Alternative investments have an impressive long-term track record, but different strategies can perform in different ways—especially when markets are volatile. It’s critical to know what you want from an alternative strategy before you buy.

Alternative strategies typically invest in a wider universe of assets. They also give managers more flexibility in structuring their investments. As a result, market movements, or beta, tend to have less influence on returns than they do on traditional “long only” stock and bond returns.

What’s more, not all alternative strategies are alike. The combination of more flexibility and less market risk creates tremendous dispersion among managers within different categories, such as long/short equity, global macro, credit/relative value, and so on. It’s important to know which strategy, or combination of strategies, is right for you.

Risk and Reward: Getting the Balance Right

Most investors who choose alternatives say they’re looking for a noncorrelated source of high returns with strong downside protection. That’s fine—but it’s vague. After all, a bank CD provides all of these—it’s federally insured, with 100% downside protection, and its predetermined returns are uncorrelated with the broad market. But for most investors CD returns in today’s era of low interest rates aren’t that compelling.

That’s why it’s critical to have specific requirements and characteristics in mind.

1. Downside protection: Investors might start by asking themselves how much protection is enough. If the S&P 500 Index falls 20% but your portfolio is down 10%, is that a win? Or is a relative victory not really a victory at all? Maybe you can only stomach losses of 5% or less in any given year, irrespective of what the broader market does.

2. Returns: It helps to be specific about your return expectations, too. How much participation in up markets are you looking for? The stronger the downside protection, the more you’ll likely have to give up in returns when markets rise. If an investor knows she needs to earn at least 6% a year over time, she can save time and focus on the strategies and managers most likely to meet that goal.

3. Noncorrelation: This one’s tricky. Having zero correlation to the S&P 500 or another benchmark index isn’t a prerequisite for success. Most alternative strategies have some degree of positive correlation to the broad market or index. Many have fairly high correlations. It’s a manager’s individual security selection, or alpha, along with the downside protection, that often determines a strategy’s success.

Outpacing Traditional Strategies

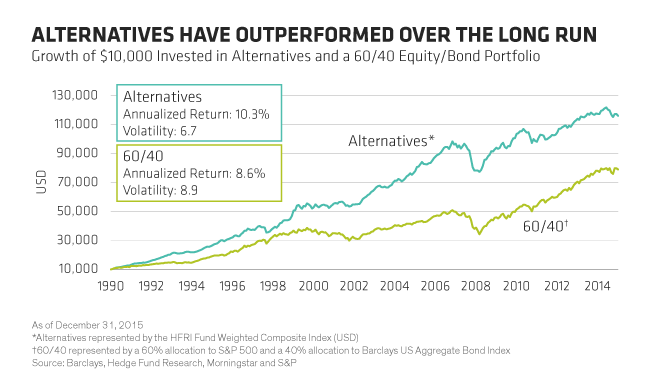

In recent years, alternative strategies have struggled. That had a lot to do with very specific market conditions. Over the long run, though, those who invested in and stuck with an alternative strategy came out ahead. Alternatives have provided better returns than a typical “60/40” portfolio of stocks and bonds over the past 25 years (Display)—and they’ve done it with less risk. The Sharpe ratio, which measures return per unit of risk, was 1.09 for alternatives and 0.66 for the “60/40” portfolio.

That’s important, because the global financial backdrop has become more conducive to alternative strategies over the past year. The beta trade—simply chasing an index—that worked while stock markets were booming probably won’t be as effective in the years to come.

So how have alternative investment managers on the whole been able to outpace a traditional mix of stocks and bonds over time? The secret of this outperformance can be found in a little appreciated but very effective investment metric known as the “up/down capture” ratio. We’ll dig more deeply into that in future posts.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.