Defined contribution (DC) plan sponsors are putting more importance on their fiduciary duties, based on results from our latest survey, Inside the Minds of Plan Sponsors. We also saw more plan sponsors turning to third parties for guidance as well as a growing appreciation for professional training and fee transparency.

This is especially welcome news as sponsors face disruption of their plans and their participants are grappling with market unsettledness caused by the coronavirus (officially COVID-19) crisis. Well before the COVID-19 pandemic, we saw plan sponsors stepping up and increasingly fulfilling their fiduciary duties by putting participant interests first amid new plan rules and other challenges.

This take-charge attitude is now vital in navigating the pandemic’s harsh impact on retirement account values as well as in getting word to participants about how the new Coronavirus Aid, Relief, and Economic Security (CARES) Act can help them.

Fiduciary Self-Awareness Rising—Especially for Larger Plans

About 70% of plan sponsors define themselves as a plan fiduciary, and that’s up from 58% in our last survey. The uptick is especially strong among plans with $250 million or more in assets (78% vs. 62% last time). Since all respondents are fiduciaries, based on their roles, having more of them self-identify as a fiduciary is a big step in the right direction. Yet, not all of them do, as some 20% of fiduciaries from large/mega plans still did not check that box.

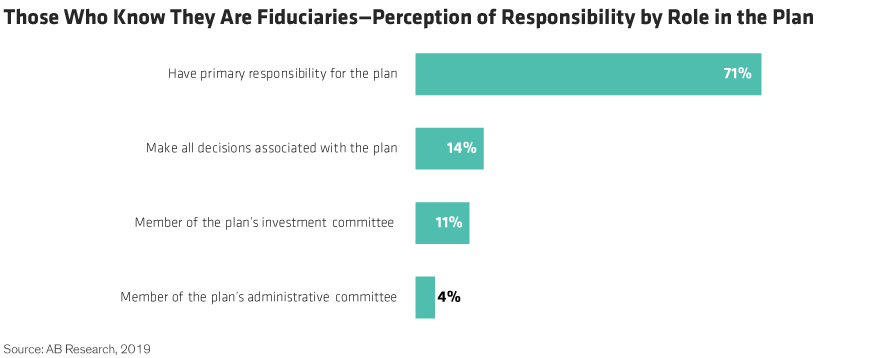

Of the four plan designations that qualify as fiduciaries, the category that denotes individual responsibility is generally more aware of its status. Roughly two-thirds of those with “primary responsibility” for the plan know they’re fiduciaries (71%). But awareness drops significantly in the two team categories—investment or administrative committees (Display). One fix for this would be to remind all team members that they’re both individually and collectively responsible as fiduciaries.

We think US Department of Labor (DOL) efforts to install the fiduciary rule a few years ago played a role in the increased awareness of fiduciary responsibilities. Although the DOL rule never landed, many plan sponsors saw the writing on the wall and picked up the pace to address aspects that would impact them the most. In particular, the rule codified the decision to hand fiduciary duties to a third party as a fiduciary act in and of itself.

Although a wide sample of sponsors are taking their fiduciary role more to heart, self-actualization varies among three distinct camps: investment/treasury roles, senior leadership and human resources (HR). For example, across all plan sizes, respondents in treasury roles (59%) and HR functions (69%) are less likely to consider themselves fiduciaries than those in senior leadership (72%) roles.

It’s no surprise these numbers rise for large- and mega-size plans, yet interesting that they increase in lockstep for each of the three distinct roles. We wonder if the disparity among them occurs from something as simple as being the named fiduciary on the plan document, which is typically a senior leader or ERISA attorney. But the bottom line is that you’re always a fiduciary—named or not.

Plan Rules and Complexity Heighten Fiduciary Role of Third Parties

We’re also seeing more value being placed on the fiduciary offerings of third parties, particularly advisors and consultants. Among plan sponsors who use advisors/consultants, more are turning to them for fiduciary services, rising from 65% to 89% since the last survey. Over half (54%) of this group says it’s “very important” to have one act as a fiduciary, up from 35% in the last survey.

The ways an advisor/consultant adds value remain relatively unchanged from our prior survey. “Quality investment advice/guidance” scored highest (50%), followed by “quick responses” to calls/inquiries (44%) and “providing access to individuals who are highly knowledgeable or an expert on fiduciary and plan design issues” (43%).

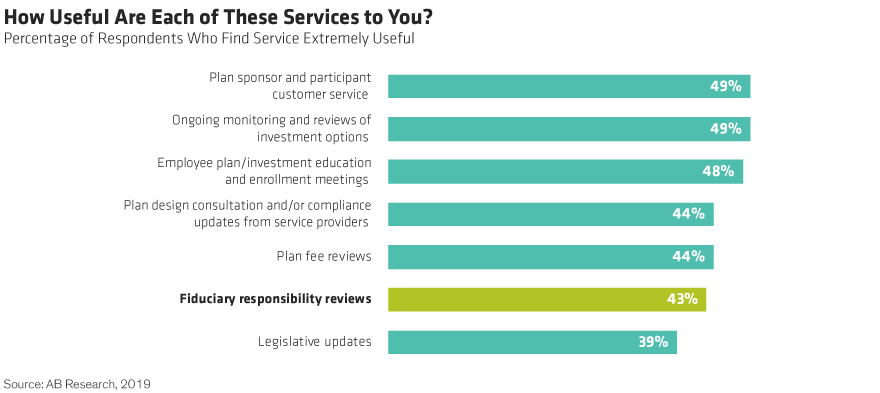

About 60% of plan sponsors say they use an advisor/consultant for an objective check and balance on another third-party they may be using—also unchanged from three years ago. But a larger number say they’re using an advisor/consultant as a fallback in case something goes wrong—up from 27% in our previous survey to 42% in our latest one. And yet, when sponsors were asked to rank the most useful components of services provided by advisors/consultants, fiduciary reviews were near the bottom of the list (Display).

The widening reach for expertise is primarily driven by the demand for more focus on investment choices, including diversified asset classes, custom target-date funds, collective investment trusts (CITs) and guaranteed lifetime income products—recently boosted by 2019’s Setting Every Community Up for Retirement Enhancement (SECURE) Act. With more plan diversification choices coming to light, sponsors are increasingly turning to outside experts for best practices to implement and oversee them.

Rule Changes and Volatility Also Test Fiduciary Role

DC plans have benefitted from a decade-long bull market, which came to an abrupt halt with the recent economic shutdown and market selloff in response to COVID-19.

Besides keeping participants calm in the face of shrinking plan values, the CARES Act also forces all-hands-on deck to communicate how the Act could benefit the participants in the plan. Plan sponsors will undoubtedly depend more on an advisor/consultant to steady the ship through helpful participant communications, if they haven’t already done so. As we see it, the more uncomfortable things get, the more professional advice will be relied on by sponsors.

Innovation Advances—Some Still Holding Back

Plan sponsors are also increasingly conscious of potential fiduciary exposure and backlash in a dynamic and often-litigious environment, even if they’re confident in their existing fiduciary structure and documentation process.

In the 11 years leading up to 2017, plan litigation soared, mostly dealing with investment choices, fees or proprietary investment options. In this survey, we probed sponsors’ feelings about plan innovation and whether they are hesitant about making plan design changes amid the growing threat of lawsuits. About four in 10 plan sponsors (38%) say they feel litigation has hindered plan changes “a great deal.” Considering the wide opportunities created by the SECURE Act, this response really caught our eye.

The SECURE Act provides a safe harbor for the selection of insurance providers so we’re hopeful that more plan sponsors will start to feel comfortable that they won’t get sued if they follow its guidelines and will therefore willingly adopt these solutions.

In this vein, general housekeeping is on the rise too. More plan sponsors report having a written and widely distributed investment policy statement (67% vs. 55% in the prior survey). Meanwhile, 93% say their plans effectively document the fiduciary process—up from 80% last time. All good news.

Greater Understanding of Plan Fees

Sponsors seem more in tune to plan fees today and are relatively satisfied with what they get in return. Some 80% feel “very confident” or “confident” in understanding what the fees pay for—up from 66% in our previous survey. Three of four sponsors (76%) say they feel “confident” or “very confident” they are getting the best value for fees, not just for the plan but for participant services, too.

Just how plugged in are sponsors? One-third (33%) say they review plan fees quarterly. In our previous survey, that number was just 21%. Annual reviews, however, fell from 40% to 29%, which could be a by-product of more frequent due diligence throughout the plan year. As more plan sponsors rely on advisors/consultants for fiduciary help, we’ll likely see even more confidence in them and their services.

More Training Completed and Appreciated

Fiduciary training is on the rise, providing even more evidence that plan sponsors are taking their fiduciary responsibilities more seriously—especially among larger plans.

In our latest survey, 88% of sponsors report completing fiduciary training, up from 78% last time. Among plans with $250 million or more in plan assets, 91% say they conducted some form of fiduciary training, up from 84% in our last survey. More broadly, we see stronger belief that fiduciary training is “important” and “comprehensive.” Around 60% of respondents say their organization provides relevant training to ensure all plan fiduciaries understand their responsibilities, compared to 41% in our previous survey.

Training aligns closely with reinforcing the purpose and self-awareness of the plan sponsor’s role. This could be one reason why fewer respondents said their company-sponsored training wasn’t relevant, which fell from 41% to 28%. At the very least, this is a good indicator that more sponsors are valuing—and likely absorbing a greater amount of—what they’re learning.

Using the Fiduciary Torch to Light the Way

Based on our survey, plan sponsors are taking their fiduciary responsibilities seriously. The growth in fiduciary awareness, training and accountability is encouraging. However, four in 10 plans still offer less than comprehensive training or none. Even among those who consider themselves plan fiduciaries, nearly half feel that their plan procedures could be better.

Of course, there’s room for improvement. But it’s obvious that plan sponsors are trying to work smarter and more effectively in a role that each day grows more responsible for the well-being of many. We believe more sponsors will answer this call, especially now, and put their fiduciary houses in order with intelligent plan design, effective diversification of investment options and innovative ideas to benefit their participants now and well into the future.

Jennifer DeLong is Head of Defined Contribution at AllianceBernstein (AB).

“Target date” in a fund’s name refers to the approximate year when a plan participant expects to retire and begin withdrawing from his or her account. Target-date funds gradually adjust their asset allocation, lowering risk as a participant nears retirement. Investments in target-date funds are not guaranteed against loss of principal at any time, and account values can be more or less than the original amount invested—including at the time of the fund’s target date. Also, investing in target-date funds does not guarantee sufficient income in retirement.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.