When a stock price tumbles, investors often think that something is really wrong with the company. But that can be a mistaken assumption—especially as ETF-oriented investors are buying broad sectors rather than individual companies.

Momentum is a funny thing. Share price momentum isn’t necessarily an indicator of business momentum. Sometimes a stock is falling simply because investors are taking profits after its outperformance, or because a portfolio is changing its risk profile in a volatile market. There are countless reasons why share prices move.

Last year’s narrow market is a case in point. Investors might assume that the underperformance of a large swath of the US stock market means that most companies are in bad shape. But there is another plausible interpretation. It could also mean that there are a lot of buying opportunities in undervalued companies that have much better businesses than is widely believed. Distinguishing between price momentum and business momentum is one of several ways that active investors can capture excess returns over long time horizons.

Healthcare Swings Ignore Company Fundamentals

The healthcare sector provides a good example. Fears about potential drug-pricing controls have been a recurring theme during the US presidential campaign.

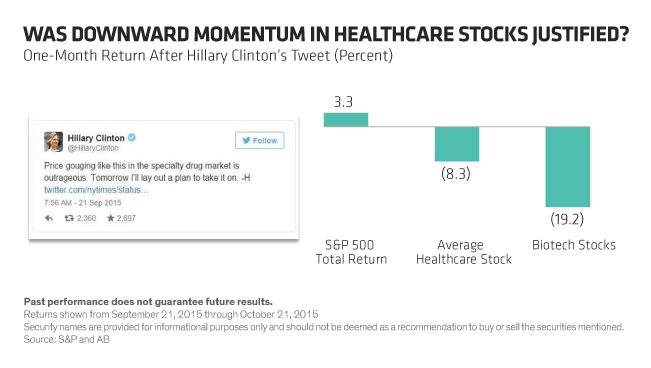

Back in September 2015, when Hillary Clinton announced with a tweet her intention to impose controls on prescription drugs, investors in pharmaceutical companies reacted instantly. It didn’t matter that she hadn’t even been nominated as a presidential candidate or that the political hurdles to her proposals would be formidable. That day, shares of drugmakers in the US and Europe fell sharply.

Among those companies was Zoetis, which tumbled by 11% over the following week—more than the broader US pharmaceutical sector did. But investors had missed something. Zoetis manufactures animal health products, so it probably wouldn’t be a target for pricing controls on medicines for people—and it’s long-term growth prospects hadn’t changed.

Over the following month, the healthcare sector continued to underperform the S&P 500 Index (Display). Biotech stocks were also hit, including companies like Biogen and Celgene, which are expected to grow their earnings (and innovation pipeline) by at least 10% annually over the next five years.

Despite the furor about drug-pricing controls, nothing has changed in the business prospects of many pharmaceutical companies. The downward stock price momentum was fueled by speculation about a potential shake-up of industry dynamics, without any real consideration of individual company fundamentals, cash flows or earnings power.

Assessing Technology Momentum

Share price momentum has also created a conundrum for investors in the technology sector. In early 2015, some of the large and more mature (“legacy”) US technology companies were trading at very low price/earnings multiples. Some investors may have seen this as a buying opportunity. Yet over the next several months, these companies’ share prices continued to move even lower. In this case, the companies were facing significant challenges, as the evolution of information technology was weighing on growth at their underlying businesses. Here, price momentum may indeed have been a reflection of business momentum, in our view, so it’s important for investors to assess the two separately, and to keep in mind that just because a stock is cheap, it doesn’t mean that it can’t get cheaper.

Rallies May Mislead Investors

Similarly, not every stock that rallies sharply has a healthy underlying business. Take energy stocks as an example. Over the past year, shares of energy companies have tended to move up and down in close correlation with the oil price. But just because the oil price has rebounded in recent weeks, it doesn’t mean that every energy company has a resilient underlying business.

In our view, some exploration and production companies have weaker business dynamics and could still struggle to grow their earnings even if the oil price continues to climb. But we believe that some of the larger integrated companies have higher-quality balance sheets and more scope to cut costs, which could help to minimize the earnings impact of continued volatility in oil prices.

Instead of blindly trading stocks based on price swings, it’s important to scrutinize the fundamental business prospects of each one in order to ensure that the stock’s long-term earnings path is sustainable. Passive portfolios will be vulnerable to swings in momentum by holding every stock in the benchmark. By being attuned to shifting momentum, active equity managers can aim to avoid false signals from sharp swings in share price, especially those driven by flows of exchange-traded funds. And when momentum surges upward, active equity managers can make tactical trims to positions in richly valued holdings, raising cash temporarily in order to redeploy into attractive stocks when the prices correct.

This blog was originally published on InstitutionalInvestor.com.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.