With so many vehicles for charitable giving, sometimes donors find it hard to choose. Here’s a versatile strategy that can play many roles.

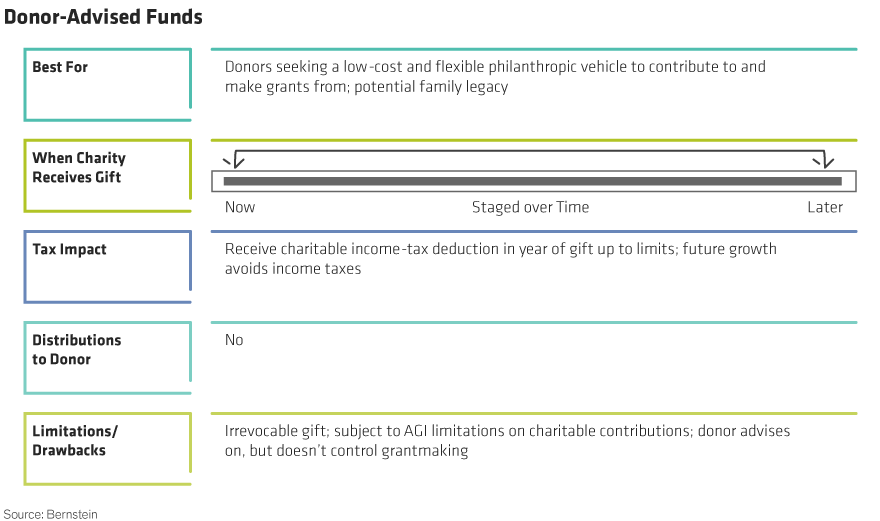

Donor-advised funds (DAFs) have been the fastest growing vehicles for charitable giving in recent years because they offer a flexible and relatively low-cost way to give over many years—and a large, upfront tax deduction.

As a donor, you will receive an immediate charitable income-tax deduction* for the full amount of the gift to a DAF, although the grants may be distributed over many years. Funding a DAF is especially attractive in years when your income is unusually high, perhaps because you sold a business, received an outsized bonus, or saw restricted stock vest. But that’s not the only catalyst. Donors turn to DAFs for a host of other reasons, including:

How It Works

A DAF is an account or fund that you create at a sponsoring organization that is itself a qualified public charity—perhaps a community foundation, faith-based organization, or specialized provider. As the donor, you make an irrevocable contribution of cash or securities (including highly appreciated stock), which the DAF administrator can sell without triggering capital-gains tax. Typically, the DAF administrator reinvests the cash proceeds in a diversified portfolio that will fund grants to not-for-profit programs.

The sponsoring organization sets up and administers the accounts, performs due diligence, and makes grants. As a result, the legal and accounting fees that the donor pays and the demands on the donor’s time are relatively low.

Other Important Considerations

Most DAFs have fairly long time horizons, often a decade or two. Unlike private, nonoperating foundations, DAFs are not subject to annual giving requirements: They can give as little as 0% or as much as 100% of their assets in any year.

Most DAF programs will make grants in a way that does not disclose your identity, if you prefer anonymity. But DAFs can also make a gift public, if the donor wants to attract attention to a cause or be associated with the gift.

The chief drawback is that when you donate assets to a DAF, you relinquish legal control. You submit recommendations for grants to the DAF administrator. Most of the time, the administrator will follow your recommendations, but there’s no guarantee.

DAF sponsors and administrators also have the right to introduce restrictions on investments or grantees at any time, and can refuse a particular grant request, perhaps because the philanthropic cause, the geographic region, or the grantee lies outside the administrator’s area of interest.

Determining an appropriate asset allocation and spending policy to recommend requires careful consideration of your charitable goals and the needs of the causes or organizations the DAF supports. But it’s time well spent—this is one utility player you’ll be glad to have on your team.

*Under the Tax Cuts and Jobs Act, itemized deductions are mostly limited to mortgage interest, state and local taxes (capped at $10,000), and charitable gifts. At the same time, the standard deduction was increased to $12,000 for individuals and $24,000 for married couples filing jointly. For those who have itemized deductions that exceed the standard deduction, under the Internal Revenue Code as it now stands, the maximum deduction you can use in any year is equal to 60% of your adjusted gross income (AGI), if you donate cash. If you donate appreciated assets, the maximum deduction you can use in any year is equal to 30% of your AGI. Deductions not used can be carried forward for five years.

For more tips on becoming financially engaged, explore Women & Wealth, a new Bernstein podcast series designed to educate, empower, and inspire female investors, and for additional thought leadership, check out the related blogs here.

The views expressed herein do not constitute, and should not be considered to be, legal or tax advice. The tax rules are complicated, and their impact on a particular individual may differ depending on the individual’s specific circumstances. Please consult with your legal or tax advisor regarding your specific situation.