Smaller US stocks were hit harder than their large-cap peers during the January sell-off. We think the harsh treatment is unwarranted and a strong recovery could be in the cards when risk appetite returns.

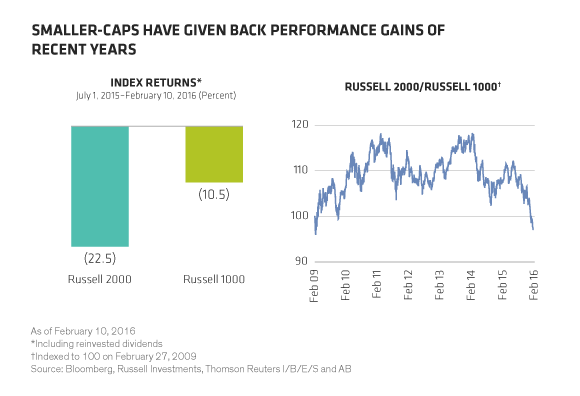

Sharp downturns in equity markets are never kind to smaller-cap stocks. Over the last seven months, the Russell 2000 Index of smaller-cap stocks has fallen by 22.5%. The Russell 1000 Index of larger-cap stocks fell by only 10.5% over the same period. The slump wiped out the strong performance gains that small-caps had been enjoying over large-caps since the financial crisis in 2008 (Display).

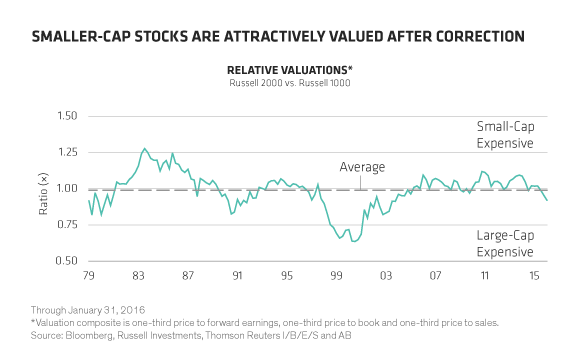

After the correction, valuations look attractive, in our view. When compared with large-caps on several metrics, the relative valuation of smaller stocks hasn’t been this low since the end of 2003 (Display, below). But investors are still wary. Smaller names are still seen as much riskier.

Is the Bad Rap Deserved?

But do all smaller-cap stocks really deserve such a bad reputation? We don’t think so. Although US smaller-caps are risk assets that will be vulnerable in market drawdowns, if you choose the right companies, with solid fundamentals, they aren’t necessarily as dicey over the long term as many investors believe.

Recent selling has been indiscriminate. Smaller stocks fell sharply across a broad range of sectors, even though individual company profiles are very diverse. Within the SMID-cap universe, there are a wide range of companies with different attributes in terms of valuation, free cash flow, quality and growth. For example, the gap between the most attractive and least attractive stocks on measures of value have widened to levels not seen since 2011. Yet by punishing smaller stocks so harshly, investors are treating them as if they’re all equally dangerous.

The anxiety is inconsistent. While concerns about China, the oil price and global economic growth are real, abandoning all smaller US companies isn’t necessarily the right response, in our view. Smaller companies can adjust business models much faster than their larger peers and can position themselves to weather the current environment more effectively. And smaller US companies get a higher share of their revenue from domestic markets than do larger firms, so they can benefit from the current relative strength of the US economy.

Don’t Focus on the Macro

When choosing smaller stocks, we don’t think macroeconomic analysis is the key to longer-term success. Bottom-up research into the sources of a company’s business advantages and earnings potential should be the focus, even when markets are fixated on economic trends.

That principle is perhaps even more valid today. By focusing on a small slice of the market with much stronger fundamentals, active managers can scoop up stocks with more resilient characteristics and better return potential at attractive valuations.

The trick is to look for companies that have diverse return drivers. In other words, search for companies that are exposed to different types of business trends that aren’t directly driven by economic cycles. For example, look for companies that are restructuring to improve their cash flows, but have not yet been rewarded for their efforts. Or consider companies in the healthcare sector that are exposed to structural growth trends created by the Affordable Care Act, which is boosting patient numbers and transforming industry dynamics.

After the Crisis

Smaller cap stocks often do well after a market meltdown. They outperformed strongly following the global financial crisis, as shown above. Yet it’s almost impossible to time a potential inflection point. So we believe it’s important to be invested before the market turns. During seven small-cap bull markets since 1926, which lasted 5.2 years on average, the average one-year annualized return was 37.3%. But our research shows that if you missed the best month of each bull market, your annualized return would fall to 31.2%. And missing the best five months would cut your returns to 16.2% a year.

When markets are so shaky, it’s easy to understand how anxiety spreads to smaller stocks. Yet it’s also a great opportunity to find smaller companies that can pack a big punch in a recovery. At times like these, we believe investors should consider reallocating to a small- or SMID-cap portfolio, which can offer premium return potential in a broader market recovery.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.