As the path back from the depths of the COVID-19 pandemic continues, accompanied by massive stimulus measures, markets have generally fared well. As the recovery progresses, however, eventually the return-to-normal trade will fully play out.

At that point, the same issues that existed before the pandemic will remain, only more acute because stimulus has pulled returns forward in time. In this case, the capital markets landscape will put a strain on traditional investment strategies—and income investing won’t escape the pitfalls. What investors do next will go a long way toward determining success or failure in securing income and legacies.

Capital Markets Headwinds Are Intensifying

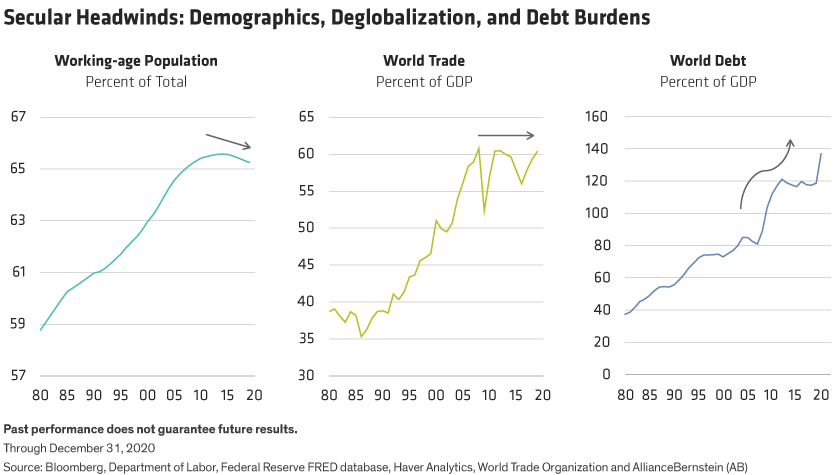

As we look out over the next decade, we see three secular headwinds—changing demographics, deglobalization and high debt levels—converging (Display). In our view, this combination will slow economic growth and make investing—whether it’s for income, growth or a combination of the two—much more challenging in the years ahead.

A rising tide of globalization has made world trade a support pillar for economic growth and

wealth creation for many years. Recently, though, that tide has started to ebb, driven by

wide-ranging factors including rising wages in emerging markets (including China), resurgent

populism and trade wars, and the desire to balance risk management with cost savings as a

result of COVID-19-related global supply-chain disruptions.

Finally, the debt burden of the world’s major economies has exploded. In the wake of the global

financial crisis, the ratio of sovereign debt to gross domestic product topped 100%; that load

is now approaching 140%. Not only does a growing pile of debt divert more of government

budgets to servicing debt, it also ties the hands of central banks as they seek to manage

inflation and growth.