The recent sell-off has plunged the US stock market into bear territory as measures to prevent the spread of the coronavirus have disrupted major global economies. The economic implications are only beginning to emerge, and considerable uncertainty abounds. Both the progression of the virus and the extent of the damage to consumer spending, business activity, and equity markets remain unknown.

Given this backdrop, some investors are wondering whether this is a good time to wade into the market—or wait on the sidelines for the crisis to pass. After all, there is a chance that markets could fall much further. Historically, forging ahead amid uncertainty has proven a better approach than waiting for markets to recover, even if you invest before the trough.

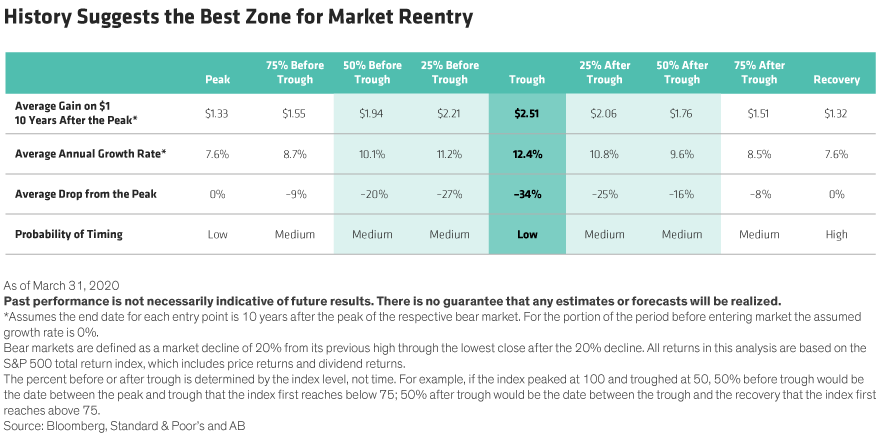

Consider the following entry points—the peak before the bear market (which has already passed) and the point at which markets fully recover to that prior level. From a return perspective, those are the two worst points for a long-term investor to buy stocks, as they yield the lowest growth over the subsequent 10 years (Display). Why? By waiting until stocks return to their previous high, an investor may avoid losing capital in the short run. But she will also miss buying in at discounted prices and harnessing the associated compounding effect once the bear market turns into a bull.

Is There a Better Way?

What about investing somewhere in between? The intervals between peaks and recoveries in bear markets have varied widely, depending on the severity and duration of economic downturns. Through all pullbacks, investors have invariably tried to beat the improbable odds of timing the bottom, though few have pulled it off. What is more likely is that investors buy while markets fall to their eventual trough or as they rise to their ultimate recovery.

To gauge the outcomes of investing during a decline and subsequent rise, we examined a range of entry points for each bear market since World War II. In our analysis, we considered one quarter, one half and three quarters of the way down from the peak, as well as one quarter, one half, and three quarters of the way up from the trough.

Keep in mind, the entry points are not a function of time, but rather a proportion of the cumulative fall and ascent. For example, if the index peaked at 100 and bottomed at 50, the date that the index first crosses below 75 represents halfway down from the peak. Conversely, halfway up from the bottom would be the moment that the index touches above 75 once again.

When to Wade Back In

Not surprisingly, investing close to the bottom yields the best return. However, the key point is that investing on either side of the trough will earn a similar amount in total dollars. What’s more, most of the benefit is captured at levels within 50% from the trough—with an average return of 16% to 20% below the peak. That’s not too far from where US stock indices stand today.

When turning to history as a guide, it’s important to look through a realistic lens. If we could predict the precise moment this bear market will level off, we’d know the optimal entry point. But of course, we can’t. That said, our analysis suggests that prices may have fallen to attractive levels for investors who were waiting for a better opportunity to deploy some cash—and who have a tolerance for risk.

Ultimately, remaining invested outweighs one’s entry point. And given that an extremely volatile market environment can cause self-doubt, risk-averse investors may want to adopt a dollar-cost-averaging strategy as markets climb in order to increase their odds of staying the course.

Even better? Don’t let emotions rule your investment decisions. Instead, develop a plan that reinforces your time horizon, while explicitly aligning your asset allocation and objectives. This will reassure you that your portfolio can withstand a significant market downturn while maintaining a very high likelihood of achieving your long-term goals.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.