Volatility is remarkably low today, but it’s not likely to stay that way. Alternatives have the potential to provide diversification and reduce risk when markets get stormy again. But what’s the best way to design an alternatives allocation?

The recent run of market tranquility makes it easy to forget that we’ve seen more volatility spikes in the past two years than there have been in the previous 20. It’s true that most of these surges were short-lived. But investors shouldn’t expect that they will always be.

Investors who ignore rising US interest rates, global policy uncertainty and political risk—particularly in Europe and other developed regions—do so at their own peril. In fact, the lower the risk, the higher the probability of a sharp reversal.

The good news is that a well-designed allocation to alternative investments may help portfolios weather uncertain market environments. When volatility and market sentiment fluctuate, it tends to cause bigger differences in the return paths of individual securities in equities and fixed income. That creates more opportunities to take advantage of security selection to enhance performance.

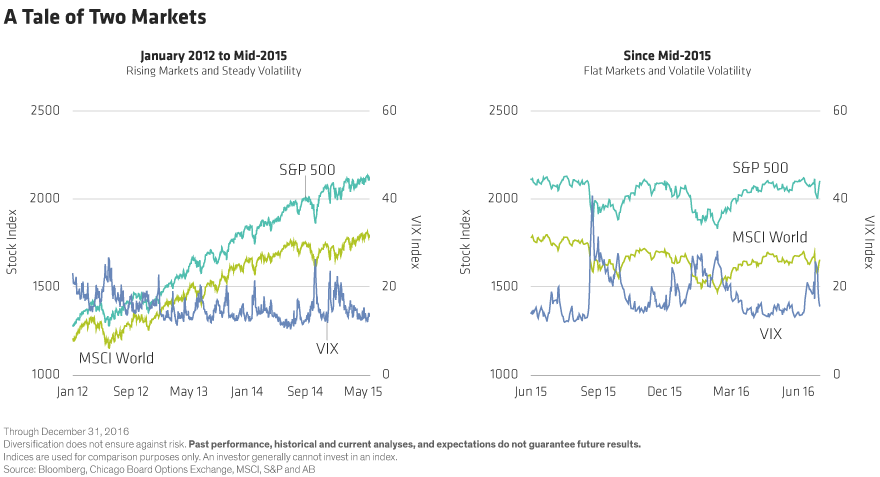

The right alternative strategy may also help diversify a portfolio and provide protection in down markets. That’s critical, because the returns of major equity indices haven’t been climbing as steadily as they were before 2015. Volatility, meanwhile, has seen quite a few ups and downs (Display).

But to get the right fit, investors need to have a strong sense of their investment objectives and the alternative design that best complements their portfolios.

An Allocation Framework

Alternatives have a wide range of strategies that behave very differently: they can’t be defined by any one asset class. Asking the right questions can help determine the best strategy for a specific investor. It’s also necessary to look deeper into the mix of categories, strategies and approaches that define how individual alternatives behave.

Once investors have these answers, they can start building an alternatives allocation. We think these four steps provide a helpful framework:

1) Define Your Investment Needs. Before picking an alternative strategy, investors should have their specific objectives in mind. This includes knowing how much downside protection they want, the amount of upside participation that defines “success” from their perspective, and how much correlation they can tolerate.

2) Choose an Alternatives Allocation. There are two ways to access alternatives. The first is by investing in a prepackaged diversified allocation run by an experienced hedge-fund manager. The second way is for investors to work with financial advisors and design their own mix. This option provides more control, but it also takes time, effort and expertise to manage.

3) Determine How to Fund Alternatives. What portfolio allocations will you reduce to invest in alternatives? Stocks, bonds or both? Alternatives are usually funded from parts of a portfolio that have similar risk/return profiles. For example, assets from equities could be moved into long/short equities. Or, bond assets could be shifted into market-neutral or nontraditional bond strategies. Diversified alternative allocations could come from both stocks and bonds.

4) Select the Right Manager or Managers. Whoever designs the alternatives mix should assess three key factors in a manager and strategy: the market it will invest in, how sensitive it will be to that market, and the mix of market returns and active management that will define its total return. It’s essential to review alternative managers’ experience, qualifications, track records and infrastructure.

We believe that following these four steps makes it more likely that investors will end up with an alternative allocation that works best with their specific portfolios. And sticking with a well-designed strategy has the potential to deliver the best of both worlds: reducing downside risk and uncovering opportunities that more volatile markets can produce.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.