It’s taken for granted in financial circles that lower oil prices are a boon for stocks, as they fuel an economy-boosting cycle in which money saved at the pump ultimately flows to the market. But oil prices that are too low could be too much of a good thing.

Historically, the cheap oil signal has turned from green to yellow when prices fall about 15% below their five-year average. Given the recent oil market rout, that threshold isn’t far away. West Texas Intermediate crude prices dipped to $49.88 per barrel on December 17, down 53% from their recent October 3 high. If oil dips below $40–$45 a barrel, we would consider the signal to have turned yellow.

Cheap Oil: Good Until It Isn’t

Many allocation models view a fall in oil prices as favorable for equities and other risk assets, and for good reason. There’s a strong, well-established relationship between oil-price movements over a 12-month period and equity performance in the following month. Equities tend to rise after oil prices drop, and vice versa.

It’s not hard to understand why this is so. Cheap oil gives consumers an instantaneous tax cut, which helps the companies that produce the goods and services that consumers buy, which in turn boosts the businesses that supply those companies. Low oil prices also allow central banks, particularly the Federal Reserve, to relax about inflation. Easier money is generally supportive for risk assets.

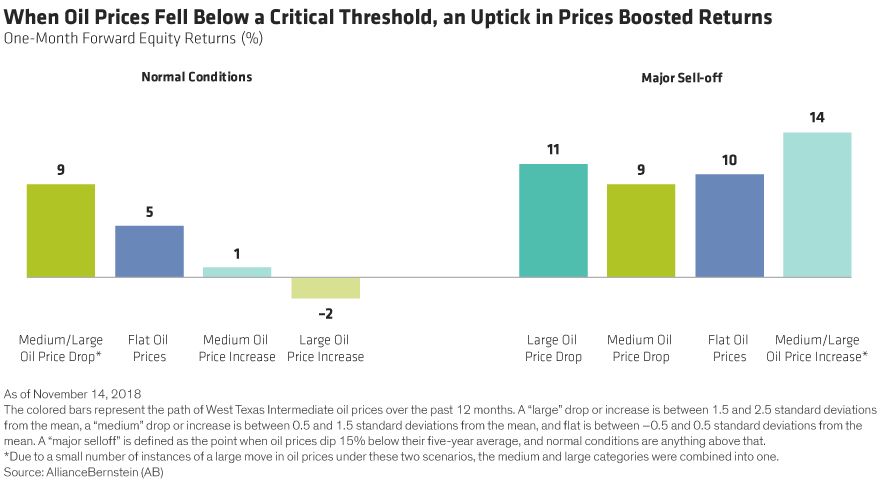

But the inverse relationship between oil prices and equity performance shifts into reverse during a major sell-off in oil. We studied what happens when oil prices drop 15% or more below their five-year average—a level we believe would indicate a major sell-off—and found that falling oil prices didn’t signal better equity returns past that point. In fact, stocks actually benefited from rising oil prices after a shock of that magnitude (Display 1).

When Negative Correlations Turn Positive

The departures from “normal” behavior don’t stop there. A major oil-price shock starts to affect equity markets in real time, not just as a leading indicator. Look back a year on any given day during humdrum times, and you won’t find much of a relationship between oil prices and stock returns. When oil prices are well below their five-year average, however, oil prices and stock performance move in lockstep. When oil falls, so do stocks. When oil rises, stocks breathe a sigh of relief, and rise as well.

This isn’t as counterintuitive as it seems. The five-year average price of oil is a decent proxy for how much it costs oil companies to produce a barrel of oil in the recent past. When prices fall significantly below this average, it’s a pretty good indicator that energy companies’ profits will struggle, which can set off an economic chain reaction that creates headwinds for risky assets. It doesn’t do much to boost sentiment, either. Another reason oil prices and equities likely tend to move together during an oil-price shock? A major drop in the price of oil is sometimes indicative of a major drop in demand, which would also tend to hurt stocks.

It’s Not All About Oil

At the end of the day, a healthy allocation to equities is critical to driving long-term growth potential, and oil is just one of many factors to consider when building a multi-asset portfolio. In our view, there are several reasons to be cautious about risk assets at the moment, whereas falling oil prices are a reason to be slightly more positive.

Concerns about risk and return potential across asset classes tell us that it’s time for investors to start thinking about reducing their exposure to equities in a diversified portfolio. Modest downward earnings revisions in the US, geopolitical concerns over tariffs and populism, widening credit spreads and the potential for further rate increases from the Federal Reserve are all part of that notion.

So, what does it mean if oil prices slip below $40–$45 a barrel? It means it’s time to scrutinize existing models that may still read falling oil prices as supportive of equity performance. It may even be a reason to reduce equity exposure even further. Ultra-low oil prices are not in and of themselves a reason to run for the hills, but they aren’t a reason to be more bullish, either.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.