As Earth Day celebrations shift into high gear this week, it’s a good time for investors to think about the environment too. Start by mapping out the trade-offs of different approaches to responsible investing.

Earth Day on April 22 has become an important annual global environmental event. This year, it will be marked by the landmark Paris accord, a climate protection treaty that will be ratified by the US, China and another 120 nations.

Increasing global sensitivity to the environment has compelled investors to sharpen their focus on environmental, social and governance (ESG) issues in their portfolios. But responsible investing means different things to different people. So clarifying the terminology is important to help investors consider the most appropriate approach. Here are the most common ways that investors can apply ESG considerations to building portfolios.

1.ESG Integration. In this approach, investors explicitly consider ESG factors in research and integrate their economic impact into the fundamental investment analysis, which helps form the final investment decision.

For example, when looking at companies with exposure to fossil fuels, analysts would incorporate how stranded assets—potentially unusable assets from oil, coal and gas projects—might impact their forecasts. This could lead to underweight positions in companies with material coal exposure and an undefined plan to transition to a low-carbon economy, or an overweight in companies with a clear transition strategy in place. The impact of new regulation would also be applied to industry outlooks.

2.ESG Screening. The investment universe is narrowed through negative or positive screening based on certain ESG criteria, or driven by the investor’s moral/ethical perspective.

In negative screening, certain types of investments are excluded based on specific criteria, such as alcohol or tobacco companies, weapons manufacturers and producers of fossil fuels.

Positive screening takes the opposite approach by applying a specific threshold of ESG criteria, often using a best-in-class approach relative to peers. For example, ESG research providers publish ratings and indices to help investors distinguish between companies that score better or worse on ESG criteria, even if they’re in industries that are often considered problematic, such as energy.

3.Sustainable Thematic. These strategies focus on one or more specific themes, in which a social and/or environmental need creates an opportunity to allocate capital. Examples of themes include resource scarcity, renewable energy and green bonds, where investments support climate-related or other environmental projects.

4.Impact Investing. Portfolios driven by impact investing target a specific social and/or environmental goal. These may include private equity or private debt market funding for specific projects in underserved areas, such as schools or hospitals in emerging countries. Today, the term “impact” is increasingly used to include public investments as well.

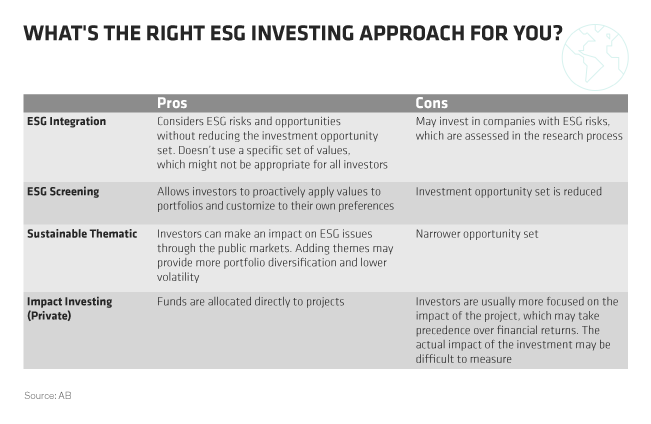

There are pros and cons to each of the ESG approaches described above (Display, above). And of course, each approach could affect the risk profile and return potential of an investment portfolio.

But even before we assess the potential impact on fund performance, Earth Day is a great opportunity to consider how changing priorities around the world should be applied to investing. For the asset-management industry, this evolution is a complex process that must balance fiduciary responsibilities with risk and return objectives and ethical concerns. By understanding the options, we believe investors can ask managers the right questions to determine which approach is most effective and appropriate for their investing needs.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.