The financial markets are giving off mixed signals of late, and credit investors may wonder whether to be downbeat or optimistic. After all, Europe has emerged from a mild winter with none of the calamitous effects expected of its divorce from Russian energy, gas and oil, and most eurozone economies are expanding—albeit slowly. In the US, job numbers continue to impress, and a dreaded recession remains more rumor than reality after two years of doomsday predictions.

Still, corporate bond investors remain wary, and for good reason.

Macro Backdrop Is Tenuous

Despite strong news on the jobs front, the global growth outlook is uncertain—particularly given concerns around midsize and regional banks and an inverted Treasury yield curve hinting at recession. Although we believe that recent banking turmoil is largely idiosyncratic rather than systemic, there’s little doubt that banks will need to be more cautious in extending credit, and we’ve lowered our growth forecasts accordingly.

Stubborn global inflation is also an issue. With the European Central Bank nearing the end of its rate-hike cycle and the fed funds rate north of 5%, we expect inflation across most developed markets to continue moderating. Still, it could take another year before it falls to the Federal Reserve’s long-range target of 2%, and we’re not nearly as dovish as some market participants about rate cuts in the second half of 2023. In both Europe and the US, housing and wage inflation still warrant monitoring.

Given these macro-level crosswinds, is it too risky to invest in corporate bonds? We don’t think so, based on fundamentals, valuations and technical factors. But investors need to be selective.

Corporate Fundamentals Are Sound

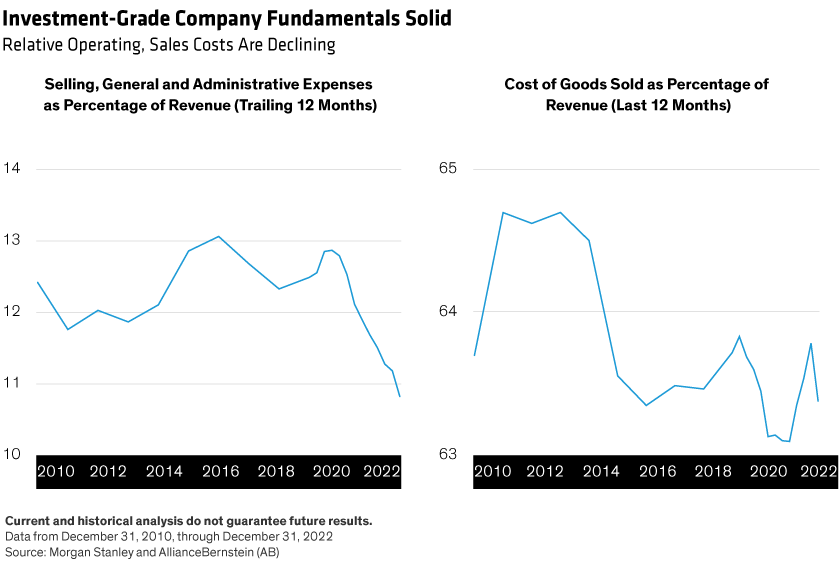

At first blush, corporate fundamentals appear to be softening, with top-line growth and earnings showing signs of slowing. But context matters. This inflection is coming from an initial position of strength. Both revenue growth and profit margins are coming off their highest levels in more than a decade. Moreover, issuers are managing their balance sheets conservatively, with both operating and sales costs declining as a percentage of revenue (Display).

First-quarter earnings from investment-grade issuers have generally proven resilient, despite the unpredictable macroeconomic environment. For the corporate issuers that we follow, first-quarter earnings beats outnumbered misses by more than three times. Some of the strongest earnings performance came from traditionally cyclical industries such as capital goods and autos—which are at odds with a recessionary environment. Although companies’ management teams were cautious about their outlooks, overall earnings are in line with our more optimistic view of corporate fundamentals.

Importantly for bondholders, issuers are paying their debts. Even with lower cash reserves, interest coverage is hovering above long-term averages, indicating that companies are having little trouble meeting fixed-income obligations. In fact, the percentage of investment-grade issuers with higher year-over-year debt has fallen in recent months and remains well below long-term averages. Companies also did an excellent job of locking in lower yields over the past few years, and it will likely take time to see the impact of higher rates flowing through to companies’ interest expenses.

Lastly, it appears the era of stock buybacks and special dividends may be coming to an end. Investment-grade issuers are increasingly reinvesting cash into their operations, rather than returning it to shareholders. This, too, can be a plus for long-term bondholders.

Valuations Are Compelling

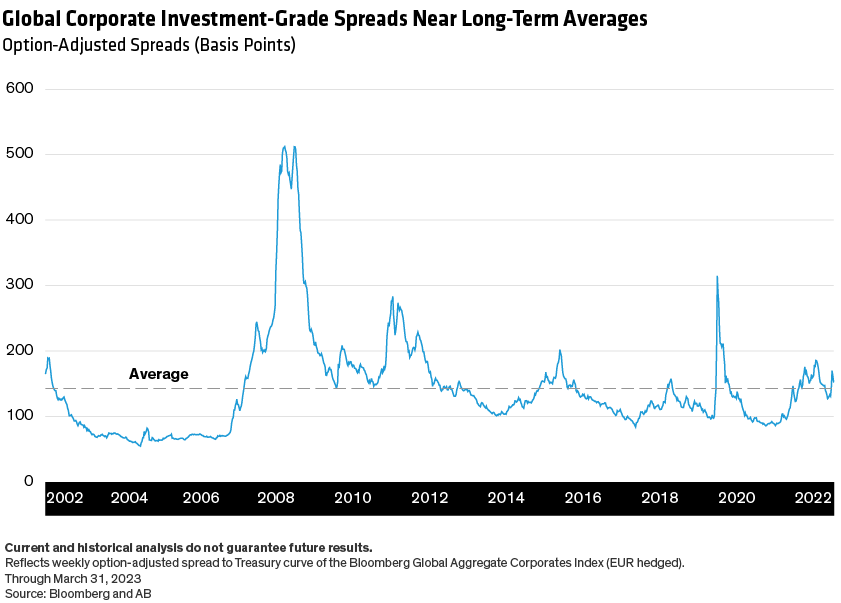

For investors considering investment-grade corporates, we believe that valuations could make for a good entry point. Average prices for US dollar- and euro-denominated investment-grade bonds are at their lowest levels since the global financial crisis, due in large part to elevated interest rates. Lower prices should help to limit potential downside should the market experience volatility. Meanwhile, global investment-grade credit spreads—the difference between corporate bond yields and government bond yields—have climbed back above long-term averages (Display).

In the US, rising Treasury yields have helped drive investment-grade corporate yields well above 10-year averages. That comes with a bonus: historically, high yields have been good predictors of forward returns.

Strong Technicals Underscore Investor Confidence

Elevated yields have had a knock-on effect by improving technical factors. In both the US and Europe, fund flows have reversed course from 2022, with high yields attracting investors to investment-grade corporate strategies in large numbers despite persistent market volatility. Ultimately, strong flows should bode well for longer-term valuations. Even if monetary policy becomes more accommodative over the coming year, we expect elevated yields to continue luring investors from the sidelines.

Technicals are also benefiting from the lack of primary-market activity so far in 2023 for investment-grade corporates. New-issue supply continues to underwhelm compared with the past few years. Supply in 2022 was about 12% lower than in 2021, and through April 2023, supply was off by 19% year over year, driven by reduced supply from financials.

Looking for the Sweet Spot

Of course, investment-grade bonds come with different risk/return profiles, and it’s important for investors to do their due diligence. In today’s volatile environment, high-quality bonds help investors play defense, but we also see some opportunities in select lower-rated investment-grade credit.

Although it may seem counterintuitive, we believe that select banks and technology companies may help buffer market volatility.

In the US, senior bank bonds currently have attractive valuations and strong starting fundamentals, and in our view, they may benefit from an improving technical backdrop. The discount for senior bank bonds versus non-financials is at the widest level we’ve seen in more than a decade. At the same time, bank supply continues to underwhelm, with new issues from financials down 39% versus this time last year.

European banks trade at a discount to their US peers and may be sheltered from some of the recent issues facing US regional banks. Globally, investors might also consider covered bonds—a high-quality segment that can serve as a buffer within the more cyclical banking industry.

Despite their reputation as high-risk plays in a volatile sector, technology firms with strong business models and resilient income streams can provide a defensive layer to a portfolio. Here we see yield potential in attractively priced, longer-dated securities without the need to sacrifice credit quality. We also see opportunities in select BBB-rated issuers, where we believe that spreads more than compensate for potential risks given the issuers’ strong cash-flow profiles and commitment to investment-grade ratings.

The coming months are likely to offer another dose of mixed economic news. It can be difficult to make sense of it all and allocate assets accordingly. But given sound corporate fundamentals, compelling valuations and strong asset flows, we believe that investment-grade corporates deserve a closer look.

Tiffanie Wong, CFA, is Director—Fixed Income Responsible Investing Portfolio Management and Director—US Investment-Grade Credit, and Tim Kurpis, CFA, is Portfolio Manager—Investment Grade Credit.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.