking for industry leaders that are contributing to net-zero goals and addressing climate risks. Investment candidates should also have business models with wide competitive moats, the ability to generate sustainable long-term growth and attractively valued shares.

Despite challenging macroeconomic conditions, we think the push to wean the global economy off fossil fuels will continue unabated. This should translate into persistent growth drivers for companies empowering the energy transition. By focusing on Chinese companies with solid fundamentals that are deeply embedded in this global green effort, portfolios can capture an attractive source of return potential that has gone largely unnoticed by investment managers.

John Lin is Portfolio Manager—China Equities at AllianceBernstein (AB)

Lily Zheng is Portfolio Manager—China Net Zero Solutions at AB

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.

References to specific securities are presented to illustrate the application of our investment philosophy only and are not to be considered recommendations by AB. The specific securities identified and described do not represent all of the securities purchased, sold or recommended for the portfolio, and it should not be assumed that investments in the securities identified were or will be profitable.