Interest rates have reached extreme lows around the world, and they’ll likely stay low for some time. Does this mean global bond investing is no longer worthwhile? Should US-based investors revert to a US-only bond strategy in their hunt for yield and safety? We don’t think so.

Yields tumbled worldwide this year, thanks to the massive global policy response to the COVID-19 pandemic. We expect today’s low—and in some cases, negative—yields to persist for the foreseeable future, as central banks put a pin in key rates and continue to deploy quantitative easing programs and other measures intended to shore up financial markets and support fiscal rescue packages. (Only China has bucked the global yield trend; its yields are now higher than before the pandemic.)

Even in the face of low government bond yields, however, investors should take care not to reduce duration, a measure of interest-rate sensitivity, too drastically. While the coronavirus has turned our world upside down in ways we never imagined, duration continues to play its traditional role as an offset to risk assets.

Similarly, no evidence points to a fundamental shift giving a long-term advantage to a single bond market such as the US. In fact, in volatile environments, global bonds have historically had an advantage over US bonds.

Below are three key reasons why we think US investors should embrace the global bond market today.

1. The global bond market is less volatile and supplies bigger diversification benefits than the US bond market.

The global bond universe is much larger and more diverse than the US bond market. Not only does it offer more opportunities from which an active manager can choose, but its differing landscapes provide significant variety.

Countries’ bond returns differ greatly from year to year because of varying economic cycles, monetary cycles, business cycles, inflation regimes, geopolitical concerns and yield curves. Returns also vary by sector within countries and regions. Retailers in the US aren’t exactly like retailers in Japan, for instance. And individual opportunities and risks differ greatly, too. That’s a lot of variation compared with a US-only mandate. The result of all this variety is a compelling risk/return profile and strong defensive characteristics.

Historically, the global bond market has generated higher return with less volatility than the US bond market. For example, over the 10 years ending July 31, 2020, the Bloomberg Barclays Global Aggregate Index (hedged into US dollars) posted an average annualized return of 4.17%, versus 3.88% for the Bloomberg Barclays US Aggregate Index. And it did so with 20% less volatility.

That’s not all. Both the US and global bond markets provide a nice offset to US stocks. Between January 1987 and July 2020, the US bond market and hedged global bond market both averaged very low correlations to the S&P 500, at 0.09 and 0.05, respectively.

But the real power in global bonds comes during extreme down periods for stock markets. During months when US stocks fell by more than one standard deviation, US bonds saw correlations to the S&P 500 fall to –0.12, while the correlations of hedged global bonds to stocks fell to –0.28.

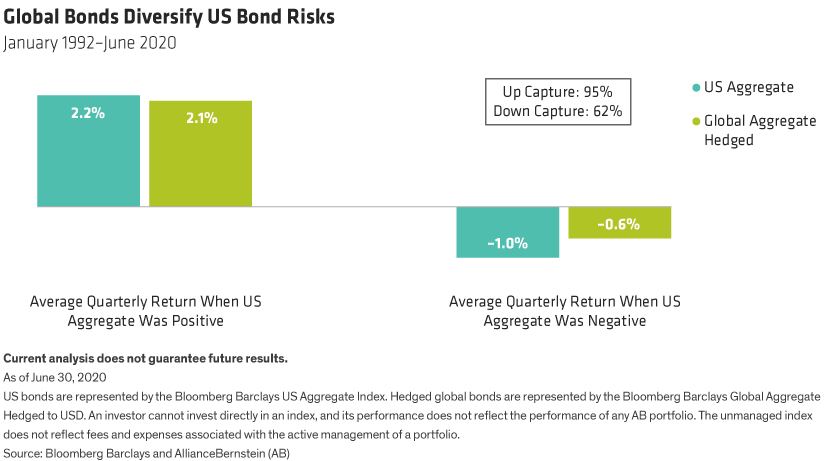

Lastly, bond investors didn’t miss out on US bond market rallies by investing in global markets. But they also didn’t concede as much when US bond markets fell. In other words, global bonds have historically provided attractive up/down capture ratios versus the US bond market (Display 1).  Since 1992, during quarters when US bonds rallied, hedged global bonds captured 95% of positive returns. Conversely, when US bonds sold off, hedged global bonds preserved more capital, experiencing just 62% of that downturn.

Since 1992, during quarters when US bonds rallied, hedged global bonds captured 95% of positive returns. Conversely, when US bonds sold off, hedged global bonds preserved more capital, experiencing just 62% of that downturn.

2. The global bond market provides unique ways to generate alpha.

Beyond its attractive risk/return profile and defensive characteristics, the global bond market offers some unique sources of alpha. One of these comes from differences between countries’ yield curves.

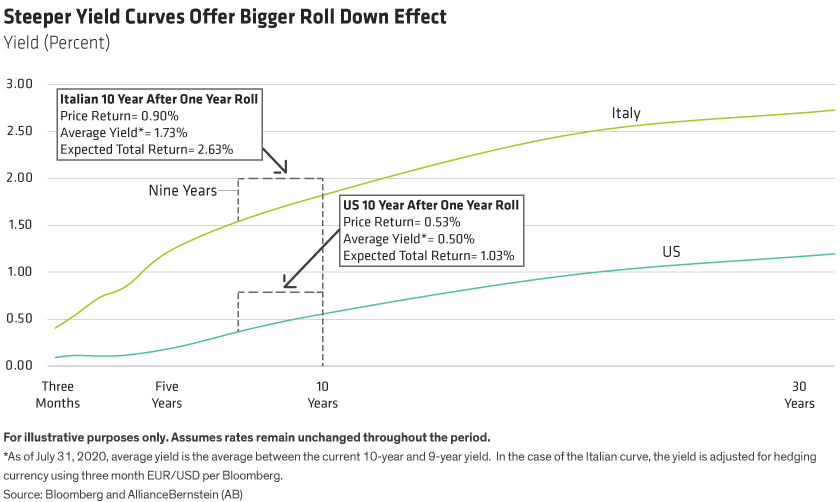

In Display 2, we’ve illustrated two similar investments. In each case, the investor holds a 10-year government bond for one year. Yet the expected outcomes are quite different, because of differing levels and slopes of the two yield curves.

Our example compares US Treasuries to the government debt of Italy, a riskier but still investment-grade sovereign. The Italian yield curve isn’t just higher than the US yield curve, it’s steeper, too. This means investors can expect a bigger price boost from an Italian bond as it “rolls” down the yield curve over the course of a year. Together, higher yield plus the benefit of roll translate into higher potential return.

Our example compares US Treasuries to the government debt of Italy, a riskier but still investment-grade sovereign. The Italian yield curve isn’t just higher than the US yield curve, it’s steeper, too. This means investors can expect a bigger price boost from an Italian bond as it “rolls” down the yield curve over the course of a year. Together, higher yield plus the benefit of roll translate into higher potential return.

Another source of opportunity unique to global bond markets can arise when a single company issues into more than one bond market. In such cases, differences in market demand can lead to price dislocations, even though the underlying credit risk of the two issues is identical.

3. Hedging into US dollars can boost low and negative yields.

Why invest globally when so much of the global government bond market is trading with negative yields? US investors should remain in global mandates because those negative yields can be turned into an opportunity, thanks to currency hedging.

Currency hedging can be implemented cheaply and effectively with currency forwards and futures. In fact, the currency forward markets are among the most liquid markets in the world, making transaction costs very small—on the order of one to two basis points to initiate a hedge from a developed-market currency into US dollars, then an eighth to a quarter of a basis point to roll it forward as needed.

Hedging foreign currency back into US dollars accomplishes two things. First, it lowers the volatility of the portfolio while preserving global bonds’ diversification benefits. Second, in today’s markets, the currency hedge can increase yield (Display 3).

For the euro area, for example, as of mid-August, currency hedging into US dollars lifted bond yields by more than 0.75%. It raised French government bonds trading with negative yields to levels nearly comparable to those of 10-year US Treasuries. It boosted the yields on Spanish and Portuguese bonds above 1%. And it raised the Italian 10-year government yield to almost three times the yield of a comparable-maturity US Treasury bond.

For the euro area, for example, as of mid-August, currency hedging into US dollars lifted bond yields by more than 0.75%. It raised French government bonds trading with negative yields to levels nearly comparable to those of 10-year US Treasuries. It boosted the yields on Spanish and Portuguese bonds above 1%. And it raised the Italian 10-year government yield to almost three times the yield of a comparable-maturity US Treasury bond.

The key is actively managing these exposures, because hedging relationships change. An actively managed global bond portfolio optimizes the dynamic relationships that comprise the capital markets.

In short, while low rates may stick around a while, US-based investors seeking yield and safety don’t have to give up the benefits of being global. Given its return, volatility and diversification advantages and its unique opportunities for adding alpha, an allocation to global bonds still makes sense. That’s why US-based investors would do well to heed the maxim, “Don’t fence me in.”

Scott DiMaggio is Co-Head of Fixed Income at AB.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.