The broad-based decline in prices creates an opportunity to add exposure to countries and companies with strong fundamentals that have been unfairly punished.

But the way we see it, the broad-based decline in prices creates an opportunity to add exposure to countries and companies with strong fundamentals that have been unfairly punished.

Rising yields and dollar strength are headwinds. But they’re not necessarily game changers. In fact, currency moves may not matter as much today for EM countries and companies as they once did. For example, many countries have reduced their current account deficits in recent years. That makes them less dependent on capricious portfolio inflows. At the same time, foreign direct investment—a more stable source of funding because it tends to be long-term in nature—has increased.

EM companies are less exposed to changes in the dollar than investors may realize, too. For example, companies with export revenues dominated in dollars have a natural hedge against their dollar liabilities. For these types of firms, a rising dollar is good news because it boosts margins, which leads to higher cash flow and creditworthiness.

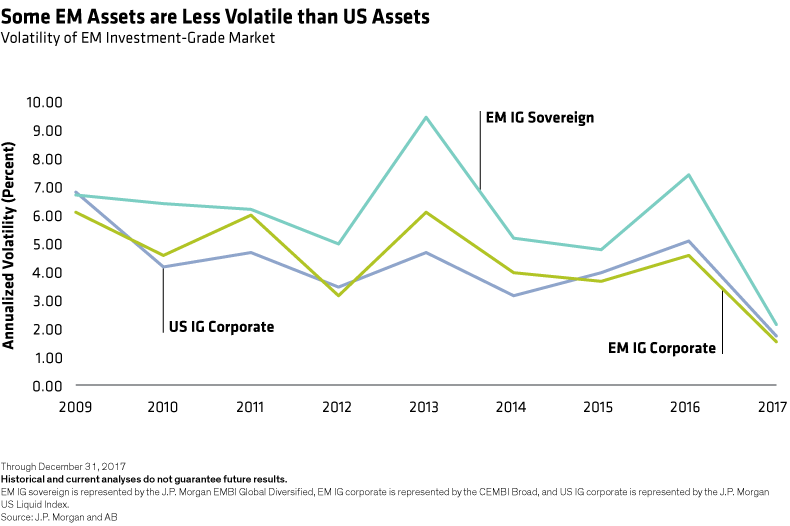

EM corporates with investment-grade ratings have also become much less volatile investments. In fact, over the last three years, high-grade EM corporates have been less volatile than their US counterparts (Display). This is partly because the buyer base has improved: these assets tend to attract large institutional investors with longer investment horizons.

As always, there are risks that investors will have to monitor as we move into the second half of the year. These include ongoing trade tensions, slower growth in China and political risk—in emerging and developed countries alike.

That’s why it’s important to be selective. Country and sector selection matter, because political and economic risk varies across the developing world. We think a tactical approach to EMD will be critically important in 2018.